Money laundering is a major financial threat facing the world today. It is estimated that anywhere from two to five percent of global GDP is laundered each year through organized crime. To counter this, governments worldwide have introduced strict legislation that mandates financial firms to do a thorough background check of entities and specific transactions.

Anti-Money Laundering (AML) is mandatory legislation, and organizations must follow its provisions. However, meeting its requirements manually can be time-consuming and this is where AML compliance software can come in handy.

Selecting the Right AML Compliance Software

Selecting the right AML compliance software is a critical decision. With the right platform, you can meet the requirements with minimal time and resources, and avoid the penalties that come with non-compliance. That said, the choice of tool depends largely on your organization’s unique needs, so understanding them is the first step.

Below are a few important factors to consider when selecting an AML compliance platform.

Regulatory Coverage

Different jurisdictions have distinct AML regulations, such as the Bank Secrecy Act (BSA) in the U.S., the EU’s Anti-Money Laundering Directives (AMLD), and FATF recommendations. A good AML tool should support compliance with these global standards and be adaptable to evolving laws.

Transaction Monitoring Capabilities

AML software must provide real-time transaction monitoring to detect suspicious patterns and flag high-risk transactions. It is a bonus if it can generate alerts instantly, so the IT team can take the necessary steps. Tools that leverage machine learning and AI-driven analytics can further increase the accuracy of detection and reduce false positives.

Customer Due Diligence (CDD) and Know Your Customer (KYC)

The AML tool you select should streamline the associated KYC and CDD processes for a comprehensive approach. It must automate identity verification, risk assessments, and screening against watchlists like OFAC, Interpol, and PEP lists.

Case Management and Reporting

A comprehensive AML solution should offer case management features that allow compliance teams to track, investigate, and document suspicious activities. Automated regulatory reporting to agencies like FINCEN and FCA will also be helpful.

Integration and Scalability

Your AML software should integrate well with existing banking systems, ERP platforms, and third-party databases. A key aspect to remember is scalability, especially if you want to handle large transaction volumes without performance issues.

Cost and Deployment Options

Another key aspect to consider is the licensing and deployment costs. Weigh the costs of on-premise versus cloud-based AML solutions to decide which is the right fit for you. While cloud-based tools provide flexibility and automatic updates, on-premise deployments offer greater control over data security.

With these factors, pick the perfect AML compliance tool for your needs.

Best AML Compliance Tools

Many AML compliance platforms are available today, and we have selected the best ones based on factors like scalability, breadth of features, cost-value proposition, and suitability for a wide range of industries.

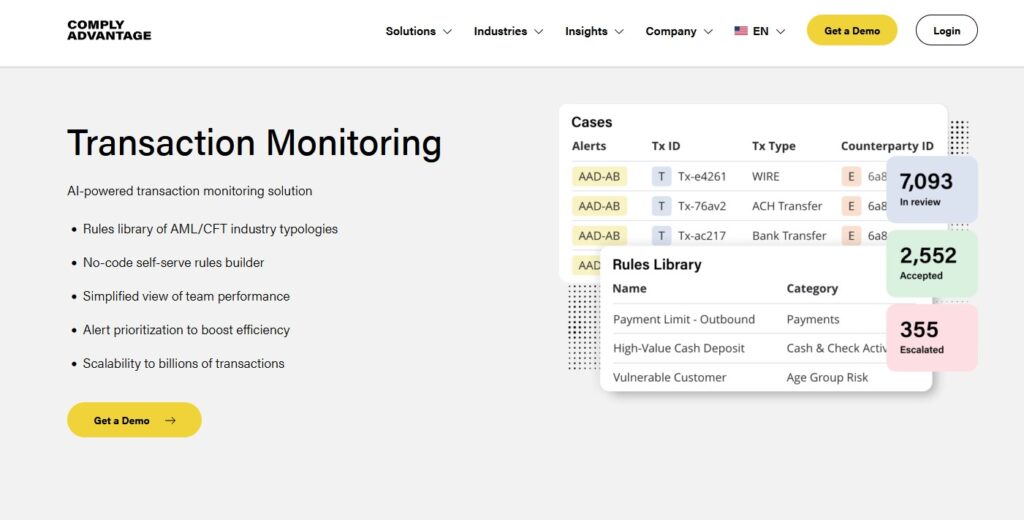

1. ComplyAdvantage

ComplyAdvantage is a leading AML compliance solution that leverages AI and machine learning to detect financial crimes. Its many features, like real-time transaction monitoring, adverse media screening, and risk assessments, help financial institutions improve their compliance.

