Cyberattacks are ever-increasing, and businesses must always be alert to counter them. Research shows that cybercriminals are more likely to attack data-rich industries like financial services, technology, media, and telecom over others. Moreover, 44% of cybercrime in the financial services industry was due to customer fraud.

The best KYC software are:

- Trulioo A global identity verification service meeting the requirements of KYC, AML, and Know Your Business (KYB).

- KYC-Chain A blockchain-based KYC verification platform that securely manages the entire customer lifecycle.

- ComplyAdvantage An AI-driven platform for identifying fraud and detecting risks to AML compliance.

- KYC360 An onboarding, screening, and KYC compliance platform that increases business outcomes.

- SEON An end-to-end fraud protection platform to protect your users and prevent money laundering activities.

One way to counter these cyberattacks is to use a set of processes called Know-Your-Customer (KYC), which verifies the identity of your users before they are onboarded to your platform. The advantage of KYC is that you can identify fraudulent user accounts before they become a part of your system. If you’re in regulated industries like banking and financial services, KYC is mandatory to onboard new users.

In this guide, we will discuss KYC in-depth, its processes, and why it benefits your organization. Finally, we will review the top KYC tools to help you select the best fit for your organization.

What is KYC?

Know Your Customer(KYC) is a part of the Anti-Money Laundering (AML) standard that protects organizations from fraud, money laundering, and financing for illegal activities. It can help companies improve their security and mitigate risks. During this process, a new user’s identity is verified through multiple channels to ensure that the users are who they claim to be. This approach reduces the chances of impersonation and identity fraud.

Next, let’s see how you can implement this KYC in your organization.

KYC Implementation

Though the exact implementation varies among organizations, every KYC must implement three components or pillars. They are:

Customer Identification Program (CIP)

The first component of KYC is identity verification, where you must verify if the customer is who they claim to be. This CIP applies to both individuals and enterprises.

For individuals, the verification involves the checking of name, address, date of birth, and government-issued IDs like passports, driver’s licenses, social security numbers, and more. For corporate customers, the verification involves checking the business license, partnership agreements, financial statements, and articles of incorporation.

At the end of this process, you must ensure that your customer’s identity is real and can be traced to a proven document.

Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD)

After verifying a customer’s identity, you must collect additional credentials to evaluate if they pose a risk to your organization. There are two sub-parts of CDD, and they are Simple Due Diligence (SDD) and Enhanced Due Diligence (EDD).

As the name suggests, you can do SDD for customers with a low-risk profile and EDD for those who fall in the moderate to high-risk categories, especially if they have a history of fraudulent behavior.

Continuous Monitoring

The third component is about establishing the risk level of a customer. In this component, you must check if the customer’s activities have changed over time. Specifically, check if they are now a part of any worldwide sanction or watch lists. Also, evaluate if an individual is a Politically Exposed Person (PEP), as this could have negative ramifications for your organization.

Note that these checks must be ongoing and apply to both new and existing customers.

Overall, these three components offer a comprehensive idea of your users and the potential risks they bring to your organization. You can accordingly choose to accept or deny access to those who do not meet the KYC checks.

Next, let’s look at some benefits of KYC for your organization.

Benefits of KYC

One of the key benefits of KYC is that it can reduce customer fraud and keep your data and networks safe from cyber threats. Besides this enhanced security, here are a few more benefits.

Meet Regulatory Compliance

KYC helps your organization comply with stringent anti-money laundering (AML) and Counter-Terrorism Financing (CTF) regulations mandated by regulatory bodies and even governments of different countries. Compliance with these regulations can also enable you to safely perform cross-border transactions.

Mitigate Risks

KYC provides a layer of risk coverage for your organization by mandating the in-depth scrutiny of customers and their risk profiles. With such information, you can identify potential frauds and prevent them from entering your system in the first place. In case of changed behavior, you can simply identify and remove the customer from your system. All these measures can boost your defense and protect you against fraudulent activities.

