The many financial scandals and cyberattacks have eroded the trust and confidence of investors in the financial market. The U.S. Congress created a non-profit organization called the Financial Industry Regulation Authority (FINRA) to address these concerns, protect investors’ rights, and keep the financial markets fair and transparent. FINRA writes and enforces rules that govern the actions of all broker-dealer firms and other registered brokers in the U.S., and the Securities and Exchange Commission (SEC) oversees this implementation.

We evaluated hundreds of tools and picked the top six ones that complement existing checklists and templates while making your systems future-proof:

- Red Marker An automated risk detection platform that ensures FINRA compliance to avoid the ensuing disciplinary actions.

- DASH Tech A leading tool that supports financial markets firms to meet SEC and FINRA compliance.

- Smarsh A streamlined tool that captures, archives, and monitors business communications to ensure FINRA compliance.

- CloudCodes An integrated CASB solution that meets FINRA compliance requirements.

- SteelEye An integrated financial services compliance platform that captures, safeguards, and analyzes orders, trades, communications, and more.

- Process Street An AI-based tool to manage FINRA compliance and boost efficiency.

If you’re a financial services company or broker in the U.S., you must comply with FINRA’s rules. This guide will discuss FINRA in-depth and how you can comply with it. Finally, we will review some of the best tools to ease this compliance.

What is FINRA Compliance?

FINRA has developed a set of rules and regulations that all brokers and brokerage firms operating in the U.S. must follow. These rules relate to the conduct of financial transactions on the New York Stock Exchange. As a part of its regulations, FINRA requires all brokers to be licensed and registered, and they must pass the relevant examinations to be qualified for conducting business in securities.

Read through the complete list of FINRA rules to ensure your operations comply with them. To assess if your brokerage firm is following the specified guidelines, FINRA conducts regular audits. Any potential violations are examined in-depth to assess the impact on the financial markets. To give you an idea, FINRA processes an average of 427 billion events every day conducted by 3,378 securities firms, 620,882 registered representatives, and 150,647 branch offices. These massive operations are well-funded and supported by the U.S. government.

Failure to meet FINRA compliance can result in heavy fines and penalties. For example, in 2022 alone, FINRA imposed $54.5 million in fines, suspended or barred 555 individuals, and sent 663 cases for prosecution.

To avoid facing the above fines, you must understand and comply with FINRA’s rules.

FINRA Compliance Pillars

FINRA updates its guidelines every year. The first step towards compliance is to read and understand these guidelines, so you can make the necessary changes to your processes and workflows. Also, at the heart of FINRA is extensive written records that encompass all transactions and communications. Moreover, these records must be systematically indexed and easy to find.

For 2024, FINRA has introduced new regulations, and they are:

Crypto Asset Developments

These provisions apply to member firms engaged or seeking to engage in crypto asset-related activity. This includes:

- Review and evaluate supervisory programs and controls.

- Perform due diligence on crypto asset private placements.

- Supervise the associated persons’ involvement in crypto asset-related outside business activities (OBAs) and private securities transactions (PSTs).

- Ensure compliance with AML, manipulative trading, and cybersecurity guidelines.

OTC Quotations in Fixed Income Securities

This provision relates to the Exchange Act Rule 15c2-11 which covers the publication or submission of quotations by broker-dealers in a medium other than the national securities exchange’s OTC format. Though the SEC provided relief from this provision for fixed-income securities, members must maintain a system for supervising the process to achieve compliance.

Advertised Volume

FINRA Rule 5210 says that firms can’t share information about buying or selling stocks unless they buy or sell them. But, firms can share their trading activity if they want to, as long as it’s truthful and accurate. They can use service providers to spread this info to subscribers and the market, but they still need to follow the rules of Rule 5210.

