The growing cyberattacks make some tests and checks mandatory to protect an organization from unauthorized access and data breaches. These tests take on a whole new meaning in financial institutions that deal with the money and sensitive information of millions of users. This is why Know Your Customer (KYC) is a mandatory process that every financial institution must undertake periodically to ensure that its customers are who they claim to be, and the funds are not used for banned activities.

However, manually conducting these tests is time-consuming and error-prone, and this is where KYC compliance software helps. In this guide, we will look at the top free and paid KYC compliance software, including their key features, pros, and cons.

Importance of KYC Compliance Software for Financial Institutions

For financial institutions, KYC processes are mandatory and safeguard their assets from bad actors. With the right software, you can automate identity checks and document verification to speed up processing time and improve accuracy. It can also provide real-time insights into financial transactions that are used for funding banned activities. Moreover, you can check if your customers are on any of the watch lists issued by global enforcement organizations, so you can take the necessary action to prevent fines and to comply with the local laws and regulations.

Above everything, using a KYC compliance software eases the process for users, as they can upload their documents through an intuitive interface, without having to visit the local branch to submit their documents. It is also hassle-free, making the process quick and easy for everyone.

Due to these reasons, financial institutions around the world are using KYC software to check customers’ backgrounds. However, given the growing number of KYC tools, selecting the right one requires extensive research.

Factors for Selecting a KYC Compliance Software

Choosing a KYC compliance software that fits into your existing workflows while meeting your requirements is not easy. Here are some factors to consider while making this choice.

- Extensive coverage of global ID databases and watch lists.

- Accuracy of identity verification and biometric capabilities.

- Support for different risk levels and workflows.

- Data security and compliance with GDPR, CCPA, and other laws related to your regions of operations.

- Option to provide AML checks and risk scoring.

- Real-time monitoring and fraud detection.

- Details audit trails and reports for regulatory compliance.

- Customer support and SLA commitments.

- Flexible APIs for integration.

Additionally, consider the price and ensure that it aligns with your budget.

Based on the above factors, here are our top nine free and paid KYC compliance software for financial institutions.

NICE Actimize

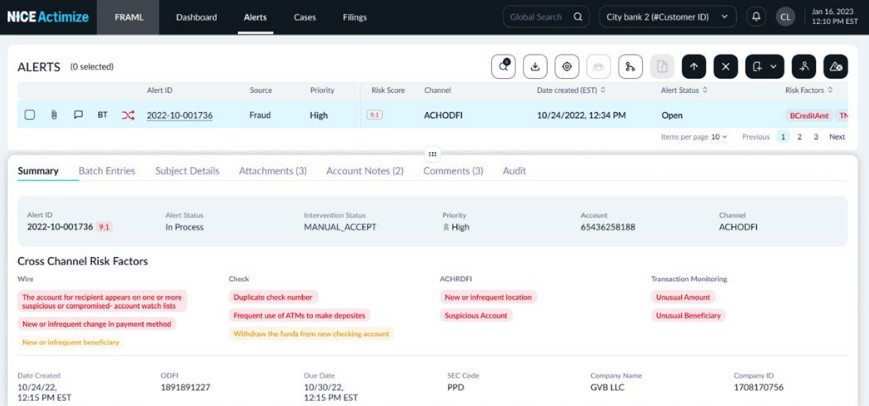

NICE Actimize is a well-established name in the world of financial crime and compliance management. Its Xceed AI FRAML takes a data-driven approach to combating financial crimes and protecting your organization from compliance fines. This AI-powered solution makes it easy to integrate fraud and KYC checks into your existing workflows for holistic crime prevention.

Source: NiceActimize

Key Features

- Monitors multiple payment channels, like mobile RTP, P2P, ACH, check, card, and more.

- Uses real-time fraud scoring to identify risks across channels.

- Sends immediate notifications, so you can take action right away.

- Provides a 360-degree view of risk to improve operational efficiency.

- Adapts well to changing behaviors through machine learning algorithms.

Pros:

- Scalable for large enterprises.

- Comprehensive risk and monitoring controls.

- Strong reputation in the financial sector.

- Supports multiple jurisdictions.

Cons:

- Too complex for small teams.