Enhance Reputation

When you implement robust KYC measures, it shows your commitment to ethical business practices and a proactive approach to identifying and eliminating fraud. In turn, it enhances your credibility and trustworthiness in the eyes of customers and stakeholders. With such measures to safeguard customer data and assets through stringent KYC protocols, you can build brand loyalty and lasting relationships

Due to these benefits, many organizations prefer to implement KYC, even if they are not a regulated business. On the flip side, KYC implementation can be expensive as it requires additional resources and time. This extra effort and money can be a deterrent for organizations to adopt KYC, especially if it is not mandatory. The study by Pwc (mentioned earlier in the article) states that 29% of cyberattacks are due to the failure or non-implementation of KYC.

Now comes an important question? How can organizations leverage the benefits of KYC while balancing their budget and resources?

The answer could lie in automated KYC software that eases the effort while ensuring compliance and protection.

Selecting the right KYC software is essential to gaining the benefits of KYC processes, as well as the cost and operational efficiency of automated platforms. However, it can take considerable effort to even select the best KYC software. To make this process easier for you, we have shortlisted some tools based on a set of criteria that we believe can make these tools valuable for any organization.

Our Methodology

The criteria we used for evaluation are:

- Focus on onboarding experience.

- Streamlined verification.

- Affordable and pay-as-you-go pricing to help you scale up or down.

- Easy to use.

Best KYC Software

Next, let’s jump into a detailed review of each tool.

1. Trulioo

Trulioo is an identity platform that provides information about who you are doing business with, regardless of where that individual or company is located. It streamlines the verification process while helping you comply with KYC, KYB, and AML regulations.

Source: Trulioo

Let’s now look at the KYC-specific features of Trulioo.

Meets Worldwide Regulations

Many countries are mandating AML verifications, though their specific provisions may vary. Additionally, you can also comply with voluntary standards like FinCEN, FINRA, FINTRAC, CySEC, and more. Trulioo enables you to seamlessly optimize your processes to meet all these guidelines and standards.

Global Reach

Trulioo is designed for a global reach, as it can verify the identity of five billion people and 700 million entities spread across 195 countries. As a result, you can securely onboard new users and businesses from any part of the world. Moreover, Trulioo partners with 450+ verification companies to access the required information for in-depth verification.

Secure Onboarding Experience

Trulioo’s built-in trust and safety reinforce customers’ confidence in your business. It integrates data points from multiple sources to provide comprehensive views of customers and their corresponding risk profiles. With such an approach, you can leverage insights to close any gaps.

With such features, Trulioo can help you easily navigate through the KYC processes to optimize identity verification for security and compliance.

Pros:

- Quick and seamless onboarding experience.

- Consolidates the identity verification process for all regulations.

- Reduces risks.

- Good customer service.

Cons:

- API responses can get better.

- Expensive, especially for small businesses.

2. KYC-Chain

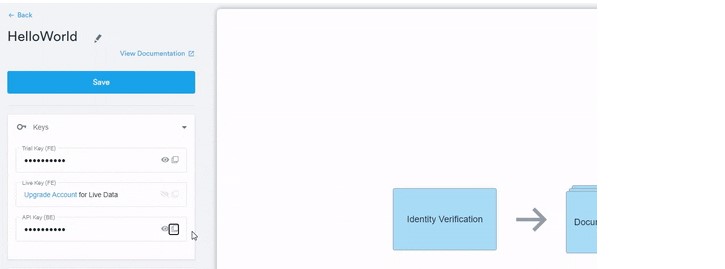

KYC-Chain is a blockchain-based platform for verifying identities and ensuring their compliance with AML and other regulations. This all-in-one workflow can streamline the KYC onboarding process while ensuring the seamless management of your complete customer lifecycle.

Source: KYC-Chain

Below are KYC-Chain’s important features.

End-to-end Workflow

KYC-Chain’s end-to-end KYC workflow ensures that your platform meets different regulations around the world. Moreover, you can either use KYC-Chain’s web platform or integrate it with your platform through APIs to process incoming workflows and conduct hundreds of thousands of checks each day. The entire process is seamless and integrates well with your operations.

AML Screening

With KYC-Chain, you can go beyond just KYC and meet all the provisions of AML screenings. Its global data sources are constantly updated with the profile of high-risk users, making it easy for you to identify new risks in real-time. It even has updated information on PEP organizations for easy checking.

Crypto AML

A highlight of KYC-Chain is that it analyzes transactions on the blockchain to identify any frauds or bad actors. Using this information, you can decide the next course of action. Moreover, you can also automate cryptocurrency wallet screening to prevent CTF.

