In our “What the heck…”-series we look at the various aspects of the FinTech revolution and how innovation is transforming the different industry. We have already covered a fair amount of the buzzwords that have grabbed headlines like #WealthTech, #PayTech, #LendTech,#LegalTechand #PropTech. Today we look at InsurTech and how it changes the insurance industry.

The Origins

Insurance is an invention of the modern age. In fact, its origins can be traced back as far as 4000 years to ancient times in Mesopotamia. Charlemagne, King of the Franks, is said to have introduced the concept of insurance to Europe by setting up guilds that would cover the ships of merchants in case of shipwreck or pirate attacks. This, of course, is the foundation of the most famous insurance market of the world, Lloyd’s of London, which was first established in the late 17thcentury in a coffeehouse that served merchants and ship owners with shipping news and turned into an exchange for marine insurance. Today, the Lloyds market insures people and businesses in more than 200 countries in dozens of sectors from accident and health to terrorism with gross written premiums of £33.6bn in 2017.

Every aspect of our lives, every corner of the world

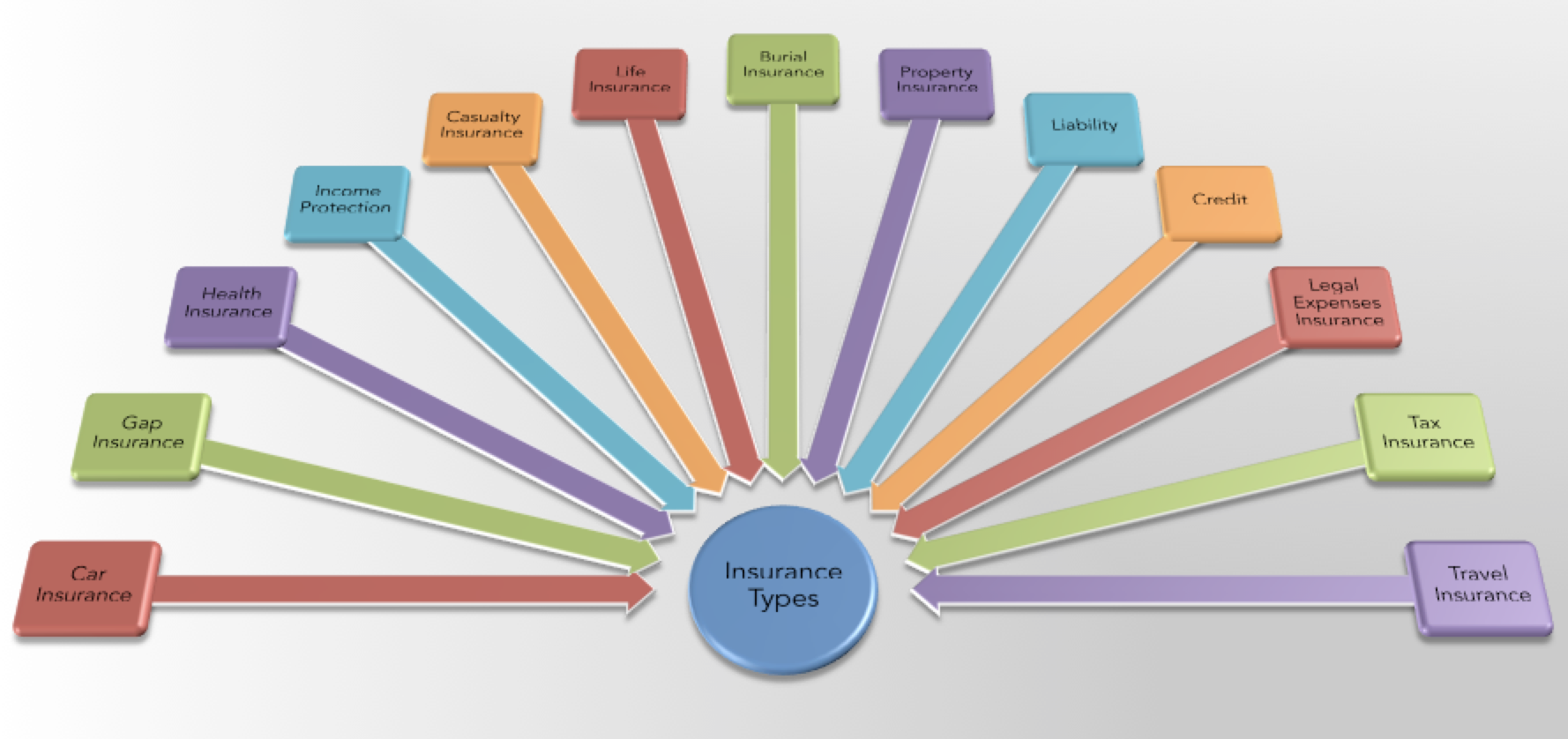

A simple concept of risk management where a group of stakeholders that face the same risk pool a financial contribution, the insurance premium, to compensate those members of the community that are hit by the particular risk. Since not all ships sank or were captured by pirates on their journeys, the premiums of the lucky ones covered the damages and provided the insurer with a profit for underwriting the risk. It was such a successful business model that it was it has since been transferred to every angle of our lives and every corner of the globe. The below image presents an overview of the most common types of insurance