Market Access Rule

The Exchange Act Rule 15c3-5, also known as the Market Access Rule, says that firms offering market access must manage risks properly. This is to protect their finances, and those of other market players, and to keep trading fair and the financial system stable. The rule covers various types of securities traded on different platforms, including stocks, options, ETFs, bonds, and crypto assets that are considered securities under the Exchange Act.

Besides the new ones, broker firms must continue meeting the existing guidelines on firm operations, communications and sales, market integrity, and financial management.

As you can see, FINRA compliance is elaborate and complex, and at the same time, necessary to avoid heavy fines. To help you through this process, FINRA offers many compliance tools, including checklists, document templates, processes, charts, disclosure forms, and more.

You can also leverage automated compliance platforms to further streamline FINRA compliance processes. Next, we will look at the best FINRA compliance software available today.

Our Methodology

While evaluating different tools, we created a set of factors that can improve compliance rates while making it less stressful and resource-intensive for organizations.

The factors we considered are:

- Ability to import data from different sources.

- Detailed and insightful reports.

- Automatic categorization of transactions.

- User-friendly interface and robust integration.

Best FINRA Compliance Software

Let’s take a detailed look into each of these tool’s capabilities.

1. Red Marker

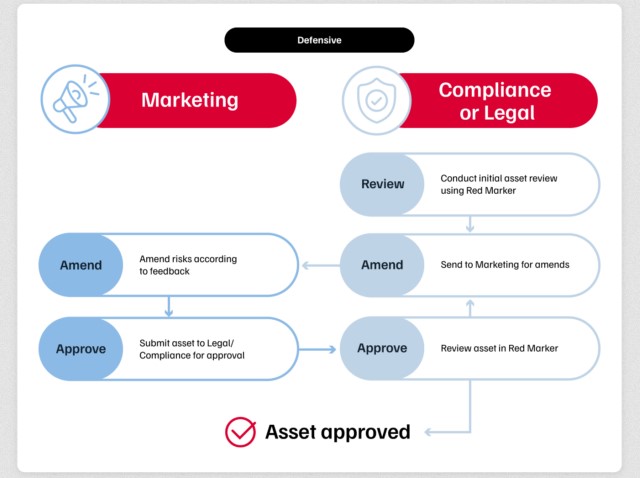

Red Marker is an intelligent software that automates and optimizes the documentation and review processes to ensure FINRA compliance. It also provides real-time feedback that’s aligned with specific requirements to help you take corrective action right away. Moreover, it offers the necessary tools to help the compliance team meet FINRA’s requirements.

Source: Red Marker

Below are some ways by which Red Market helps with FINRA compliance.

Focus on Digital Communications

Communication from brokers-dealers is one of the pillars of FINRA compliance. Red Marker scans all digital and marketing content to ensure that this communication avoids misleading claims and false advertisements. It also maintains brand consistency while optimizing the effort of your marketing resources.

Content Formats

Red Marker supports a wide range of content types and media that are FINRA-compliant. You can use these formats for confident communication with your customers. These formats can also be customized to meet your organization’s specific needs.

Data Security

Along with the right communication, you must safeguard your customer information. This is why data security is an essential part of FINRA compliance. Red Marker helps you prioritize data security with cryptographic techniques, layered security protocols, and regular updates to security policies.

With such features, Red Marker ensures that your marketing and advertising departments are always FINRA-compliant.

Pros:

- Automated marketing and website compliance.

- Streamlines the approval process.

- Quick and comprehensive.

- It offers an API for easy integration.

Cons:

- The mobile app can be better.

- Expensive.

2. DASH Tech

DASH Tech is a FINRA compliance tool that simplifies adherence to FINRA’s rules and regulations. Specifically, it helps meet the requirements of FINRA 4210, which is related to the complex margin requirements. Likewise, it helps compliance with FINRA 4524, which deals with supplemental focus information.

Source: DASH

Here’s a look at DASH’s FINRA tools.