ComplyAdvantage

Comply Adavantage is a SaaS-based risk intelligence platform that brings together global intelligence to your processes, enabling you to fight financial crimes before they impact your organization. It offers real-time AML and KYC screening and transaction monitoring to help you proactively identify risky customers and transactions.

Source: ComplyAdvantage

Key Features

- Streamlines the onboarding process by detecting risky individual customers.

- Evaluates the risk profiles of company entities through a systematic approach.

- Continuously track changes to customers and businesses for proactive monitoring.

- Monitors transactions using advanced tools, like ID clustering, graph analysis, and machine learning algorithms.

- Reduces false positives and improves the overall efficiency of your operations.

Pros:

- Easy integration with existing systems.

- Customizable risk scoring rules.

- Quick update to global watch lists.

- Compliant with GDPR and CCPA.

Cons:

- Limited customizable options.

Price

ComplyAdvantage offers two plans – The Starter plan, starting at $99.99/month, and the Enterprise plan, which has custom pricing.

Trulioo

Trulioo is another popular global online identity verification service that meets the requirements of all Know Your Business (KYB), KYC, and AML requirements. It works well for all jurisdictions, making it ideal for global organizations that onboard customers from different parts of the world. Its in-house built advanced data intelligence, modular architecture, and audit readiness make it ideal for organizations of all sizes.

Source: Trulioo

Key Features

- Its API is highly scalable and can be customized to meet the requirements of different jurisdictions.

- Combines risk mitigation, fraud signals, document liveness, and biometrics to increase your operational security.

- Taps into 450 data sources and supports 14,000+ document types from around the world.

- A modular architecture and dynamic workflows make the entire verification process seamless.

- Its proprietary machine learning models improve the speed and accuracy of detection.

Pros:

- Works well across all industries.

- Covers 195 countries and supports their different document types.

- Meets multiple regulatory requirements.

- Highly scalable.

Cons:

- Limited dashboard customization.

Sumsub

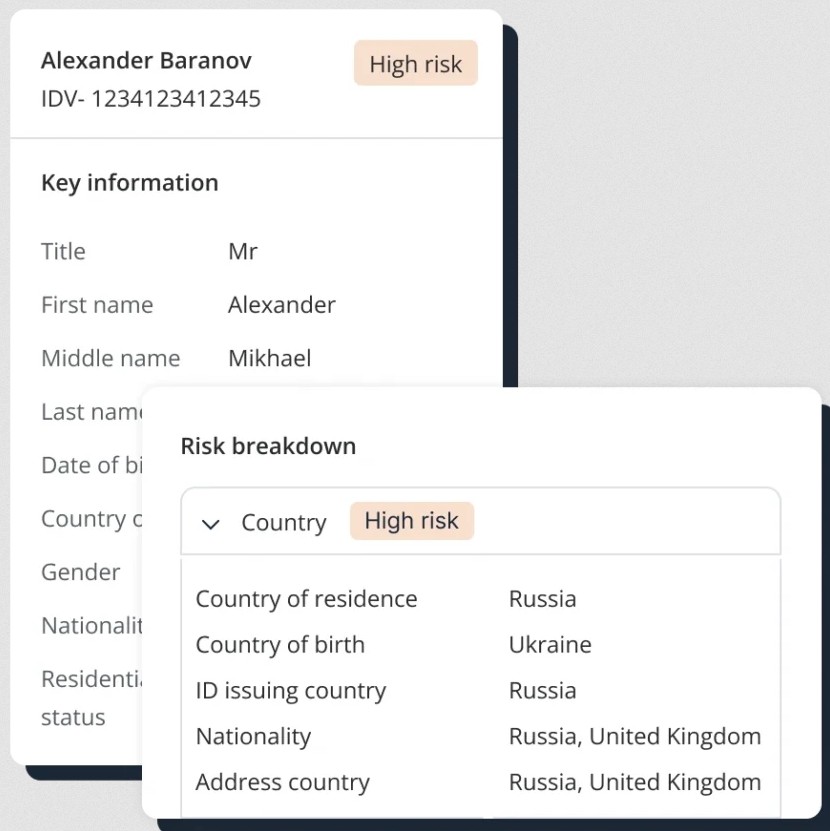

Sumsub is an identity verification platform that can easily verify users, businesses, and transactions through a configurable platform. It uses adaptive AI intelligence to catch fraud early and keep your business compliant with the existing regulations. It has a modular approach, where you can choose from User Verification, Business Verification, Transaction Monitoring, and Fraud Prevention modules.

