BaFin has issued another warning against ICOs. What doesn’t seem to be a big deal, is also a testament to the lack of proactivity and symbolises the German difficulties in the FinTech race.

Some time ago we published an article about the state of ICOs in Germany. It came on the back of an announcement of the German financial regulator, the Federal Financial Supervisory Authority BaFin, which had just published a consumer warning in respect of initial coin offerings (ICOs). In November 2017, that wasn’t something overly uncommon as a numbers of regulators had already issued similar warnings. Blockchain technology and ICOs in particular had been dividing authorities around the world for a while and many peers like it’s the German financial watchdog felt the urge to highlight the risks involved in investing in token offerings.

What was less clear though at the time and subject to ongoing discussions was the regulatory nature of ICOs and the tokens they issued. Unfortunately, back in the day unfortunately the BaFin statement did little to clarify the situation for German ICOs or the overall legal discussion. Instead added to the confusion some may feel about the approach the authorities take. Just to refresh our memories, what the BaFin did was to makes it clear that in accordance with German Banking Act cryptocurrency tokens constitute financial instruments (units of account). The regulator emphasis therefore that “undertakings and persons that arrange the acquisition of tokens, sell or purchase tokens on a commercial basis, or operate secondary market platforms on which tokens are traded are generally required to obtain authorisation from BaFin in advance”. BaFin also stated that “based on the specific formulation of the contract for each ICO, BaFin decides on a case-by-case basis whether the offeror is required to obtain authorization pursuant to the German Banking Act (Kreditwesengesetz – KWG), Investment Code (Kapitalanlagegesetzbuch – KAGB), Payment Services Supervision.

Act (Zahlungsdiensteaufsichtsgesetz – ZAG) or Insurance Supervision Act (Versicherungsaufsichtsgesetz – VAG) and whether they must fulfil prospectus requirements”. That was a little bit like stating the obvious, but it also represented a missed opportunity to provide some much needed clarity. In the end, ICOs or more so the abuse of this fundraising instrument flourished at least to an extent also because of the lack of regulatory clarity and the resulting perception that it was all happening in a lawless space. 18 months on, we obviously know better.

It represented a missed opportunity in particular since we have witnessed a kind of a competition across jurisdictions who all sought to establish themselves as the place to be for the next FinTech miracle, especially in the light of the then looming Brexit that was to change the FinTech supremacy of London. Again, with hindsight and not commenting on what is happening or might happen with the whole Brexit situation, you might do things differently, but the stern warning that stressed the responsibility of law enforcement authorities for the prosecution of criminal offences certainly didn’t instill confidence in the German prospects.

Why is this important though? For starters, because BaFin a few days ago issued another warning that crypto tokens remained risky business for consumers. The German regulator referred to the recent statements of ESMA and EBA on the subject.

The EBA, to summarise, highlighted “the need for a comprehensive cost/benefit analysis to determine what, if any, action is required at the EU level at this stage to address these issues, specifically with regard to the opportunities and risks presented by crypto-asset activities and new technologies that may entail the use of crypto-assets” and stressed that “at the EU level it is important to provide clarity about the applicability of current EU financial services law to crypto-assets/activities to ensure that there is a common understanding of the extent to which current legislation addresses the risks and supports the opportunities relating to crypto-assets and DLT.”

ESMA, on the other hand, did its own little analysis of the ICO sector. In its report, it found that most regulators of the EU’s member states felt that a number of crypto assets qualified as transferable securities or other types of MiFID financial instruments. ESMA would not need not touch upon the classification itself as it is the responsibility of an individual National Competent Authority (NCA) and will depend on the specific national implementation of EU law and the information and evidence provided to that NCA. It showed however the differences of the implementation of EU law across the member states and the information and evidence provided to that NCA.

ESMA then went on to determine that if crypto assets indeed qualify as transferable securities or other types of MiFID financial instruments, a full set of EU financial rules is likely to apply to its issuer and firms providing related services. So, ESMA analyzed the impact of the Prospectus Directive, the Transparency Directive, MiFID II, the Market Abuse Directive, the Short Selling Regulation, the Central Securities Depositories Regulation and the Settlement Finality Directive, with regard to cryptocurrencies and ESMA found a number of gaps and issues in the existing regulatory framework.

