Modern companies face numerous risks, from cybersecurity and tax to competition laws. Whether you operate in the US, UK, or internationally, a dedicated compliance team can reduce these risks by ensuring your company follows all relevant rules.

Compliance departments handle both legal and ethical compliance. For instance, they track whether employees follow your company’s behavioral regulations and implement procedures to report wrongdoing. They also ensure your company doesn’t break the law, saving you from costly fines and reputational damage.

This guide will show you how to build an industry-leading compliance team to promote effective compliance.

Building An Industry-Leading Compliance Team

Creating an effective compliance program takes time. But it’s vital in the current climate of increasing regulation.

Compliance is essential for highly regulated industries, such as financial services organizations. That said, all companies will benefit from building a strong compliance team. Below are our tips on how to do just that.

Defining and establishing the compliance team’s role

Your first task is to understand your company’s internal and external compliance obligations. Once you do, you can define the team’s role in your organization and establish policies to ensure you meet your obligations.

The responsibilities of compliance officers vary according to your industry. Broadly, though, you’ll want your compliance team to:

- Identify risks and carry out active risk management.

- Document and update compliance policies and procedures.

- Create and run operations to track compliance.

- Advise on compliance regulations.

- Handle external oversight requests.

- Find solutions to violations.

You’ll also need to appoint a Chief Compliance Officer (CCO) to oversee the team and act as your “go-to person” for compliance matters.

Developing a solid foundation

As with any department, your compliance team will need the appropriate budget and relevant resources to carry out its role successfully. You’ll also need to hire professionals with the necessary compliance skills and experience.

For instance, team members should have excellent communication skills and high integrity. Moreover, they should be aware of regulatory changes and trends. If you conduct business in the UK, you need to stay on top of new Making Tax Digital (MTD) deadlines, while US compliance professionals should be abreast of updates to the Tax Cuts and Jobs Act.

Image Sourced from thomsonreuters.com

Depending on your company’s size, your compliance department will need the following:

- Leadership: Manage compliance programs, conduct assessments of risk management, oversee training programs, etc.

- Investigations: Conduct investigations into potential compliance breaches.

- Technology: Manage internal systems and software, create and optimize workflows, etc.

- Implementation: Coordinate with other departments to implement compliance policies throughout the organization.

Fostering strategic relationships with key partners

To implement compliance effectively, your team must work with other departments, including legal, accounting, HR, and IT. This is especially important when different departments deal with different aspects of compliance activities.

For instance, your IT department deals with cybersecurity, while HR handles sexual harassment. In this scenario, your compliance team must coordinate the different groups to ensure consistency and prevent redundancy.

Ensure your team holds regular meetings with other departments and the C-suite. They should also set out who handles what and create policies to ensure issues go to the right group.

Enforcing compliance policies and procedures

Compliance policies and procedures, including the employee code of conduct, should be available to everyone (for example, on your company’s intranet). They should also be visible on your website so customers and regulators can see you’re serious about your obligations.

You also need to develop an enforcement plan. This should include how you’ll investigate potential breaches and your disciplinary actions. Make these guidelines clear to employees, for example, during onboarding and periodically afterward.

If your company operates in several countries, you’ll also need to translate the documents to reflect the local language and culture.

Cultivating a compliance-oriented culture

By creating a company culture based on compliance, you’ll empower employees to identify and report issues themselves. You’ll also reduce the risk of breaches happening.

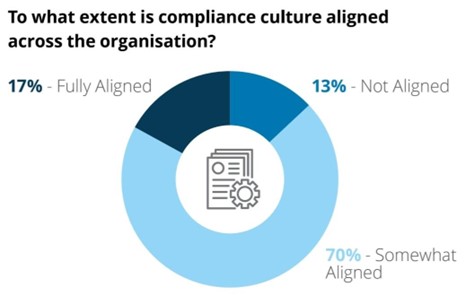

Image Sourced from deloitte.com

To build a culture of compliance, you must communicate your company’s compliance procedures and values. This communication can be verbal or in the form of an email, workplace poster, or dedicated page on your internal website.

You should also hold quarterly or annual training sessions to update employees on any policy changes. Remember to adapt training and communication to suit different departments, locations, and cultures.

Leveraging technology and automation

Technology supports compliance professionals by automating manual tasks and boosting efficiency. For instance, customer screening software supports risk identification, while analytics tools speed up investigations and provide data for any external or internal audit.

In addition, a lot of software comes with built-in compliance, reducing the burden on your compliance team. For example, UK compliance teams can leverage the features of Making Tax Digital software to ensure they follow the latest HMRC tax legislation.

On the other hand, US-based businesses can utilize automation to maintain compliance with the California Consumer Privacy Act if that is the state where they conduct business.

Here are some questions to ask when comparing technology vendors:

- How much does the software cost?

- Will the software integrate with existing tools?

- Is the software scalable?

- Does the software have all the features you need to manage compliance?

Encouraging ongoing growth and flexibility

Regulations change constantly, so compliance departments must keep up with and predict changes to avoid breaches. Plus, for your team to stay effective, it needs to grow as your company grows.

Platforms like enterprise business management software can support your compliance department by giving them a unified view of your business.

With business management systems, your team will have access to real-time data. This helps them make more informed decisions and react quickly to policy changes. They can also use the data to forecast risk, letting them take a proactive approach to compliance.

In addition, the software aids collaboration between departments and remote and office-based employees. So, it can support your compliance team’s growth, even across countries.

Measuring accomplishments and showcasing impact

Once you’ve established your team, you’ll need a way to measure their accomplishments. For this, you’ll need ongoing monitoring and regular audits.

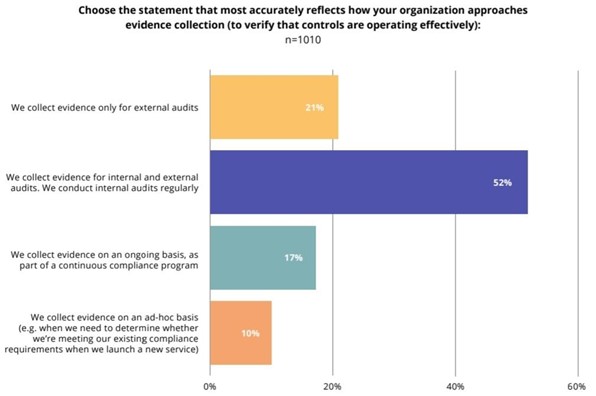

Image Sourced from hyperproof.io

The best way to monitor your team’s impact and effectiveness is to track compliance metrics, such as:

- Total incidents or violations.

- The time between incidents.

- Key risk indicators.

- Cost of compliance.

- The number of investigations.

By monitoring key metrics, you can pinpoint areas for improvement in your policies and procedures. Compare your company’s compliance performance with others in your industry and showcase your performance to senior management and external auditors.

Takeaway

A proactive compliance team is vital for ensuring your company meets its legal and ethical obligations. It also provides important risk control to reduce your chances of incurring penalties.

By following the steps in this guide, you’ll be well on your way to building an industry-leading team. And by equipping them with the latest business intelligence systems, you’ll ensure they fulfill your needs now and in the future.