Why the opportunity of RegTech is not limited to banks and financial institutions.

When we talk about the many upsides of Regulatory Technology, we sometimes forget that RegTech has not even started to tap into its real potential: the application in other industries than financial services. Sure, for most RegTech firms financial institutions are the bread and butter. Then there are the solutions that are somewhat limited to financial services because they address issues that in other sectors do not exist. KYC, for instance, could be such a field that many RegTechs are trying to address, but while customer onboarding exists in other industries, too, the value of disruption is probably limited to FinServ. However, many other areas of RegTech disruption are equally relevant in other industries that are heavily regulated. Take, for example, regulatory change, which has been particularly relevant for banks trying to stay on top of the myriad of new laws following the Global Financial Crisis of 2007/2008, but companies in other industries equally need to make sure they are constantly compliant with new and amended rules. Let’s have a closer look at the other industries that are relevant for RegTech companies to get a better understanding of the immense market opportunity:

Insurance

Ok, that’s an easy one. The Insurance shares various similarities with the Financial Industry and several RegTechs are already tackling the industry with cross-sector solutions.

The total gross insurance premiums of the global insurance industry last year were close to $5 trillion and like the Financial Industry the sector is under large pressure from new regulations: some overlapping with the latter following the Global Financial Crisis of 2007/2008, others with a common application like the General Data Protection Regulation (GDPR) as well as sector specific changes like new fiduciary rules in the US.

Solutions for risk management, regulatory changes or case management are an obvious choice, but insurance is often used as a prime example to showcase the functioning of blockchain technology and the underlying smart contracts. The idea is that the smart contract that stipulates all the aspects of an insurance agreement, for example, a crop insurance against bad weather. The details of the agreement get translated into the code of the smart contract with a link to a data source like weather sensors in order to trigger the insurance pay-out if rainfall amounts drop below or exceed a particular level. Naturally, this comes with a number of potential issues but the idea of automating the process including associated cost and time savings for both insurers and the insured makes a highly attractive concept.

Healthcare

A report by the American Hospital Association (AHA) on “Regulatory Overload: Assessing the Regulatory Burden on Health Systems, Hospitals and Post-acute Care Providers” last year found that hospitals and other healthcare providers spend nearly $39 billion a year solely on the administrative activities related to regulatory compliance in these nine domains. The report calculated that “an average-sized community hospital with 161 beds spends nearly $7.6 million annually on administrative activities to support compliance with the reviewed federal regulations”, but that figure rises to $9 million for those hospitals with intensive care. Interestingly, AHA broke the cost down to look at in another way: the regulatory burden costs $1,200 every time a patient is admitted to a hospital.

No wonder that Healthcare is considered a very attractive application for RegTech solutions and the protection of highly sensitive patient data is certainly the most important area. While it has always been a very delicate field the increasing digitalisation of health care increases the pressure on organisations. The use of wearables for patients safety goes hand in hand (no pun intended) with increased obligations in respect of data protection and privacy. The automation of processes is another factor that could produce a substantial increase in efficiency and effectiveness of health services together with sizeable cost savings, which is key to make them affordable for everyone. And then there is of course the need to keep track of regulatory changes, which several RegTech players are already trying to address.

Telecom

In May 2018, the Telecom Regulatory Authority of India (TRAI) published a draft regulation called Telecom Commercial Communication Customer Preference Regulation, 2018, that is proposed to curb the problem of Unsolicited Commercial Communication (UCC), i.e. the nuisance of the many, many calls we receive from call centres around the world trying to sell us internet lines, mobile phone deals and what not. It’s great that a national regulator gets serious about these annoying calls, but the really interesting part of it is that the new rules foresee the adoption of Distributed Ledger Technology (or blockchain) as the RegTech to enforce regulatory compliance while allowing innovation in the market. The regulator writes that “Blockchain has proven useful where the objective is to cryptographically secure information and make it available only on need to know basis. Yet none may deny their actions or tamper with records, once recorded on the distributed ledger, which uniformly enforces compliance. It appears to be the first instance anywhere in the world to use this technology at such a scale in the telcom sector.”

It’s only one area where RegTech is really useful though. Tracking regulatory change is especially relevant for the large corporations that operate in various countries, but thanks to WeChat and Whatsapp the amount of information we share across telecoms infrastructure has skyrocketed and such is the need to protect this data. It also raised the bar for collaboration between national regulators pointing to the potential of SupTech in the telecoms sector.