Source: Sumsub

Key Features

- Comes with proactive email and phone screening to detect fraud early.

- Its real-time defense intelligence flags risks in advance across all touchpoints.

- Automatically detects high-risk users by screening them against global watch lists.

- Uses 11,000 independent sources from 220+ countries for comprehensive checks.

- Identifies and monitors Politically Exposed Persons (PEPs).

- Analyzes adverse media reports and tags them to relevant categories, like enforcement, penalties, and criminal charges.

Pros:

- High accuracy rates.

- Fast customer onboarding.

- Strong API and developer tools.

- Transparent pricing.

Cons:

- Advanced features are available only in the higher-priced models.

Sumsub offers three plans (all priced per verification):

- Basic – $1.35

- Compliance – $1.85

- Enterprise – Custom

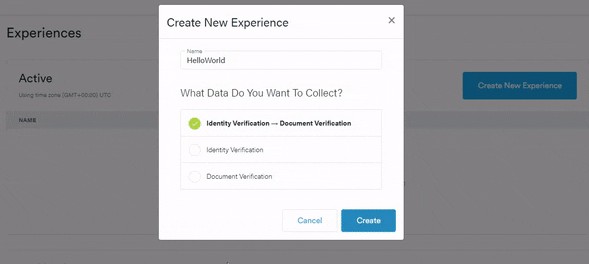

ComplyCube

ComplyCube is a SaaS and API platform that enables digital identity verification and compliance with AML and KYC requirements. It supports customer onboarding, age verification, and many other use cases. It works across the jurisdiction of 220+ countries and territories and uses 3,000+ data points from trusted sources.

Source: ComplyCube

Key Features

- Comes with developer-friendly tools, including APIs, client libraries, SDKs, and hosted solutions.

- Verifies customer identities in under 30 seconds.

- Protects underage users from accessing restricted content and services.

- Scans extensively against PEPs and sanction lists to reduce the risk of political exposure.

- Continuously monitors customers against black and gray lists.

Pros:

- Performs global KYC checks quickly.

- Supports all business models and jurisdictions.

- Minimize reputational risks for your business.

- Detects fraudsters with smart KYC checks.

Cons:

- Requires fine-tuning to reduce false positives.

ComplyCube offers three plans – Basic, Growth, and Enterprise. The Basic plan is priced at $249/month, while the remaining two have custom pricing.

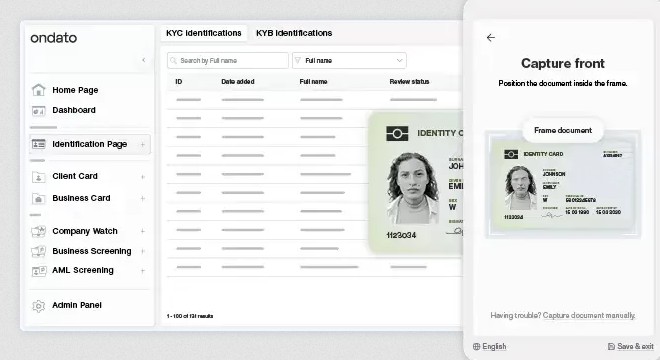

Ondato

Ondato is a complete KYC and AML verification service solution that eases onboarding for new and existing customers. It continuously screens customers to reduce risks for your business, and at the same time, does not impact user experience. It offers support during the entire client lifecycle.

Source: Ondato

Key Features

- Enables you to create custom rules from onboarding to lifecycle management.

- It can onboard new users remotely.

- Performs comprehensive Due Diligence checks.

- Manages all customer data from a centralized hub.

- Supports the KYC requirements of 192 countries with 15,000+ global sources.

Pros:

- Reduces KYC costs by 90%, as per the website.

- Simplifies processes to save time.

- Supports identity fraud prevention.

- Works well across multiple regulations.

Cons:

- Fewer third-party integrations.