However, most of these categories come with sub-categories, e.g. Property Insurance can be broken down to any form of insurance against risks to property like fire, theft, earthquakes, weather or floods, and other types exist as well as almost any risk can be insured: As long as someone is willing to underwrite a risk and someone else is prepared to pay the insurance premium. Footballers like Cristiano Ronaldo have their legs insured against career threatening injuries (he apparently would receive €140m) while Mariah Carey’s body parts are worth $70m while anything happening to Julia Roberts’ smile would get her €21m and Tom Jones was even said to have his chest hair insured for a couple of million pounds. But also events that would cause a significant damage like someone actually going the distance at the game show “Who Wants To Be A Millionaire” – if someone really wins the million, the company producing the show would actually be reimbursed by an insurer.

The Business Model

Insurers basically make money in two ways. The first one is through underwriting policies and the premiums they collect minus what they have to pay out in case of claims for damages. The second one is through investing these premiums they have collected. Insurance companies are among the biggest groups of institutional investors. According to a study, insurance companies are the largest institutional investor in European financial markets with €8.5trn of assets under management.

The main threat to the profits of insurance companies comes in the form of claims that exceed the expected forecasting. The calculation of the amount of a premium is based on statistics, i.e. how often has a certain risk materialised in the past, and probability, i.e. how likely based on statistics and other factors is it that it will happen again. For instance, natural catastrophes like hurricanes or earthquakes are reoccurring events, but last year was one of the costliest ones for natural catastrophes in the past decade. For Lloyd’s this led to aggregated market pre-tax loss of £2bn.

Insure the Insurer

In order to protect itself from events that lead to large numbers of claims, insurer “buy” reinsurance. Basically, the insurance company that has issued a policy to protect its client from a risk event sells the claim on to a reinsurance company, which would pay in case of a claim (or for part of it). For this cover the reinsurer receives a premium from the insurance company. The main reason an insurer does this is to transfer part of the risk it incurs by issuing its policies. Take for example an event like an earthquake, which usually causes so many damages that it could put an insurance company in serious trouble or even wipe out its entire value.

New Risks

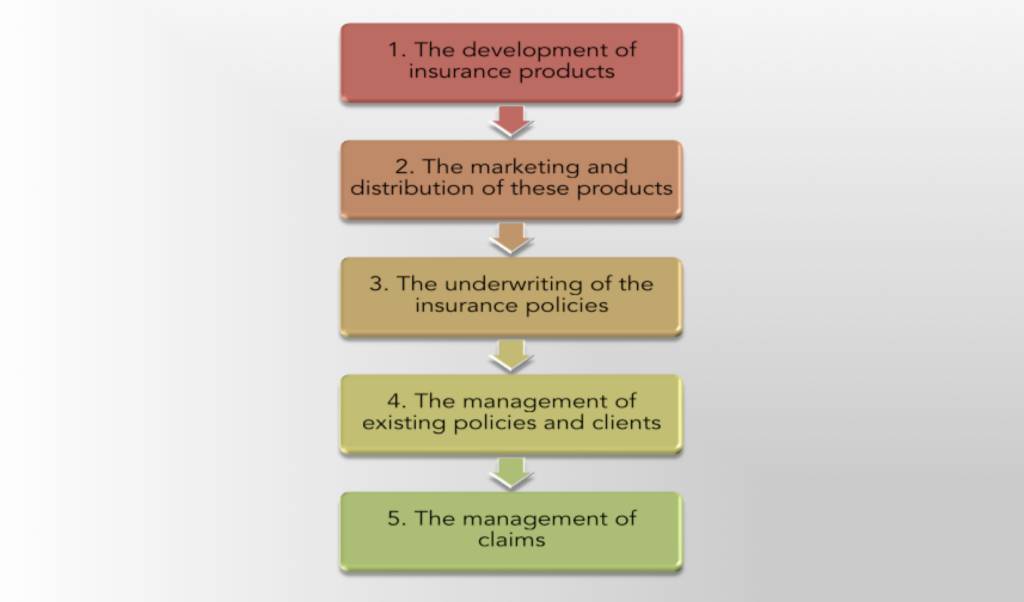

A more recent threat to the insurance industry as we know it comes in the form of innovation. A system that was built over centuries is being transformed through the use of sophisticated technologies and digitalisation. Like other industries the disruptors target any aspect of the lifecycle of insurances and the activities that govern the process.

