Risks are an inherent part of every business, but with the right tools and strategy, you can protect yourself from the most common ones. Enterprise Risk Management (ERM) is a comprehensive approach to identify, assess, address, and mitigate the possible risks that can impact your business operations. It uses a combination of tools and strategies that are tailored to your specific business.

One such commonly used tool is Riskonnect. This is a cloud-based suite of tools that covers aspects like integrated risk management, compliance, audit, and more. A highlight of this tool is its ability to connect the dots to provide a comprehensive view of the risks involved.

That said, Riskonnect comes with its share of disadvantages too, and it doesn’t work well for all organizations. In this article, we will look at the top Riskonnect competitors and alternatives.

1. AuditBoard

AuditBoard is a connected risk platform that brings together your audit, risk, and compliance teams to identify risks and mitigate their impact. This tool has multiple layers, with the inner core comprising frameworks, controls, and policies. To this core, it adds analytics, workflows, automation, and intelligence, to provide a comprehensive platform for risk management and compliance.

Source: AuditBoard

Key Features

- Using AI, it converts time-intensive tasks into streamlined and actionable workflows.

- Offers out-of-the-box dashboards and reporting templates to uncover insights and make data-driven decisions.

- Its many integrations and APIs streamline data collection and processing.

- Comes with 30+ frameworks, including SOC 2, ISO 27001, and GDPR, that can scale well to meet your needs.

- Provides 83% more efficient control mapping, 63% more efficient real-time data reporting, and 49% deeper understanding of risks, as per the AuditBoard website.

Pros:

- User-friendly interface – Its intuitive UI appeals to design and audit professionals.

- Cloud-native – The cloud-native tools improve collaboration among different teams.

- Fast onboarding – Its features support fast onboarding, so new employees can get up to speed quickly.

- SOX compliance – The automated workflows support SOX compliance.

- Risk oversight – Provides a centralized risk library and heat maps.

Cons:

- Limited customization – Non-audit users have fewer options to customize the tool.

- No advanced modeling – It does not have the scenario modeling features found in Riskonnect.

In all, go for AuditBoard if you are looking to consolidate audit, risk, and compliance with a faster time-to-value.