You can choose from three plans:

- Identity verification – €1,40 – €0,50/verification.

- Know your business – Starts from €600.

- Age verification – €0,11 – €0,01/verification.

Plaid

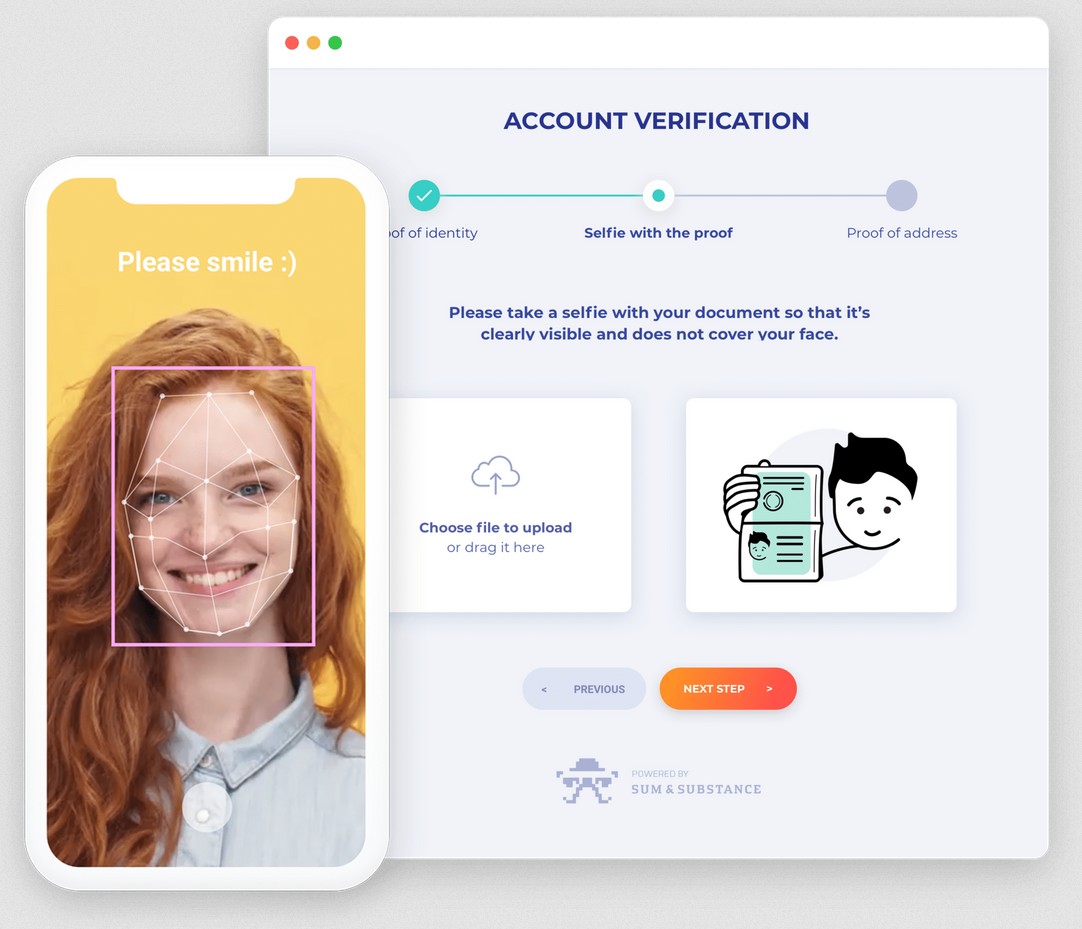

Plaid is an easy-to-use identity verification tool that can authenticate IDs, check the identity data, and confirm liveness within a few seconds. It streamlines the entire KYC process to reduce risks and fines due to non-compliance. Its anti-fraud engine analyzes hundreds of risk signals to proactively identify risk in customers and transactions.

Source: Plaid

Key Features

- Based on how users enter PII, it can identify behavior associated with bad actors, and send alerts accordingly.

- Checks if email addresses and phone numbers are new, registered with external accounts, or compromised in data breaches.

- Detects VPN, Tor, IP geolocation, and time zone mismatches.

- Identifies stolen, manipulated, and fabricated identities.

