Is Crypto dead? Of course not! The question that made the rounds across the internet because of the continued funk in coin value or the apparent lack of further adoption in the real economy was just another sign of how emotional and often irrational the discussion gets. Just take the recent rebound of Bitcoin, Ethereum and other coins as evidence that the time isn’t up on cryptocurrencies. Thus, it’s good to put crypto into perspective. For that reason, we focus on four key aspects with a handful of charts:

Volatility

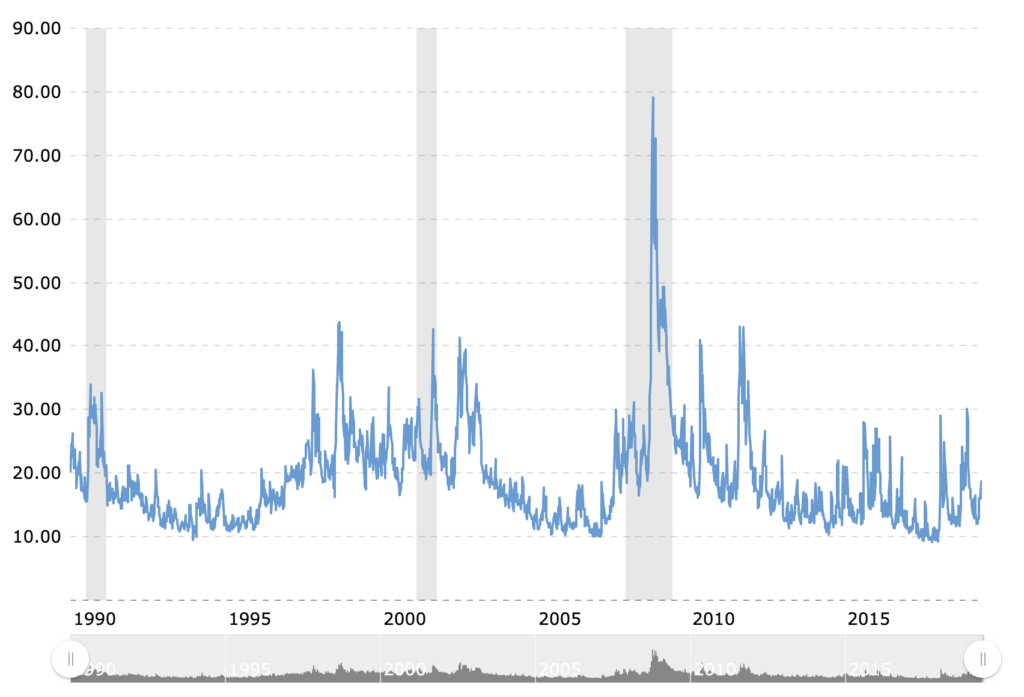

It took the biggest financial crisis of modern history to move the Dow 30 to see price swings of $500-1000 a day over the course of a few weeks on its way down from $14,000 in mid-August to a mere $6,600 in February the following year. This all happened in the most volatile period of all times when the CBOE VIX Volatility Index(VIX) hit its all-time high on October 24, 2008 at 89.53 although it closed the day at only 79.13.

Bitcoin on the other hand jumped regularly from high to lows to current value with extreme volatility of the last month between 7,000 and 9,000 with day-to-day changes of more than 10%.

The bottom line: Cryptocurrencies are still in their infancy and significant price movements can happen any time even if prolonged periods of rise or fall in value would indicate otherwise. For traditional markets it needs a major event to see comparable levels of volatility.

ICO v STO v IPO

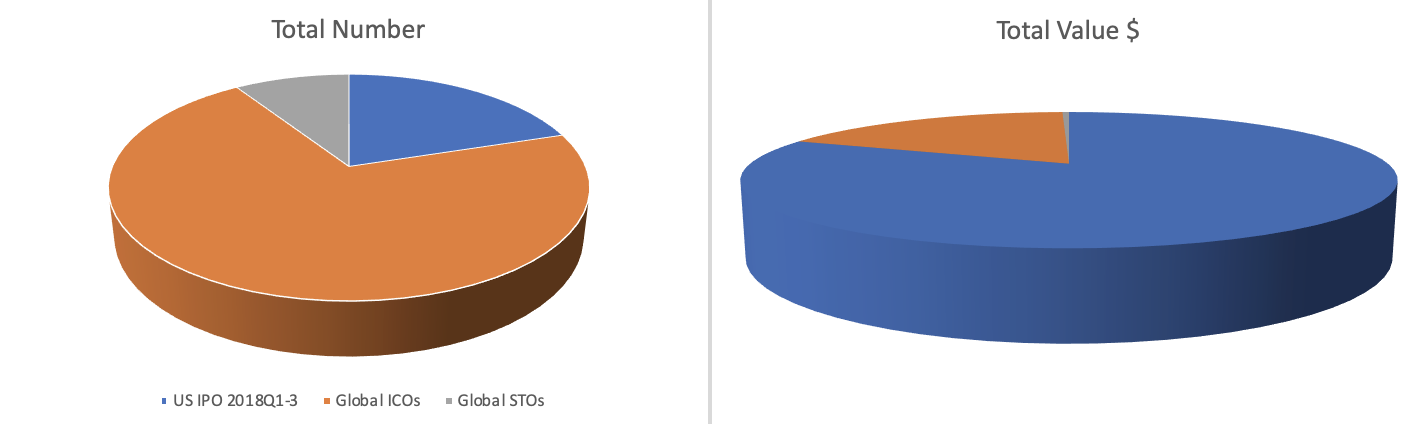

2018 saw a total number 650 ICOs globally that raised $17 billion. STOs, which are sometimes pipped to replace the declining number of ICOs, saw a total of 85 offerings during the last year and raised an estimated $380 million. On the other hand, IPOs in the US alone accounted for $75 billion in the first three quarters of 2018 across 170 public offerings with Spotify raising single handedly $9.2 billion.