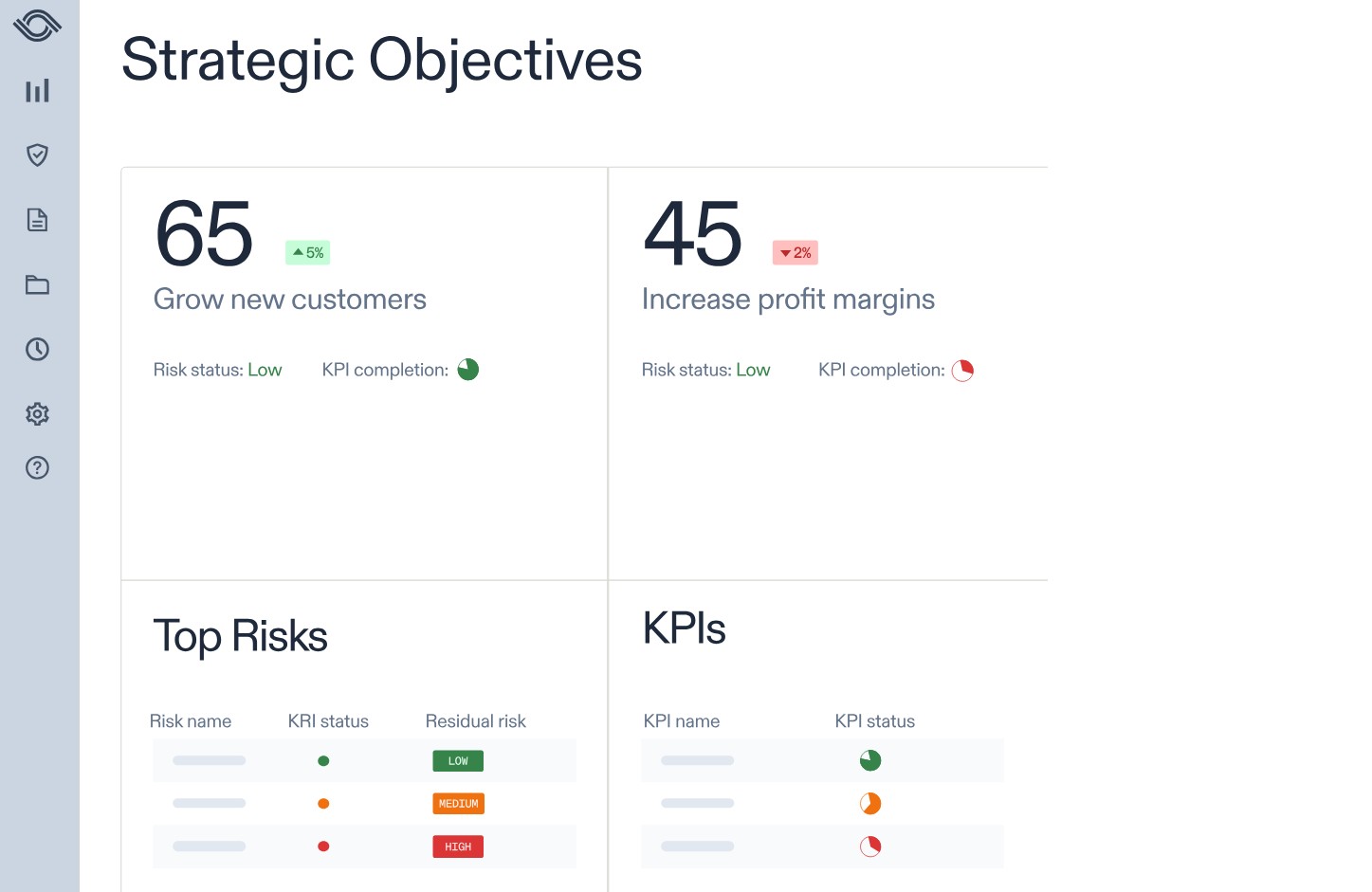

2. LogicGate Risk Cloud

LogicGate Risk Cloud is an ERM solution that combines governance, risk, compliance, and privacy in one connected platform. Using these features, you can manage different risks and drive business growth. Its compliance and audit features support scalable growth within legal and regulatory boundaries.

Source: LogicGate

Key Features

- Empowers you to track, prioritize, and respond to incidents quickly.

- Uses Monte Carlo simulations and the Open FAIR Model to quantify commercial risks and communicates the same to the concerned stakeholders.

- Automates data gathering, testing, and evidence collection to save time and effort.

- Its flexible graph database is easy to set up and requires no coding.

- Provides real-time visibility of risk across your organization.

Pros:

- Flexible Configuration – it is highly configurable, and no prior coding experience is required.

- Extensive Integration – It integrates well with different tools, and even has API access.

- Collaboration – Streamlines cross-team collaboration, bringing all the related teams on the same page.

- Automation – It automates workflows to improve efficiency and reduce errors.

Cons:

- Selective Suitability – Not suited for companies in regulated industries due to the lack of out-of-the-box compliance templates.

- Limited Reporting – No built-in reporting support for some regulatory frameworks.

Overall, LogicGate offers more flexibility than Riskonnect for organizations that need tailored workflows. It’s also more suited for mid-market firms than established organizations.