Source: ComplyAdvantage

Key Features

- Monitors known topologies and trends to identify suspicious behavior.

- Screens risks and sends alerts to prevent them from occurring.

- Combines risk data and case management to provide in-depth insights.

- Its processes are aligned with FATF regulations.

- According to the website, this platform reduces false positives by 70% and onboarding by 50%.

Pros:

- Extensive automation.

- Reduces costs.

- Highly scalable.

- Integrates well with popular platforms.

Cons:

- Advanced AI features require training.

- Additional customization is needed to integrate with legacy banking platforms.

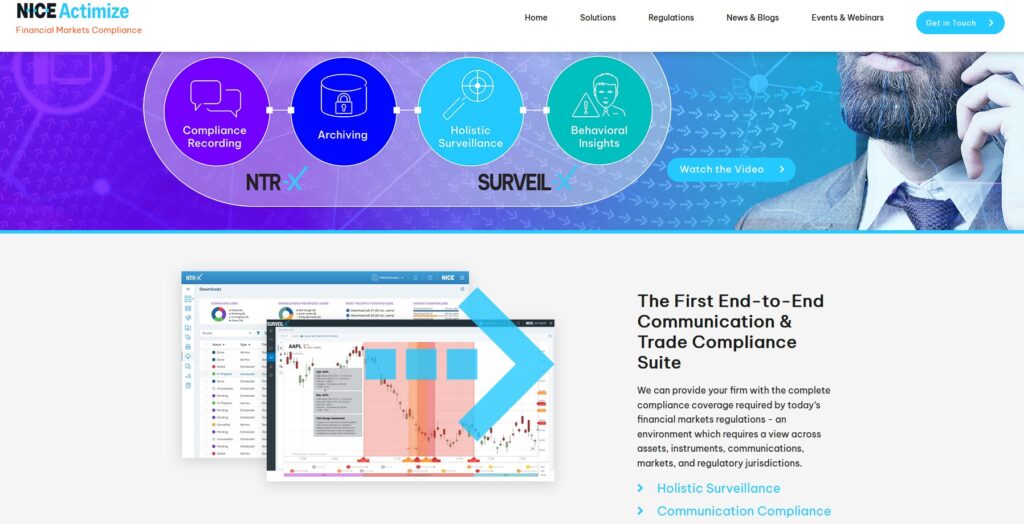

2. NICE Actimize

NICE Actimize is another popular AI-powered AML and fraud solution that can monitor transactions and reduce the chances of fraud. It also offers real-time end-to-end enterprise fraud management to safeguard your organization from a wide range of threats.

Source: NICE Actimize

Key Features

- Uses AI-driven behavioral analytics to detect unusual patterns in financial transactions.

- Automates customer risk assessments with real-time data from global sources.

- Provides ongoing monitoring against regulatory watchlists, including OFAC, FATF, and EU sanctions.

- Provides alerts and supports compliance with AI-assisted workflows.

- Identifies and adapts to emerging threats with predictive analytics.

Pros:

- Reduced false positives.

- Comprehensive KYC and CDD capabilities.

- Scalable and customizable.

- Strong automation.

Cons:

- Expensive for small businesses.

- Can generate a high volume of alerts.