Comprehensive Dashboard

DASH360R, a hosted regulatory reporting portal, creates insightful reports that provide information on compliance gaps. Moreover, its streamlined audit and back office processes streamline all your reconciliation efforts on a single platform.

Document Generation

FINRA requires all member firms to compose and submit their Financial and Operational Combined Uniform Single (FOCUS) reports to FINRA. With an automated FOCUS reporting tool, DASH makes this compliance a breeze for your organization. All you have to do is provide the relevant information and the tool generates a document in the eFOCUS format.

Margin Requirements

DASH enables you to comply with the stringent margin requirements laid down by FINRA. Its Risk-Based Margin (RBM), Intraday (iRBM), Option Margin Optimizer System (OMO), and Day Trader Margin (DTM) System help meet every requirement of FINRA rule 4210.

With such features, your FINRA compliance becomes automated and less stressful with DASH.

Pros:

- The workflow builder is intuitive.

- Good customer support.

- Extensive compliance.

- In-depth search options.

Cons:

- Clunky user interface.

- Not possible to save custom views.

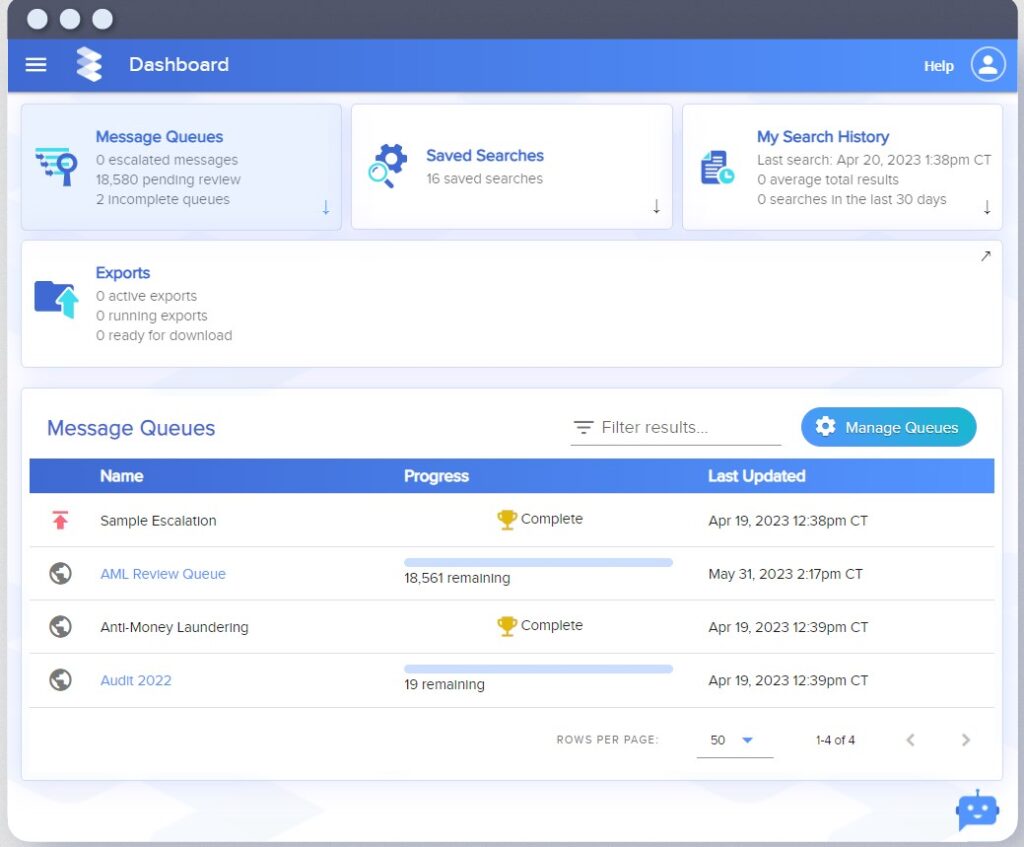

3. Smarsh

Smarsh is a simplified communications platform that unifies the processes required for FINRA compliance. It also supports collaboration across departments to unify communication to a single platform for easy compliance. Moreover, it even integrates generative AI capabilities to help companies take advantage where appropriate.