3. MetricStream

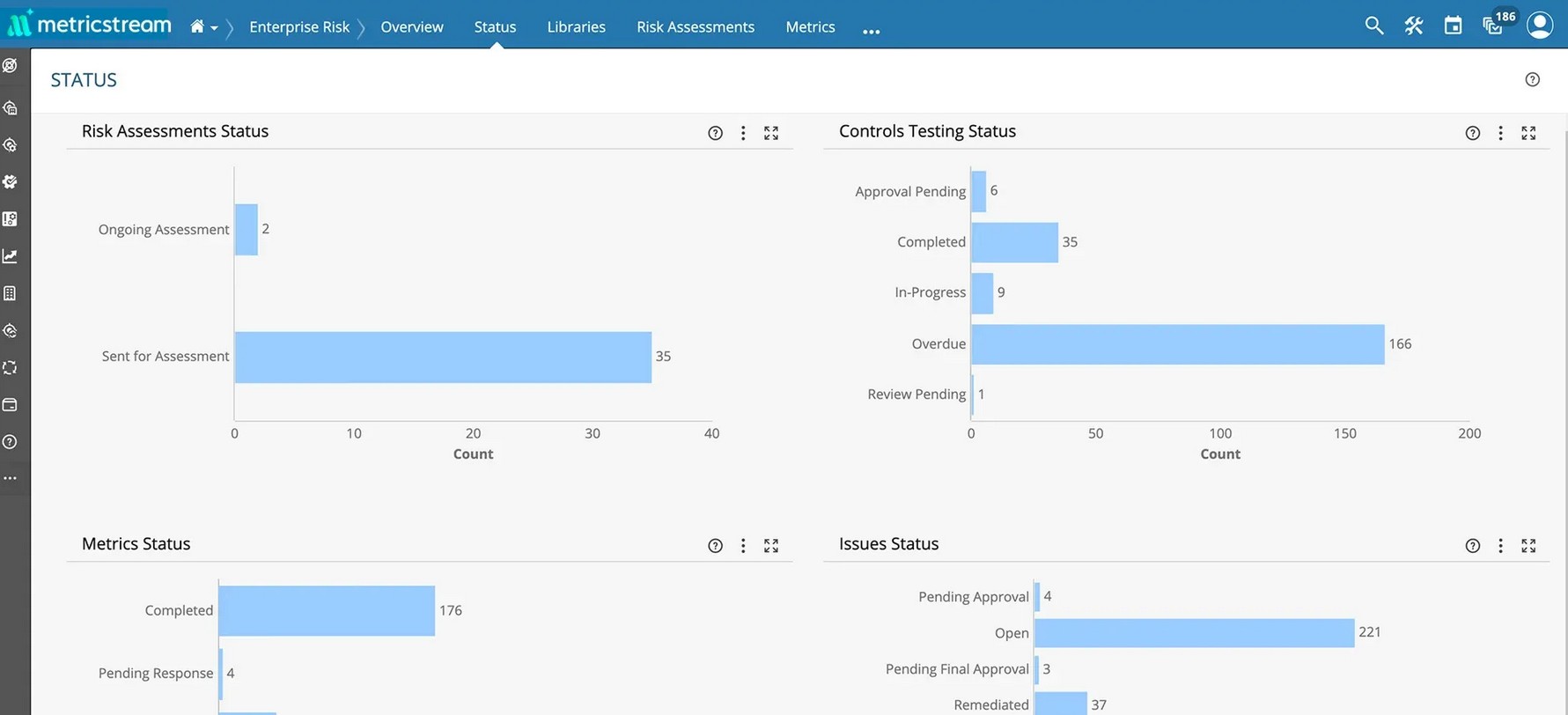

MetricStream is an AI-first connected GRC platform that can transform risk intelligence into concrete action. It uses a combination of models and controls to simplify operational and enterprise risk management. It also automates compliance to eliminate the gaps that come with manual efforts.

Source: MetricStream

Key Features

- Automated risk identification and analysis to speed up risk responses.

- Uses agentic AI for continuous audits and to gather evidence.

- Generates summaries to identify control gaps.

- Helps build a proactive cyber program through continuous control tests.

- Creates real-time summaries of risk and compliance data on vendors and third-party service providers.

Pros:

- Regulated Industries – its deep compliance tools make it an ideal platform for companies in the financial and energy sectors.

- Intelligent feeds – Provides risk and compliance intelligence feeds to enable teams to take quick action.

- AI Use – Extensively taps into the power of AI to automate processes and gather data.

- Optimization – Allows you to optimize response plans for targeted simulations.

Cons:

- Implementation – The initial setup and implementation can be complex.

- Small organizations – Not ideal for small organizations, as its features can be overwhelming.

In all, MetricStream is a close competitor to Riskonnect in functionality and market share. It is even better in compliance intelligence and the depth of AI usage across many areas. It works best for companies that have a global risk and compliance requirement.

