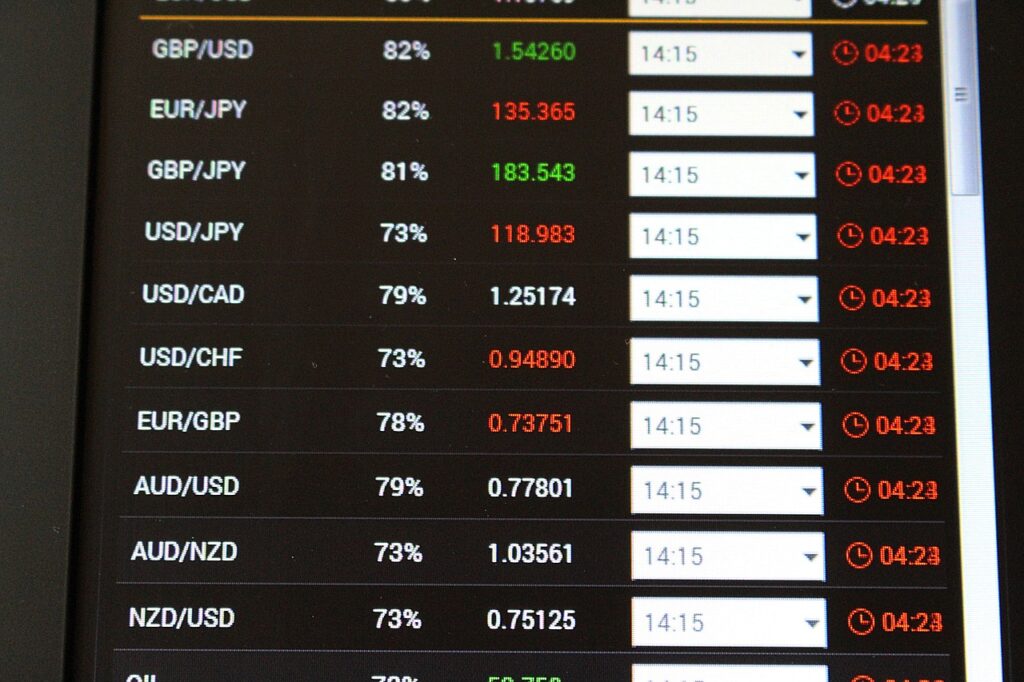

ESMA prepares for MiFID II systematic internaliser regime

The European Securities and Markets Authority (ESMA) has published an updated questions and answers (Q&A) document on the application of MiFID II/ MiFIR which clarifies when ESMA will publish the first set of data needed to implement the Systematic Internaliser (SI) regime and the date by when firms must comply with the SI regime for …

ESMA prepares for MiFID II systematic internaliser regime Read More »