Source: Smarsh

Below are the notable FINRA compliance features of Smarsh.

Real-time Reports

Smarsh archives all your data, making it easy to produce real-time reports for assessment, evaluation, and even investigation into specific issues or lawsuits. Its well-developed search capabilities make it easy to find the required data in record time.

Unified Platform

Amidst the thousands of messages your firm sends daily, it can take just one chat or email to fall out of compliance. A simple oversight can eventually lead to a regulatory or even PR disaster. But with Smarsh, every message goes through multiple filters to remove anything that can negatively impact your organization.

Spots Risks

Another advantage of Smarsh is that it closely scrutinizes your communications to identify red flags and alerts your compliance team. This proactive approach keeps your communications safe, relevant, and compliant. Moreover, it spots risks before they turn into fines.

Overall, Smarsh helps firms meet FINRA record keeping requirements and obligations with confidence.

Pros:

- Easy data archiving and retrieval.

- Best enterprise search features.

- It comes with social media monitoring.

- Extensive cyber protection.

Cons:

- Confusing pricing structure.

- Sorting can be better.

4. CloudCodes

CloudCodes is a comprehensive Cloud Access Security Broker (CASB) designed to keep your cloud data and applications secure. It is an integrated solution that efficiently protects the entire universe of SaaS data, resources, and applications. Its focus on data security and communication helps meet FINRA regulations.

Source: CloudCodes

Below are the FINRA-compliant features of CloudCodes.

Data Loss Prevention (DLP)

The growing risk exposure requires organizations to have a streamlined DLP solution that protects sensitive data from internal and external threats. Moreover, data is largely stored in the cloud, making DLP even more relevant for organizations today. CloudCodes offers a DLP solution that can meet the data security requirements of FINRA.

Cybersecurity

Cloud services are the perfect vectors for cyberattacks as they are exposed to the Internet. However, with a tool like CloudCodes, you can streamline access, create filters for communications, and more to help with FINRA compliance.

Identity Management

Identity management streamlines the use of identity and provides the necessary authentication, authorization, roles, and privileges to the appropriate users. With the growing role of social media in today’s world, organizations find it increasingly difficult to meet FINRA compliance. CloudCodes offers identity management solutions that align with FINRA.

In all, CloudCodes is a CASB solution that provides features to improve your security and compliance with FINRA and other regulations.

Pros:

- Supports multiple cloud providers.

- Simplifies compliance with FINRA, GDPR, HIPAA, and PCI-DSS.

- Scalable and flexible architecture.

- Focuses on data security.

Cons:

- Supports mobile device management.

- Limited customer support.

5. SteelEye

SteelEye is an integrated surveillance solution for financial companies to help them meet FINRA compliance. With SteelEye, you can meet FINRA rule 4511 about preserving books and records. Similarly, you can meet other record keeping regulations like 2210, 2241, 2360, and 5130.

Source: SteelEye

Below are SteelEye’s features that help with FINRA compliance.

Record Keeping

FINRA lays down stringent rules for establishing, enforcing, and maintaining records. You must ensure that your records meet the established supervisory controls and procedures. Also, you must review these records periodically for compliance. SteelEye comes with all the required record keeping support to meet FINRA’s specifications.

Streamlined Communications

Communication is another pillar of FINRA compliance, as brokers-dealers must not provide misleading communication on any channel. Moreover, they must record their transactions and store them for at least three years. Also, the records for the first two years must be in an accessible place. With SteelEye, you can stop worrying about these provisions.

Integrated Surveillance

SteelEye offers simple and effective supervisory controls that stay on top of all the data across multiple formats and environments. As a result, you can get rich reports and automated workflows and analytics. With such integrated surveillance, you can even quickly identify suspicious activities.