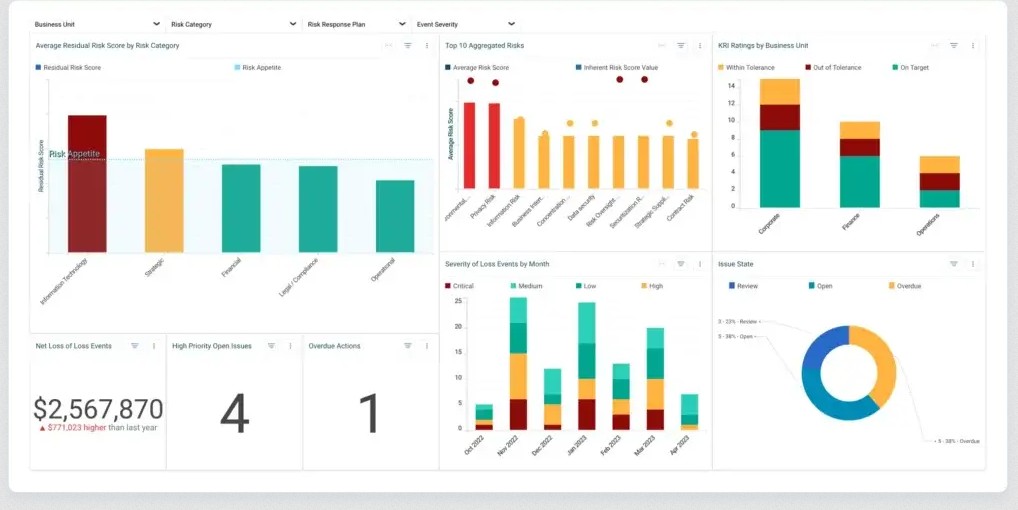

4. Resolver

Resolver is a popular ERM platform that provides a comprehensive view of the risk exposure in your organization. It performs multi-dimensional risk analysis to identify all the different types of risks that can impact your organization. More importantly, it offers real-time analytics for smarter and data-driven decision-making.

Source: Resolver

Key Features

- Aligns risk management with your business objectives.

- Consolidates all the risk data to provide 360-degree visibility and complete control over risk assessment and mitigation.

- Offers pre-configured risk assessment templates, which are based on COSO and ISO 31000.

- Its automated ERM workflows reduce manual effort by up to 95%, as per the website.

- Simplifies reporting through intuitive forms, notifications, and in-app comments.

Pros:

- Risk management – The focus is largely on risk management, thereby strengthening the risk culture in your organization.

- Collaboration – Its centralized data repository and risk assessment support seamless collaboration across all business units.

- Scalable – It is scalable and adaptable to multiple use cases.

- Actionable insights – This tool breaks down data silos to provide actionable insights.

Cons:

- Limited – It does not cover third-party risks.

- Integrated – Fewer integrations when compared to other similar platforms.

Resolver is a good Riskconnect alternative, but its scope is largely limited to physical security, incident-driven risk strategy, and operational and financial risks. This tool is ideal for organizations that need insights and support in incident management and operational risk handling.