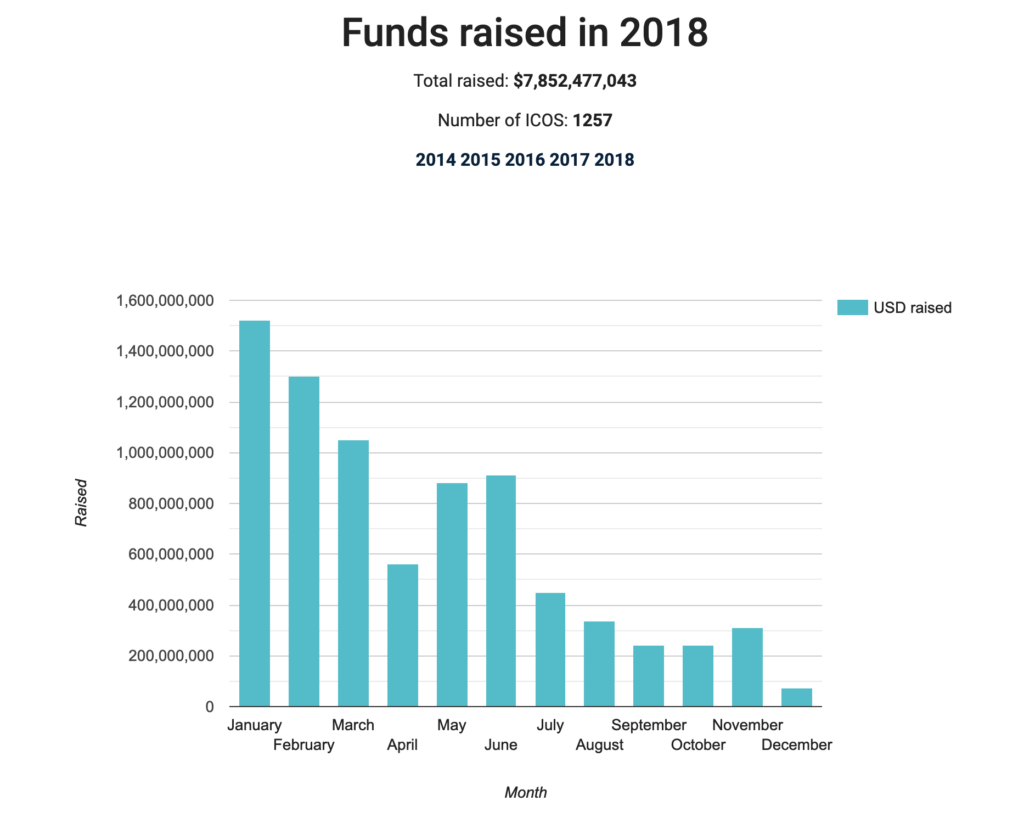

While this is certainly is valuable advice, it was nothing more than another little piece in a much larger puzzle that still wasn’t anywhere close to being solved. Instead, the lack of a common approach with regard to the application of existing securities regulation for instance has dominated the discussion for some time and only in the last 12 to 18 months the direction, into which lawmakers globally are going to go, has become more apparent. At the same time the attractiveness of ICO continues to diminish as the numbers from icodata.io show:

In its place, we see a move towards investment forms that are based on compliance with securities regulations such as Security Token Offerings (STOs).

STOs generally refer to a financial security issued in the form of a digital asset that usually represent ownership rights in an underlying company or its assets. It’s a move toward token offerings in accordance with existing regulation in response to the growing enforcement actions of authorities like the SEC.

Disregarding these developments and once again missing an opportunity to promote financial innovation that is compliant with the current regulatory framework, BaFin a few days ago issued another warning against ICOs. While it mostly summarises the EBA and ESMA documents, it also reiterates “how serious the authorities the risk for consumers take”. Another testament to the reactive behaviour of the German financial regulator that puts the authority’s openness with regard to financial innovation in doubt. As a side note and rather interestingly, BaFin this week also issued a statement, in which it announces the publication of its digitalisation strategy. However, the actual document goes back to August 2018 and was apparently last updated in August 2018. While there is undoubtedly a good explanation as to why BaFin publishes this document six months after it has been drafted, it raises some eyebrows with regard to the mission statement to become “by 2025 one of the leading regulatory authorities worldwide on the subject of digitalisation” – especially in light of the issue described above.

It is commendable that the German regulator puts consumer protection above all and its mission is unlike other watchdogs like the British FCA not to promote business but foremost guard the functioning, stability and integrity of the (German) financial centre. At the same time, it would be nice though if it were a little bit more proactive, but that seems like asking for too much.