Overall, KYC-Chain helps you keep pace with emerging technologies while meeting compliance with AML, GDPR, and other stringent data protection standards.

Pros:

- Flexible to meet different compliance requirements.

- It works well for both individuals and businesses.

- Ideal for blockchain-based applications, including cryptocurrencies.

- It provides access to the SelfKey network.

Cons:

- No on-premise deployment.

- Limited documentation.

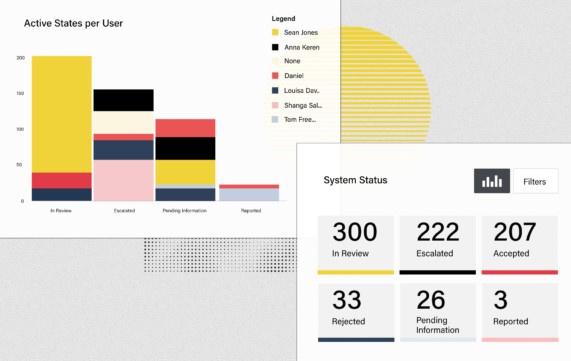

3. ComplyAdvantage

ComplyAdvantage is an AI-driven platform for detecting AML risks and preventing fraud on your platform. At the same time, it streamlines onboarding to assess risks, evaluates the risk profiles of new users, continuously monitors all the users, and sends alerts accordingly.

Source: ComplyAdvantage

Read on to understand how ComplyAdvantage helps with KYC processes.

Reduced Losses Due to Fraud

ComplyAdvantage identifies the areas and patterns that are causing financial loss to your organization through customer or identity fraud. Based on these insights, it provides the right recommendations to avoid users from suspicious locations, regions, and currencies. It also monitors existing accounts for behavioral deviations to protect you at all times.

Risk-based Approach

This platform monitors trends in transactions to identify risky behavior, so you can stop them in real time. Furthermore, you can use a combination of risk data, case management, and smart matching capabilities to meet the specific AML screening requirements of your country or region.

Alerts and Reports

ComplyAdvantage was built to overcome issues related to insights and false positives, and hence the alerts are accurate and provide the much-needed contextual information for easy troubleshooting. Moreover, the reports are well-designed, making it intuitive to find the required information.

Due to these features, ComplyAdvantage can detect and help fix the issues related to KYC and AML compliance.

Pros:

- Identifies negative news and media coverage about the users in your system.

- Works well for both individuals and businesses.

- Detects and investigates suspicious transactions in real time.

- Screens incoming and outgoing payments for potential risks.

Cons:

- No biometric verification.

- No storage for documents.