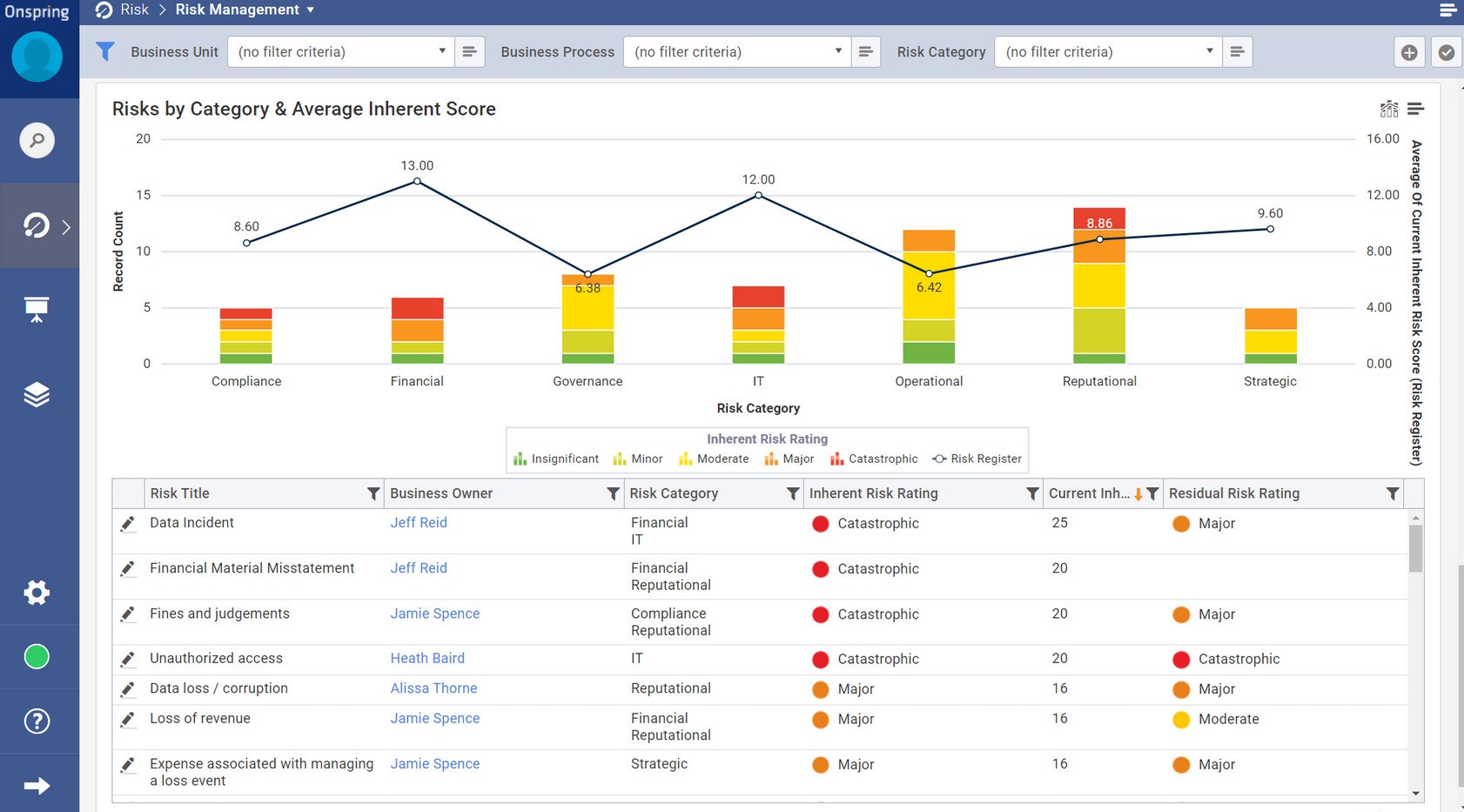

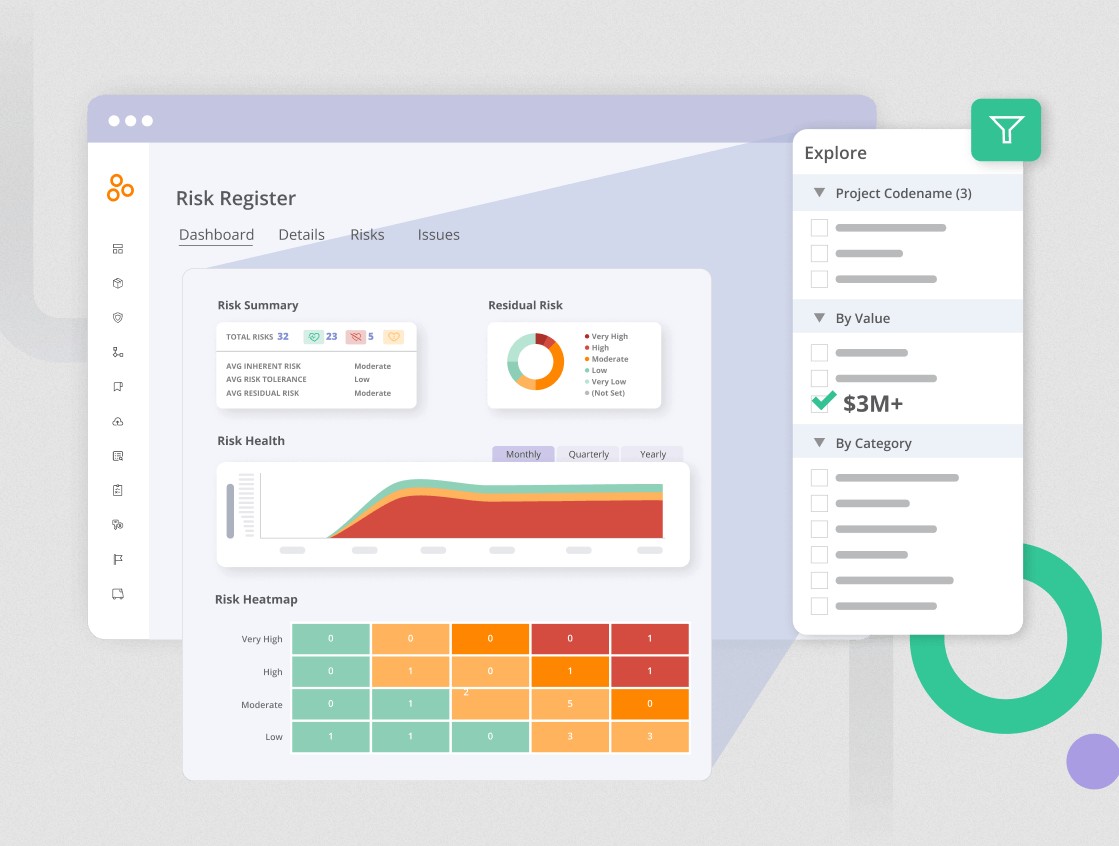

5. OnSpring

OnSpring offers a comprehensive risk management software that integrates and aggregates risk data captured across the cyber, financial, operational, and reputational areas of your business. All this data is stored in a centralized repository that can trigger assessments and notifications when specific parameters exceed the established thresholds. With such an approach, you get comprehensive and real-time visibility into different risks.

Source: Onspring

Key Features

- Offers a risk register with multiple hierarchies that provide all the information required about the different risks that can impact your organization.

- Captures and integrates financial, operational, reputational, and third-party risks as they surface.

- Automatically assigns risks based on their criticality for quick remediation. It also sends notifications to the concerned stakeholders through email and Slack messages.

- Supports the management of multiple risk frameworks, like NERC, CMMC, ISO, and more.

- Makes it easy to respond to risk assessments through the risk register.

Pros:

- Visibility – Provides complete visibility into risks, making it easier to respond to real-time risks as they happen.

- Compliance – Supports compliance with the popular regulatory frameworks.

- Communication – Provides an option to communicate risks to the concerned stakeholders for better transparency.

- Remediation – Enables quick remediation by managing the criticality of risks through a comprehensive risk register.

Cons:

- Risk modeling – Does not have the advanced features required for risk modeling.

- Integrations – Limited integrations with third-party platforms.