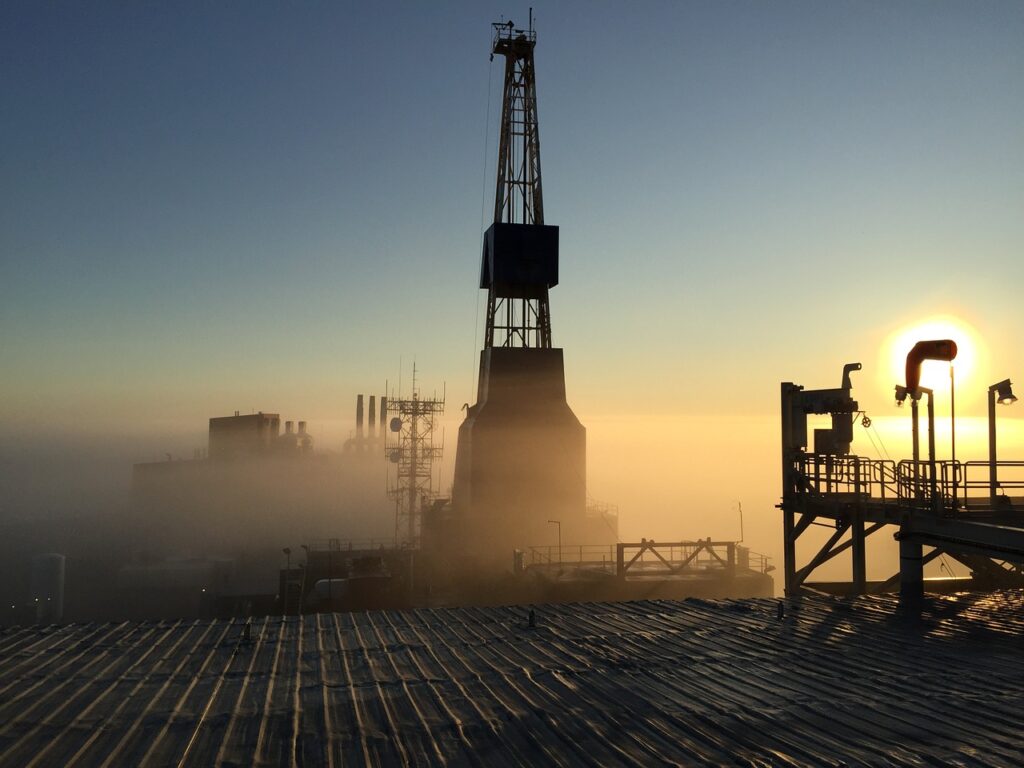

Petrol and Gas

With 25,482 restrictions Petroleum and Coal Products Manufacturing is the heaviest regulated industry according the McLaughlin-Sherouse List of the 10 Most-Regulated Industries (the separately considered industry of oil and gas industry could be included here but holds eighth place even on its own). The authors correctly conclude that this means that for oil companies probably must engage the services of a small army of regulatory lawyers to help them navigate these rules. Which is probably also very expensive and not overly efficient. So, the opportunity for RegTech to take a slice of the cake is there as long as a solution promises to drive down costs and improve the current process. Regulatory change management as well as sanctions monitoring spring to mind, but the range of application includes anything from risk management to regulatory reporting.

Energy

Energy (or the generation, transmission and distribution of electric power) is closely related to Oil and overlaps in many aspects, but is much wider and becomes particularly relevant when we look at a growing element of the sector: energy trading, which comes with its own set of rules similar (and sometimes part of) the financial industry regulations. That makes the industry so interesting for RegTechs as the knowledge gap appears to be less wide compared to other industries and a solutions transfer could be achieved easier.

Automotive

Motor Vehicle Manufacturing holds a solid third place on the list of the most regulated industries. The WHO reports that there were 1.25 million road traffic deaths globally in 2013, so the large amount of rules governing the industry doesn’t exactly come as a surprise. The drive to get autonomously driving vehicles on the road only adds to the need to create a comprehensive framework. All these rules need to be scanned, interpreted and managed and RegTech has the potential to do this at a fraction of the cost. The number of RegTechs actively trying to make a mark in the industry appears to be fairly limited, but considering the amount of data exchanged in modern automobiles there is little doubt about the actual need for smart solutions.