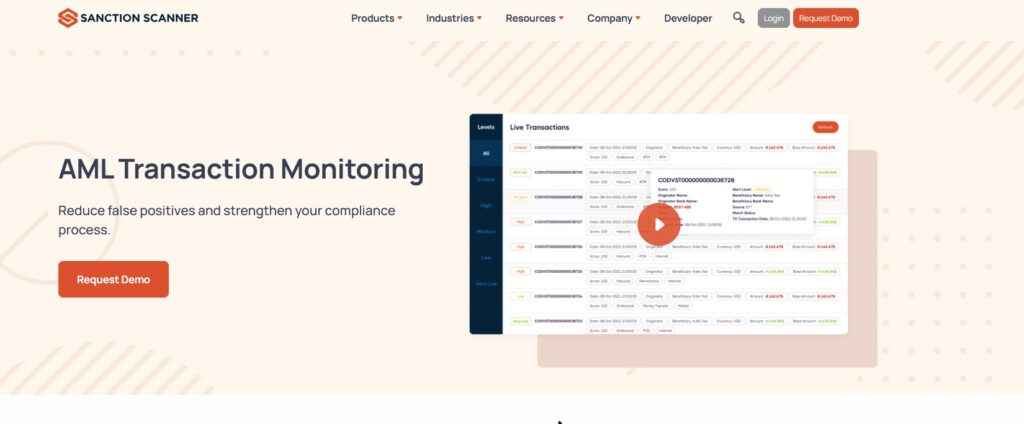

3. Sanction Scanner

Sanction Scanner is an AML compliance tool designed to help financial institutions and businesses meet regulatory requirements by providing real-time sanction screening, transaction monitoring, and customer due diligence solutions. It is particularly beneficial for small to mid-sized financial institutions looking for an affordable and efficient AML compliance solution.

Source: Sanction Scanner

Key Features

- Scans through 3000+ global sanction lists to reduce your risk.

- Automates the transaction monitoring process.

- Assigns a score to customers based on their risk profiles.

- It comes with advanced dashboards that provide detailed insights.

- Integrates well with extensive APIs.

Pros:

- Affordable for SMEs.

- Real-time screening.

- Customizable settings.

- User-friendly.

Cons:

- Not suited for large enterprises.

- Manual intervention may be needed to refine initial accuracy.

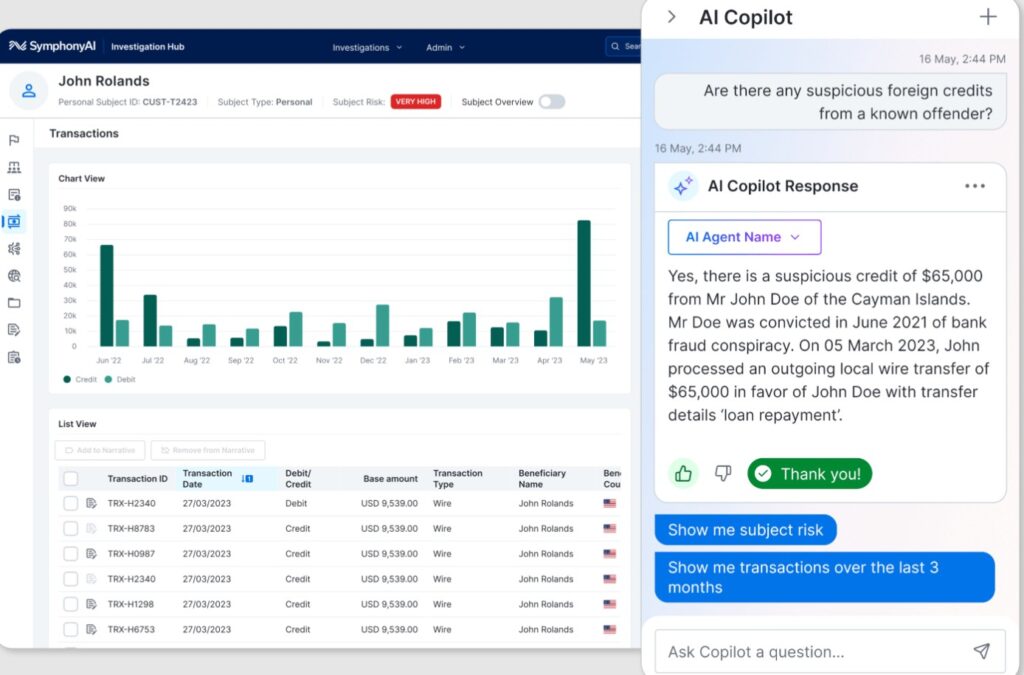

4. Symphony AI

Symphony AI also leverages the power of AI to reduce false positives and identify AML-related risks. It also performs CCD and KYC to protect your business from complex financial crimes. More importantly, this tool adapts to emerging changes and regulations for continuous protection.