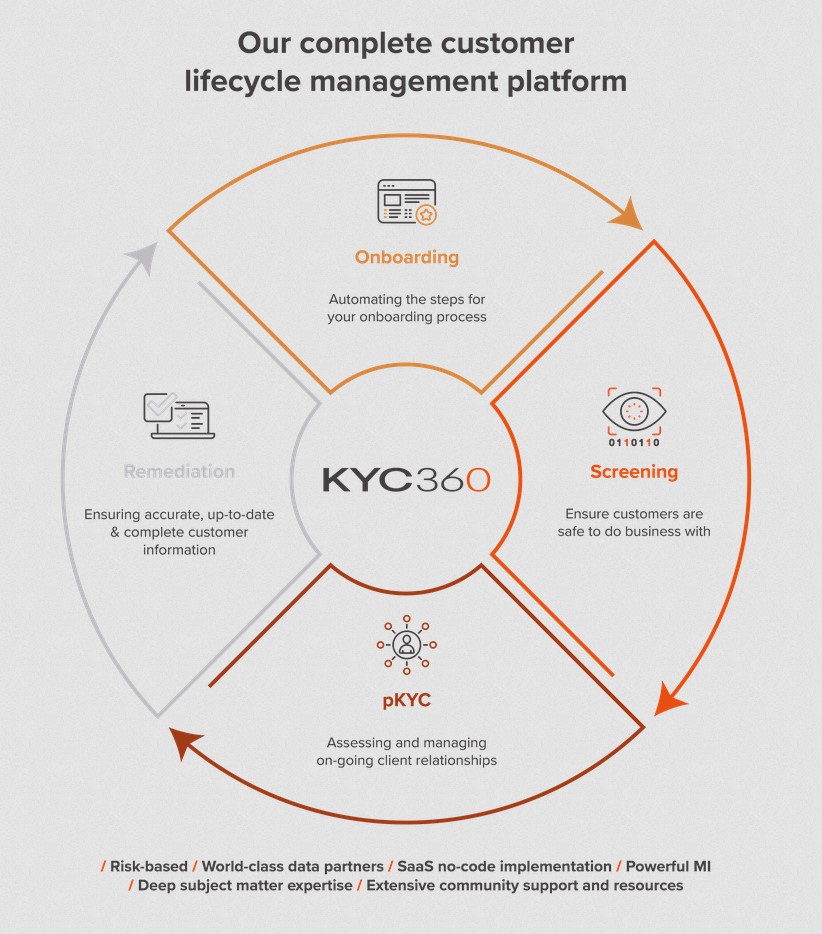

4. KYC360

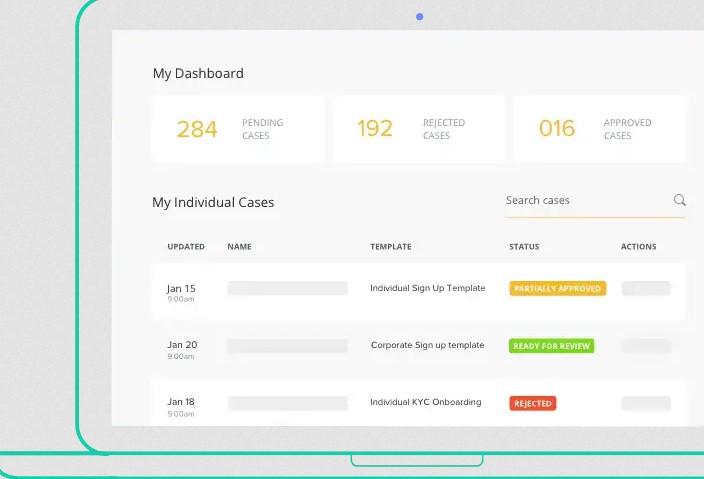

KYC360 is an end-to-end KYC compliance platform that optimizes your compliance processes to increase the Return on Investment (ROI) and drive operational efficiencies. It also focuses on customer experience to ensure a seamless boarding workflow for new users.

Source: KYC360

Here’s a look at KYC360’s features.

Rapid Deployment

KYC360 is designed for rapid deployment to help you gain the benefits quickly. It can integrate well with existing systems through pre-built connectors that connect to popular back-end systems like Salesforce, TrustQuay, NavOne, and more. It also supports APIs to connect with your existing and third-party systems.

Dynamic Onboarding

Another advantage of KYC360 is its dynamic onboarding that creates a good first impression with new customers. You also add screening to your onboarding process to protect your organization from potential fraud. It is fully compliant with GDPR as well.

Automated Remediation

Remediating KYC data for existing customers can be easy with KYC360, as it automates the identification and remediation of issues, ensuring constant compliance with KYC and AML. You can even tackle your existing KYC backlog within a short time.

In all, KYC360 comes with many features that ease onboarding while ensuring continuous KYC compliance.

Pros:

- It supports PEP screening and watches global sanction lists.

- Tracks compliance and remediates when needed.

- Supports behavioral analytics.

- Generates reports for EDD.

Cons:

- Expensive.

- Customer support can be better.

Contact the sales team for more information.