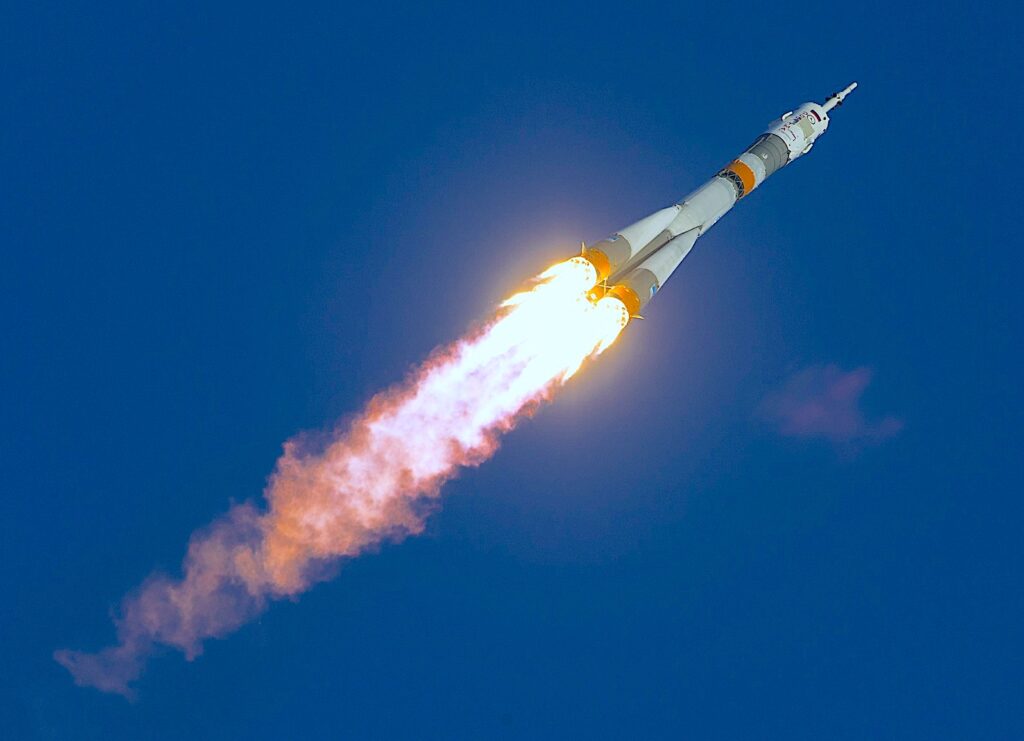

Rail, Ship and Air Traffic

The progressing globalisation is in large parts due to the surge in rail, ship and, foremost, air traffic. Considering only air transport in terms of passengers carried (i.e. leaving cargo aside) World Bank databased on International Civil Aviation Organization, Civil Aviation Statistics of the World and ICAO staff estimates concluded that in 2017 alone 3.979 billion people travelled by air. Just to put this in perspective, in 2000 this number stood at 1.676 billion and in 1980 at 641 million passenger per year. TheInternational Air Transport Association (IATA)expects that this number will almost double to 7.8 billion passengers by 2036. Now add cargo flights that last year accounted for 61.5 million metric tons (up from 46.4 million in 2008 or 51.7 million in 2013) and you understand that the skies are a busy place. To make sure that the risks are limited as much as possible, a myriad of regulation is in place. National, regional and international and all need to be adhered to by airlines. The seas, railroad and normal roads are equally subject to rules, so RegTech finds fertile soil.

Fishing

And then there is the Fishing industry that is subject to rigorous rules. The intention is one thing though while monitoring and enforcement is another.

The global increase in fish consumption combined with a drastic reduction of resources call for a better management of this system. Greenfacts writes that “the world’s oceans support economic activities on a vast scale, and the need to rehabilitate and protect their common wealth and productivity has led the international community to focus intensely on how oceans are used and governed. A critical component of that equation is sound fisheries governance, especially in terms of achieving long-term sustainable management of living marine resources, a precondition for maintaining their social and economic value”. In particular, while fisheries management poses challenges for all countries, it is even more so for those that are capacity poor. In some countries, improvements in resource management are proceeding hand-in-hand with public sector reform and measures to promote better governance. These outcomes are increasingly being incentive-linked to the provision of development assistance. However, despite positive developments, there has been only limited progress in the implementation of management measures in most of the world. RegTech and SupTech solutions though could help achieve these goals.

The bottom line

The size of the entire market opportunity is one of the reasons why we are so bullish about the future of RegTech. Even though many RegTech providers might not be able to transfer the value proposition into other industries for the reasons we discussed above, there are plenty of opportunities to be explored. We need to close with a word of warning, however, not to take this leap too lightly: similar to the success of RegTech solutions in the Financial Industry, regulatory expertise is a key element in all other heavily regulated industries, which is something that seldom can be acquired over night.