Source: Symphony AI

Key Features

- Unifies KYC, AML, and CDD sanctions screening for comprehensive fraud protection.

- Integrates with CoPilot for AI-powered assistance.

- Analyzes and summarizes risk data at scale and within seconds.

- Automatically generates SARs and other compliance reports to meet global AML regulations.

- Provides flexibility and scalability for financial institutions of all sizes.

Pros:

- Improved accuracy.

- Advanced behavioral analytics.

- Easy integration and scalability.

- Real-time monitoring.

Cons:

- AI training requires accurate data.

- Complex for organizations with limited IT resources.

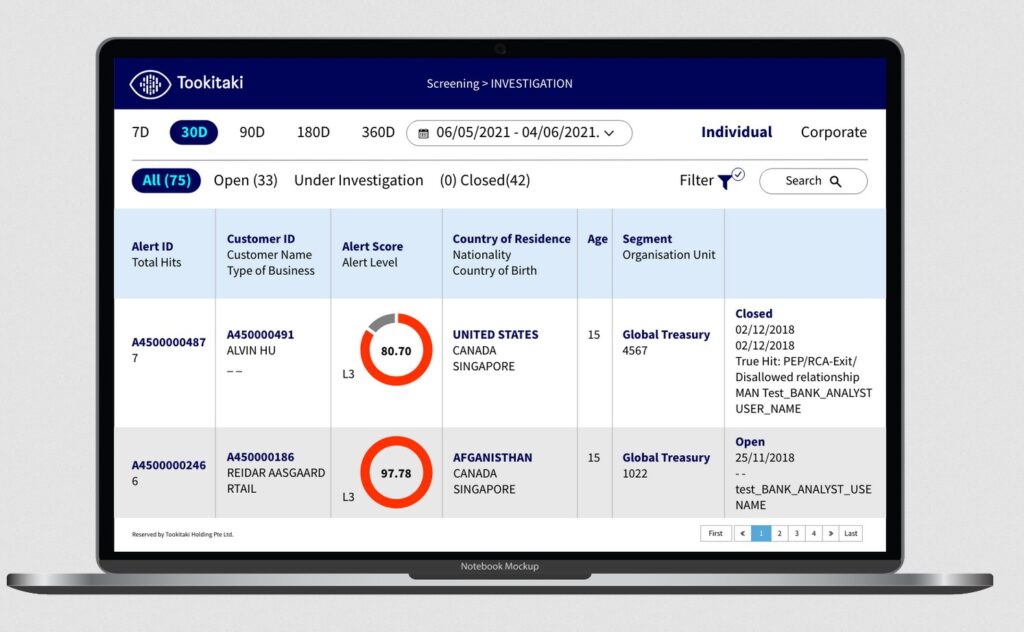

5. Tookitaki

Tookitaki is a technology-driven platform for collaborative intelligence and fraud prevention. Its extensive coverage helps build institutional trust while combating money laundering.

Source: Tookitaki

Key Features

- Offers protection from 50+ fraud scenarios, like account transfers and money mules.

- Monitors billions of transactions for suspicious activities.

- Uses advanced AI to prevent fraud in real time.

- Generates reports for different compliance requirements.

- Combines CDD, transaction monitoring, and screening.

Pros:

- Process more than 200 Transactions Per Second (TPS) with 99.9% platform availability.

- Reduces false positives by 90% and operating costs by 30%, as per its website.

- Community-driven intelligence keeps the database updated.

- Protects against emerging money laundering threats.

Cons:

- Implementation requires AI knowledge.

- Training may be required.

6. LexisNexis

LexisNexis is a comprehensive AML solution that handles complex challenges throughout the customer lifecycle. It efficiently handles critical workflows while providing complete risk visibility. It also offers integrated tools that can be configured for specific AML compliance requirements.

Source: LexisNexis

Key Features

- Simplified initial due diligence to help you onboard customers quickly.

- Automates high-volume screening.

- Sends instant alerts and supports quick remediation.

- Converts disparate big data sets into actionable risk insights.

- Supports a wide range of compliance regulations like the USA Patriot Act, FinCEN, FATF, OFAC, and more.

Pros:

- Global access to watchlists and databases.

- AI-powered analytics.