This process can be split up into five general steps:

Let’s have a look at how innovation affects each step:

- The development of insurance products

The tricky part for every insurer is to calculate the premium it charges its clients for a policy. As discussed above, it uses statistics and probability to approximate the rate of future claims based on a given risk. The insurer needs to arrive at a premium that is both attractive to the client (as the client would otherwise choose a policy from a competitor) and guarantees a healthy profit (even in case of a claims event). To achieve this data is at the centre of the process, but not only the sheer quantity of data that is nowadays available, but more so the quality of the data and the insights gained through advanced analytics and machine learning. The result should be a more accurate idea of the probability of a risk event and optimise the pricing of policies.

- The marketing and distribution of these products

The increased computing power and the advanced analytics give insurers also a better understanding of their clients’ needs. This helps insurance companies to provide customers with tailored solutions that can be delivered more efficiently thanks to digital distribution tools. In a perfect world, it provides the client with a better customer experience and the insurer with a more efficient distribution process that enables the company to cross-sell additional products, too.

Another aspect is the rise of robo-advisors. Similar to financial services and in particular wealth management, robo-advisors are online services that aim to eliminate the need for a human advisor. Using automated client profiling based on algorithms, a robo-advisor comes at a fraction of the cost of its human counterpart

Equally, the transition from traditional insurance brokers to online platforms has changed how clients choose insurance: insurance comparison sites have already established themselves firmly in the market, in particular in car insurance where dozens of platforms exist.

- The underwriting of the insurance policies

Digitalisation also transforms the process of underwriting. Cloud computing and the use of a number of channels increases the efficiency of the underwriting process. Machine Learning can help with the extension of existing policies as software re-evaluates the underlying risks and applies other factors that determine the different aspects of a policy.

- The management of existing policies and clients

Smart Data again is a key element for the improved management of existing policies and clients, but another game changing innovation comes in the form of the Internet of Things. Thanks to the sensors that are used in IoT products insurers gain real-time insights that helps with the administration of clients and their policies, but with the development, pricing and underwriting of new products, too.

- The management of claims

One of the examples that is often used to explain the value and functioning of Blockchain technology and the underlying smart contracts is insurance: smart contracts are basically contractual terms translated into code that allow for the automated execution of an agreement. If a farmer signs an insurance to protect against the risk of flooding, the smart contract could be connected to a data sources that measures the rainfall in the respective area and in case a predetermined level is reached that indicates the flooding of the area, the smart contract automatically releases the compensation to the account of the farmer. By doing so, this speeds up claims management drastically as currently often months and in some cases years pass before a claim is settled. It also reduces the costs and resources needed in an insurance organisation to administer claims significantly.

As you can imagine, the translating of contractual terms into code isn’t as straight forward as we would like it and before all insurances are automated some time will pass. In the meantime, other technologies like Augmented Reality and Virtual Reality can help with the examination of damages and evaluation of claims.

A good overview of the startups operating tackling the various aspects of the insurance value chain has been produced by Mike Quindazzi for PwC:

Challenges and opportunities for InsurTech startups

Similar to other areas of digital transformation, InsurTech startups face challenges that range from managing financial resources, to breaking up legacy thinking, to changing the mentality or regulatory restrictions. Thus, in order to succeed on their journey, the disruptors need to follow a number of important rules. First of all, like all firms, an InsurTech needs to make sure that it understands the market and the problems it is trying to solve. The proposition has to be clear, concise and related to the specific challenge or business problem. Also, many InsurTech startups tackle a particular insurance sector, but keeping an open mind and considering application in other sectors could drastically improve the chances of a startup. And finally, collaboration can go a long way: do not consider other startups or incumbents solely as competitors but try to find ways to create synergies that could complement the own offering or open doors that otherwise would remain closely shut.

What InsurTech means for insurance companies

Automation brings benefits for both insurance companies and clients. Nonetheless it is paramount to keep the customer experience personal and put the client always at the centre of the process. Digitalisation foremost needs to be used to improve the customer relation and respond to the change in client behaviour. Millennials use different channels than their parents and will not be attracted by the business models of old. Digitalisation can therefore be used to differentiate an offering from competitors. More so, the improved processes mean happy customers, which in turn will also lead higher returns.

At the same time, new technologies come with the cost of development and implementation. Organisations need to make sure to choose carefully and focusing on the needs of clients should be the basis for these decisions. It is also necessary to strike a balance in terms of timing of implementation: full scale development and testing in detail could mean that an insurer misses the train as its competitors have been faster and already occupied a space – introducing a half baked solutions with serious bugs on the other hand can create more damage than value.

As with all organisations that are subject to digital disruption through the transformation of company culture is fundamental. Change is underway in the insurance industry and as in the wider financial industry inevitable. For this reason, senior management needs to implement the right strategy for change management, embrace innovation across the whole organisation and lead by example.