In all, Onspring works well for companies that require a modular approach to risk and compliance management. Its strong and intuitive UI, coupled with enterprise-grade features, makes it ideal for organizations of all sizes.

6. Hyperproof

Hyperproof is an advanced tool that offers strong risk protection and compliance. Using this tool, you can automate different risk controls to improve efficiency while saving time and effort. According to the company’s website, it helps organizations save an average of $150K on control orchestration and 66% in duplicative controls.

Source: Hyperproof

Key Features

- Maps controls with frameworks, allowing the reuse of controls to save resources.

- Integrates risk flows to continuously monitor the real-time risks.

- Provides stakeholders with real-time insights into risk mitigation efforts.

- Streamlines risk workflows to allow you to focus on more productive and strategic initiatives.

- Supports 118+ frameworks.

Pros:

- Integrations – Integrates well with 70+ software to provide the flexibility you need to integrate this tool with any tech stack.

- Scalable – It is highly scalable, and its modular approach makes it easy to extend to more frameworks when needed.

- Automation – its automated workflows reduce time, effort, and costs.

- Visibility – Sends regular communications to your stakeholders for better transparency.

Cons:

- Risk modeling – Its risk modeling capabilities are limited when compared to other tools.

- Reporting – No advanced reporting features geared specifically for ERM stakeholders.

Overall, Hyperproof is a good alternative to Riskonnect for companies that prefer to automate their risk and compliance processes. It is better suited for SaaS companies and those that operate in regulated industries.