Due to these features, SteelEye can be a good choice for financial organizations looking to comply with FINRA regulations.

Pros:

- Comprehensive supervision and surveillance.

- Extensive reports.

- Meets FINRA’s record keeping requirements.

- Continuously monitors controls.

Cons:

- Steep learning curve.

- Expensive.

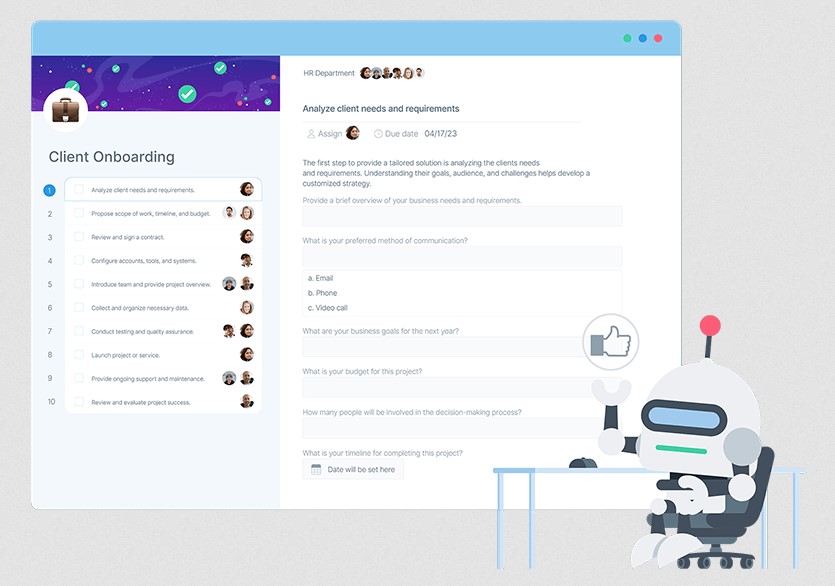

6. Process Street

Process Street is an AI-powered platform that helps companies meet the stringent regulations of FINRA while boosting their operational efficiency and security. It has many features to manage workflows, datasets, pages, forms, and more for integrated storage and control.

Source: Process Street

Let’s now look at Process Street’s features that help with FINRA compliance.

Streamlined Workflows

Process Street is a comprehensive solution for automating, tracking, and optimizing your business processes. You can use its conditional logic to respond dynamically to certain criteria and create workflows that meet your organization’s compliance and other needs.

Approvals and Permissions

With Process Street, you can have granular control over approvals and permissions. You can use its single or sequential approval process to speed up data flow and at the same time, improve compliance and accountability. Similarly, you can control who sees your data and how it is used. All these aspects meet the data security requirements of FINRA.

Use of AI

Process Street uses an AI-powered design that adapts well to your changing needs. FINRA updates its provisions each year, and this tool can help your organization adapt to these changes, making your investment more lasting and future-proof. More importantly, it ensures continuous compliance.

Overall, Process Street can ease many aspects of FINRA compliance, saving you time and effort while helping with compliance.

Pros:

- Intuitive user interface.

- Helps create checklists.

- Good customer support.

- Useful integrations.

Cons:

- Limited add-ons and templates.

- Permissions and access control mechanisms can be better.

Get started with Process Street.

Thus, these are some of the best tools to ease FINRA compliance for your organization.

Final Thoughts

FINRA is a mandatory compliance for financial organizations, brokers, and brokerage firms in the U.S. These stringent regulations aim to create fairness and transparency in financial markets, resulting in increased confidence in the American financial system.

From an organization’s standpoint, meeting these FINRA regulations is difficult, and this is why compliance tools are essential. In this guide, we reviewed six tools that will meet FINRA compliance while providing the related benefits to your organization. We hope this information is useful to improve the efficiency of your compliance processes.