- Integration with global financial systems.

- Highly customizable.

Cons:

- Too large and complex for SMEs.

- Complex user interface.

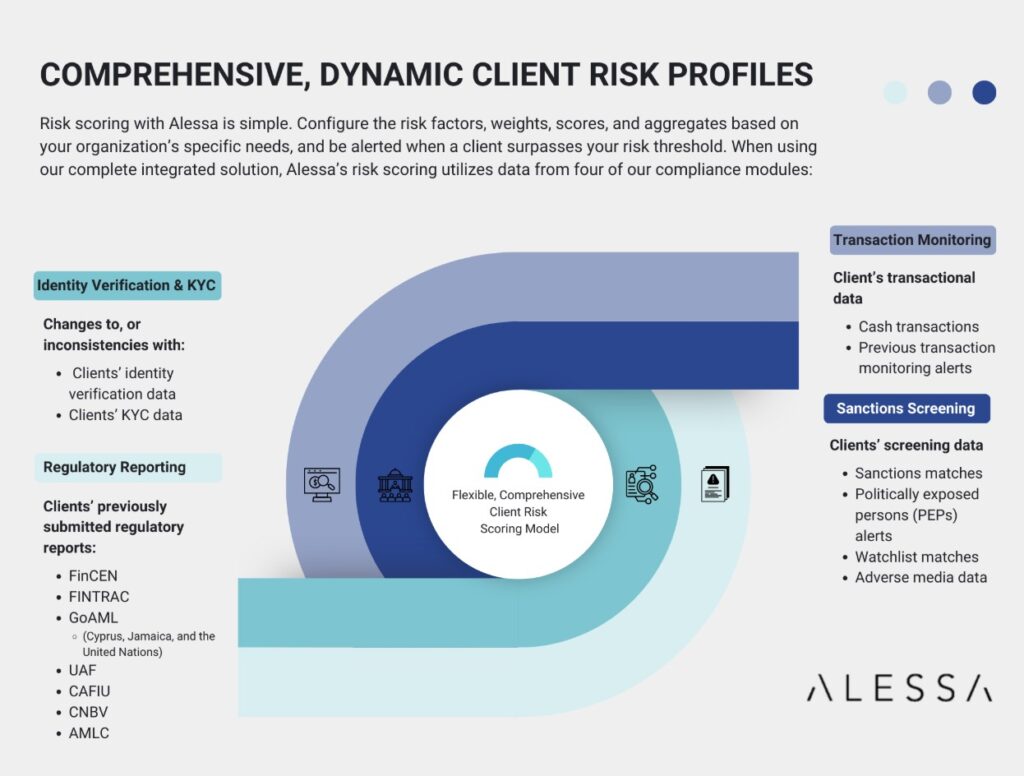

7. Alessa

Alessa is another advanced AML monitoring tool that offers 360-degree views of compliance requirements. Also, it can automate 100% of regulatory reporting saving time and resources for your organization.

Source: Alessa

Key Features

- Creates a score for every user profile to make it easy to identify the risky entities.

- Offers a case management solution to investigate a financial crime.

- Provides highly configurable and intuitive dashboards.

- Supports role-based team collaboration and communication while gating access to authorized individuals.

- Its PEP scoring models reduce false positives.

Pros:

- Better accuracy with AI models.

- Customizable rules and workflows.

- Scalable.

- Integrates with popular and custom banking systems.

Cons:

- High customization can require training.

- Expensive for SMEs.

Many of these tools also come with free trial versions and demos to help you evaluate this tool’s fit for your organization.

Final Words

To conclude, selecting the right AML compliance platform can take a lot of stress from your operations. Automated workflows, continuous monitoring, customization, and scalability can save time and resources while allowing to be on top of emerging threats. To recap, solutions like ComplyAdvantage and Sanction Scanner offer strong AI-driven transaction monitoring, while NICE Actimize and Symphony AI provide comprehensive risk management features. Tookitaki and LexisNexis leverage machine learning to enhance fraud detection, whereas Alessa offers scalable compliance tools tailored for different financial institutions.

When selecting an AML solution, consider the factors mentioned above, along with ease of integration, real-time monitoring capabilities, regulatory reporting automation, and adaptability to evolving compliance requirements.