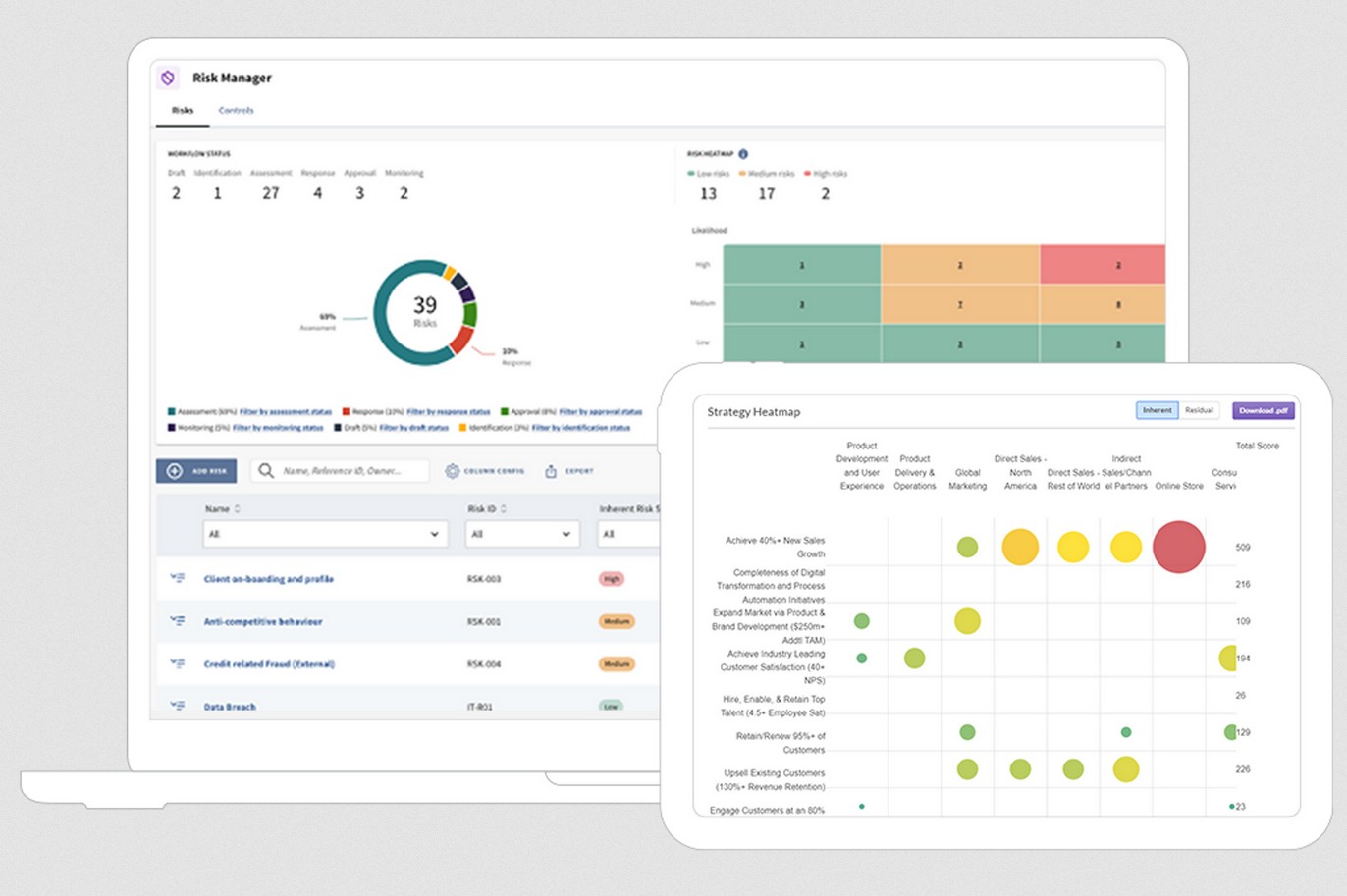

7. Diligent

Diligent is an advanced tool that offers a complete GRC program with a specific focus on risk assessment and insights. It helps identify the strategic risks by eliminating human errors and data gaps and creating a centralized risk repository that can analyze data from various sources to provide insights for data-driven decisions. It also provides leaders with the benchmark data to help achieve business objectives.

Source: Diligent

Key Features

- Centralizes all data into a single source of truth for better analysis and insights.

- Delivers real-time reports to stakeholders and the board for informed decision-making.

- Automates many time-consuming processes like data collection and evidence gathering from different sources.

- Provides a holistic view of internal and external risks.

Pros:

- Advanced Reporting – Provides extensive reports with real-time data to the board and other stakeholders.

- Actionable Insights – Creates customizable heat maps and trend line reporting.

- Collaboration – With a single source of truth, it supports seamless collaboration across multiple teams.

- Saves Resources – Offers workflow automation to save time, money, and effort.

Cons:

- Less Customizable – It has fewer customization options.

- Expensive – It may be on the higher side for mid-market companies.

In all, Diligent is best for large enterprises that treat risk and compliance as board-level priorities, as it comes with executive dashboards and ESG tie-ins.

Final Thoughts

To conclude, risk management is an essential part of any organization’s operations. The growing risks across multiple fronts make it difficult to manage them all manually through a spreadsheet, and this is where Enterprise Risk Management (ERM) platforms come in handy. These platforms offer multiple features, from automated workflows to comprehensive dashboards and reporting, enabling you to save time and resources while focusing on identifying and mitigating risks before they impact your organization.

Riskonnect is a popular ERM tool, but it may not be suitable for everyone. This is why in this article, we discussed the best Riskonnect alternatives and competitors. We hope this discussion helps you pick the ERM platform that best meets your needs.