The bottom line: ICOs may be on the decline but they still were way bigger than STOs last year. With the first quarter seeing more than half of last year’s STOs alone, the trend is apparent, but both are eclipsed by the value in traditional stock fund raisings.

Market Cap

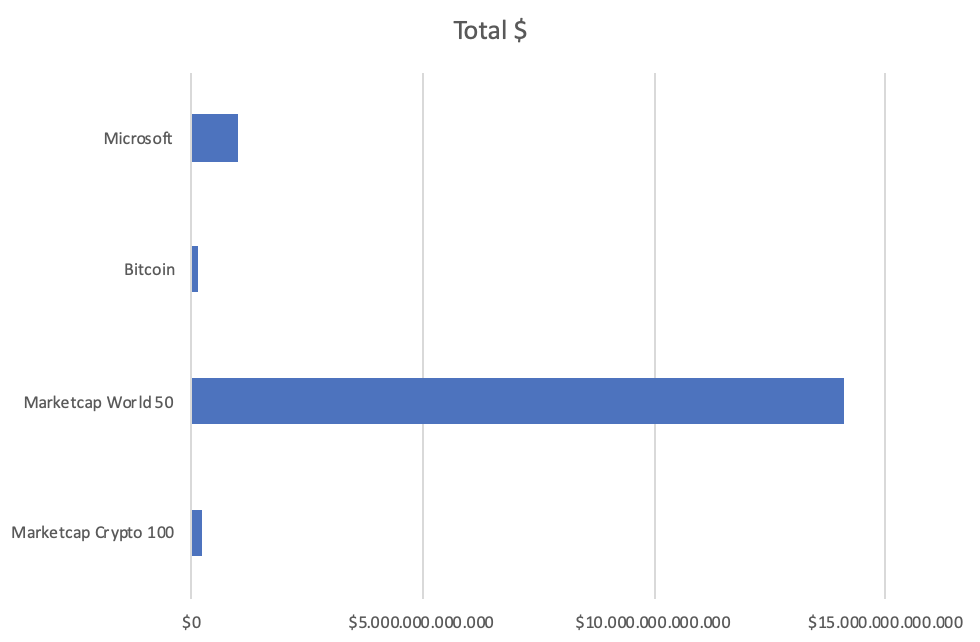

The market cap of the Top 100 Cryptocurrencies in total value is $248 billion.

The market cap of the world’s 50 most valuable public companies on the other hand exceeds $14 trillion. Breaking it down to single cryptos and stocks using the market leaders this means the following: Bitcoins market cap at its all-time high on 17 December 2017 at $20,089 for a BTC meant a total of $320billion opposed to its most recent low point at $3,191 per BTC on 15 December 2018 for a total market cap of $56 billion. Trading at the current value of $8,000 the market cap is $142 billion. Microsoft, the most valuable stock, currently has a market cap exceeding $1 trillion dollar.

The bottom line: Bitcoin accounts for 57% of the total market cap of the Top100 crypto currencies and still isn’t anywhere close to the value of the world’s most valuable stock – in fact it would just about make the Top 50 squeezing in between Anheuser Busch and Total in value.

Regulatory Sanctions

The impact of regulatory decisions on share prices or the value of investments has been subject to numerous research papers and studies.

When the Chinese regulators decided to crack down on ICOs and cryptocoin exchanges on 4 September 2018, the price of one Bitcoin dropped from $4,591 at the open to $4,100 intraday, losing 10.6% or almost half a grand in a day.

Then again, when the U.S. Department of Justice announced last year that Barclays would pay $2 billion to settle claims for billions of dollars of losses suffered by investors who bought toxic mortgage-backed securities in the run-up to the 2007 financial crisis, the share price actually rose by 1 percent.

The bottom line: investors had already factored in the upcoming fine for Barclays and as a result seemed to be relieved by the outcome. Contrarily, despite signals that crypto markets were to come under pressure for weeks (the SEC at the end of July started enforcement action against the DAO amongst other regulatory events), for crypto investors the Chinese decision seemed to come out of the blue – signaling the lack of professional investment behavior in crypto markets even though price movement in the double digit percentages are rather common in BTC.

Conclusions

A swan song on cryptocurrencies might be premature as too many aspects indicate otherwise. The recent rise in values with positives outlook if prominent predictions are to be believed. The volatility in cryptocurrencies shows that BTC and others are still a highly speculative investment.

Cryptocurrencies also remain a niche product when compared to traditional financial instruments. If the history of finance has taught us anything though, it is how quickly the importance of an investment class can change as can be seen in the various cases of meteoric rise of structured products.

Supporters, however, should not disregard the warning signals: the rise in STOs and a decline in ICOs shows the importance of regulatory compliance and even tech giants like Facebook ponder the creation of their own coins, there is no doubt that they will not risk their reputation by using a model that is not failsafe in regulatory terms.