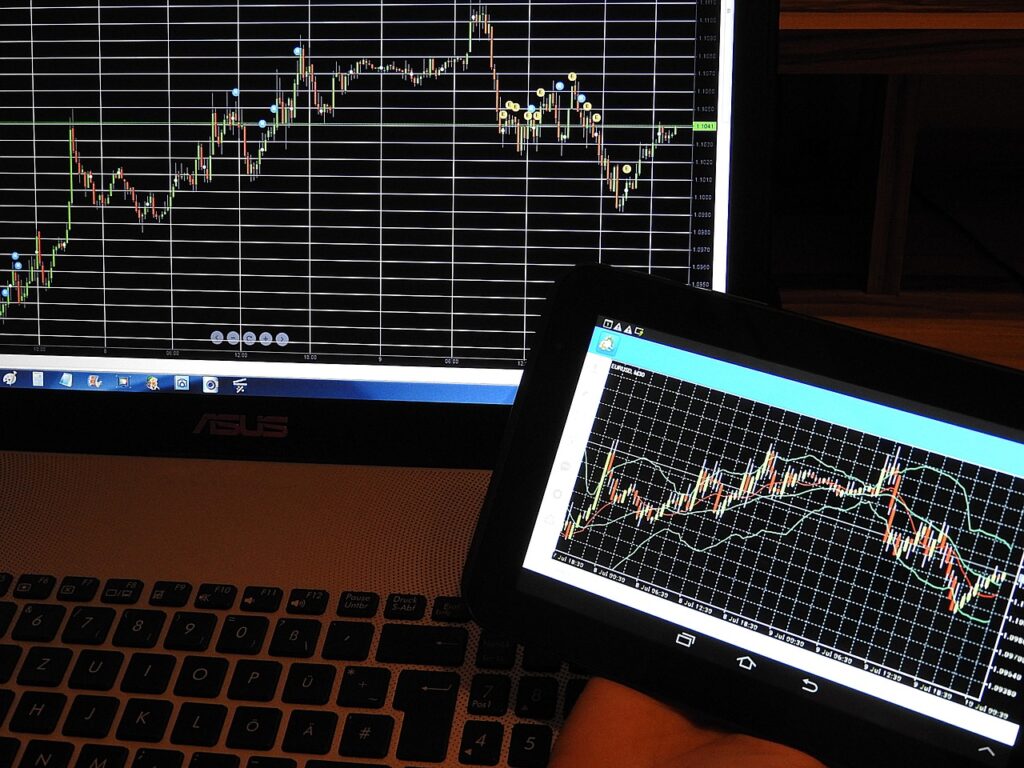

There are numerous ways to invest money in Forex but people are not certain whether a particular method will provide them a substantial return on their investment. This online sector has countless resources available for potential customers but only if you take the responsibility to look up. Many like to make a fortune within a few months and this results in a catastrophic loss. When it comes to analyzing the price trend analysis is the most important tool that one can use. Three types are commonly used by investors and they are the fundamental, technical, and sentiment analysis. We are ignoring the sentiment aspect because many believe this is not necessary for currency trading.

In this article, we will be explaining if one is practically superior to the other. Read this carefully because without the right knowledge one can never succeed in his career. We will analyses every possible aspect and also try to account for different circumstances that might provide a level playing field in terms of reaching a common decision.

Actions of the experts

Before we move to the detail, remember, the Hong Kong investors believe in technical and fundamental analysis. They know both of them are required to find the equilibrium point at trading. If you use Saxo to buy stocks at the best price, gaining confidence will be an easy task. Soon you will realize, technical analysis gives the window to open the trade at the perfect price and fundamental factors allow you to ride the trend. Since both of them are strongly linked, you must learn these two important things. Unless you do, you won’t do any better in the stock market.

The fundamental aspects are different in each of them

Before we begin to differentiate, it is important to understand that counts based on which we are going to segregate them. First of all our technical analysis primarily focuses on the technical aspects such as economic indicators, news, and currency word letters which are not related to fundamental aspects. This is a completely separate area where a person deals with statistical figures and data to plan a strategy. In terms of fundamentals, and individuals have to deal with past market news and historical movements of Forex to predict the future price direction.

The main priority is concentrated on elementary concepts than the technical terms. From this brief introduction, we expect the readers have understood the pivotal divergent features. Many communities are emerging online and investors like to compare every strategy available without ever realizing if they are at all comparable.

Every technique has its advantages

You need to understand there is nothing absolute superior in stock trading business. Some strategies might have an advantage over others but this does not imply it is the best to use. Depending on circumstances, one should use the compatible methods which can provide the best benefits. The trains are changing frequently and investors need to cope up with the ability to survive, implying there are no fixed strategies to analyses the price movement always. Before you begin with one approach, first try to understand the market. This will help to cope with adversities and probably help to win trades.

Combination is required

Many will agree that it is a healthy blend of strategies that can generate profit. The professionals have a wide range of knowledge on all aspects, starting from the least popular methods. Does this help them to make a financial decision? Of course, they have a wider focus than most investors and can select the right formula. If you only accelerate a car while driving, not breaking will result in a severe accident.

From this brief discussion, we expect the readers have got the message. Never think any method is better because it is an illusion. Traders need to use all they have got to win in forex regardless of analyses.