- Comes with dedicated data source coverage for unbanked and thin-file customers.

Pros:

- Supports multiple languages.

- Customizable workflows using a no-code editor.

- Comprehensive user and session recording for compliance.

- Flexible integrations via APIs.

Cons:

- Limited international coverage.

Plaid offers three plans – Pay-as-you-go, Growth, and Custom. Contact the support team for a custom quote.

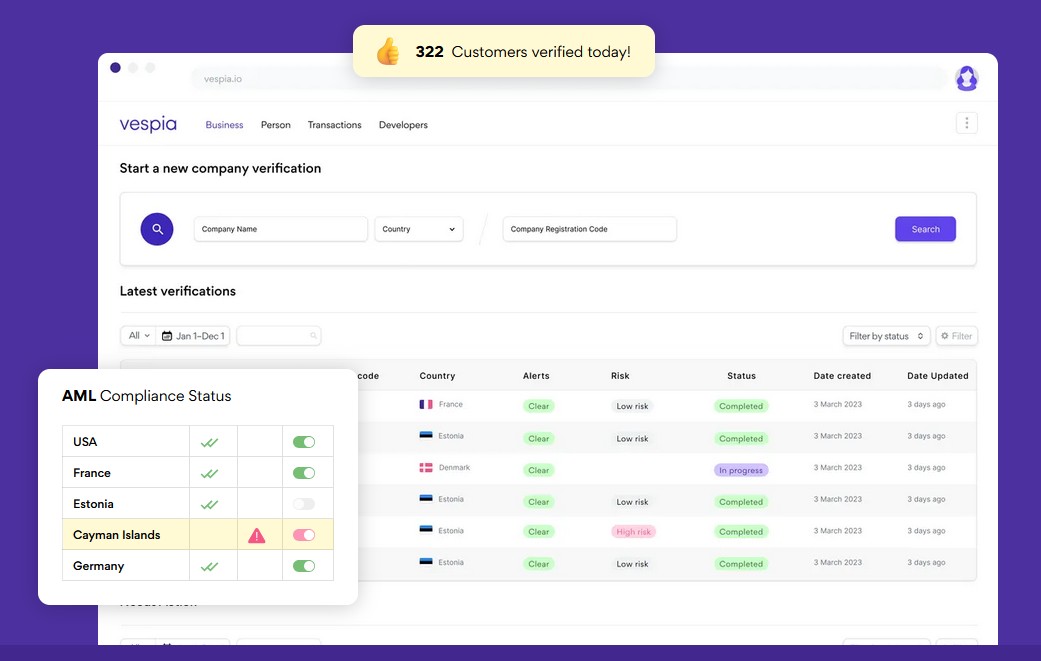

Vespia

Vespia is an AI-powered business verification solution that brings together KYB and KYC into the same platform. Using this tool, you can verify the identity of any customer or business, and ensure that the process meets the local jurisdictional requirements. It can even automate the entire AML compliance and risk analysis for improved efficiency and reduced risks.

Source: Vespia

Key Features

- Uses hybrid rule approaches and AI to screen your customers and provide a risk score for each, so you can monitor them accordingly.

- Generates audit trails and machine-readable reports for quick analysis and to meet compliance requirements.

- Offers Liveness Detection to ensure they are live.

- Sends notifications when a document has expired.

- Provides insights into global commercial registers and extensive databases.

Pros:

- Handles AML and KYC screening automatically.

- Supports more than 7000 document types across 190 countries.

- Simplifies onboarding workflows.

- Seamlessly integrates into websites.

Cons:

- International coverage is still expanding.

The Starter package begins at €99.

Final Thoughts

To conclude, choosing the right KYC compliance software is mandatory, both from security and compliance standpoints. However, the exact choice depends on your institution’s size, risk appetite, regions of operations, and integration needs. Large banks may benefit from comprehensive platforms like NICE Actimize, while startups might prefer tools like Sumsub or ComplyCube for flexibility and cost-effectiveness. Make sure to evaluate key features, like the depth of identity verification, AML features, and regional coverage, before selecting a tool. With compliance expectations only set to rise, a reliable KYC software is essential, but you can ensure that it is also a right fit for your operations.