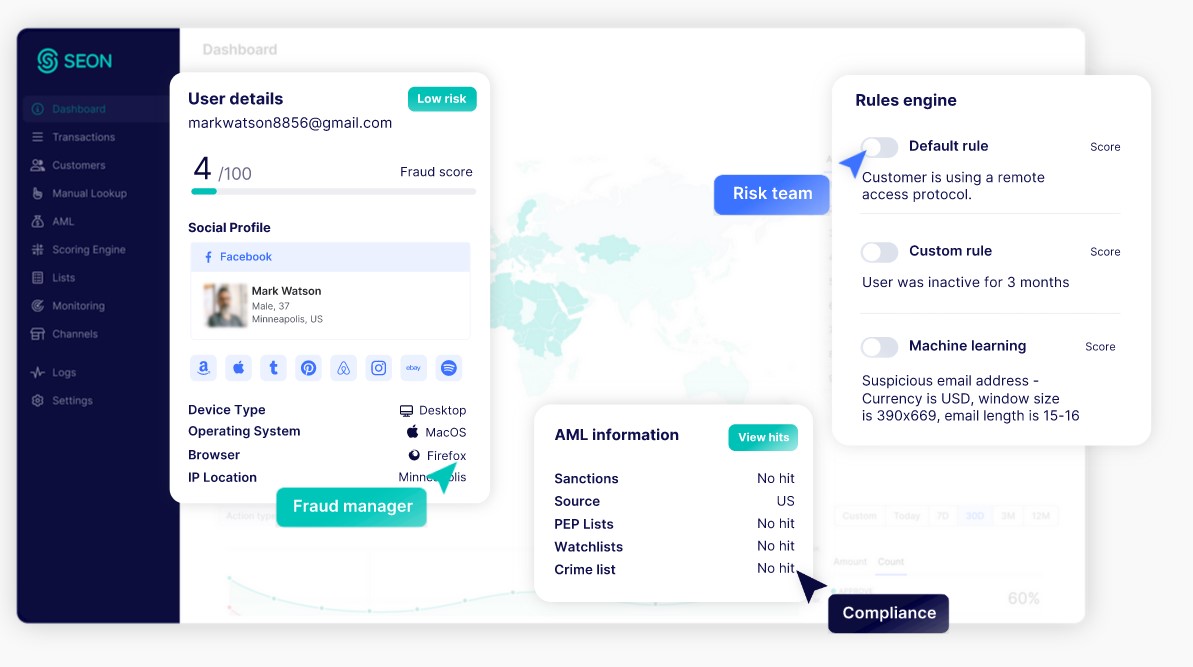

5. SEON

SEON is a comprehensive fraud prevention solution that uses AI insights to identify fraud and prevent money laundering on your platform. It also supports AML screening with specific processes for completing KYC. Its unified orchestration, AI-driven insights, and real-time monitoring are other notable aspects.

Source: SEON

Here’s a look at SEON’s KYC features.

Secure Onboarding

User onboarding is the first step to knowing more about your user and setting the stage for further risk assessment. SEON makes this process comprehensive and secure using many advanced techniques like digital footprinting, device intelligence, ID verification, and real-time signals. With such capabilities, you can block fraudulent traffic and accounts even before they have access to your platform.

Continuous Monitoring

Another advantage of SEON is that it continuously monitors user accounts in real-time. Every transaction is monitored, and any illegal transaction is flagged and declined automatically. Moreover, this continuous monitoring also extends to users and changes in their behavior that could compromise your system.

AI-driven Insights

SEON uses AI and machine learning algorithms to identify patterns and, accordingly, recommend appropriate actions. You can even suggest rules with its codeless rule builder, and the platform will send alerts when any user behavior or transaction meets your rules.

With such features, SEON protects your organization from fraud and keeps your users safe.

Pros:

- Checks social signals as a part of EDD.

- Smooth user experience.

- Saves resources as you can identify and eliminate them right at the beginning.

- Provides detailed insights.

Cons:

- No biometric authentication.

- Not a complete KYC solution.

Thus, these are the best KYC software that has a simple and easy onboarding experience while ensuring compliance with KYC provisions. Many of them even include AML screenings while continuously monitoring user behavior for risks.

Final Words

Know Your Customer (KYC) is a set of processes that ensure your platform verifies new users based on the intent to prevent fraud. It is a part of AML screening, a mandatory regulation in most countries today. There are three components of KYC – the initial verification of identity, additional verification for risky profiles, and continuous monitoring of existing users against PEPs and sanction lists.

Given the many benefits that KYC offers for your organization, it’s a good idea to include them, even if your business does not come under the mandated requirements. That said, implementing KYC can be expensive and an effort-intensive process. This is why it helps to use KYC software that can streamline the entire lifecycle management, starting from onboarding to continuous monitoring.

In this article, we explored the important aspects of KYC, including its key components and the potential benefits it can offer. We also explored the best tools that meet common criteria for KYC compliance. We hope this information acts as a good starting point to include KYC as a part of your onboarding process for added security and reduced financial loss.