Cross-border financial crimes have become common in today’s globalized world. One such financial crime is money laundering, where the origins of black or dirty money are disguised to make it appear to be from a legitimate source. Since this crime can be used for funding nefarious activities, governments worldwide take measures to curb them

Anti-money Laundering (AML) regulations aim to prevent this financial crime, and hence, organizations must comply with them. AML regulations require organizations to verify the identity of new users and continuously monitor the behavior of existing ones. Also, they have to monitor for suspicious activities and report them.

Below are the best tools you can use to screen your users and ensure compliance:

- AMLCheck A software that helps companies avoid money laundering and comply with AML and CFT provisions.

- ComplyAdvantage An AI-driven fraud and AML risk detection platform for detecting fraudulent profiles and transactions.

- Sanction Scanner An AML compliance software that offers AML screening, transaction monitoring, adverse media scanning, and more.

- Encompass A corporate digital identity platform for verifying online user profiles and helping meet AML compliance.

- ComplyCube A SaaS platform for online identity verification and AML and KYC compliance.

In this guide, we will focus on AML regulations, their provisions, and how organizations can comply with them. In the end, we will also review the best AML compliance tools that can ease this process for you.

What is the AML Compliance Program?

Anti-money laundering (AML) compliance is a set of rules governed by domestic and international laws and aims to combat financial crimes. These rules are subject to change due to evolving trends, and their compliance is monitored by associated institutions.

In the U.S., AML compliance is mandatory for companies under the USA Patriot Act and Bank Secrecy Act. In other countries and the EU, AML is mandatory for companies involved in banking, online payment, insurance, gambling, and international transfer businesses. It’s a good idea to check your local laws and regulations, as this could vary among countries.

Note that non-compliance can lead to hefty fines. In the U.S., the Bank Secrecy Act allows regulators the authority to fine anywhere from $5,000 to $1 million per violation or 1% of the company’s total assets, whichever is more, per day. The most prominent one in recent times is a $2.7 billion fine on the crypto firm Binance.

To avoid these penalties, you must know the provisions of AML and how to implement them within your organization.

How to Implement AML?

Though no exact steps are involved, AML compliance includes a broad set of guidelines that organizations must follow. They are:

- A risk-based Customer Identification Program (CIP) that enables an organization to identify its customers.

- Continuous monitoring techniques to conduct ongoing Customer Due Diligence (CDD).

- Designation of a compliance officer for overseeing everyday compliance.

- Regular training for employees.

- Independent testing by a third party.

Now that you know what aspects must be included, let’s turn to some best practices that can help you achieve AML compliance.

Best Practices for AML Compliance

As the exact implementation steps can vary among countries, check the local laws before creating your AML compliance program. Still, the below best practices can come in handy across all situations to improve the efficiency of your compliance.

Risk Assessment

Start with a comprehensive risk assessment, where you understand the possible money laundering risks that your business can be exposed to. Some aspects to look into are the transactions from countries that fall in FATF and sanction lists, the nature of products offered like cryptocurrency, customers living in geopolitically sensitive areas, and more. By evaluating these factors, you can better protect your organization from financial crimes, and the resulting AML non-compliance.

Comprehensive Screening

Make sure to set up a comprehensive screening process that verifies the name, address, date of birth, and national ID of individuals who are associated with your organization. This includes end users, customers, employees, investors, and other stakeholders. When it comes to verifying businesses like vendors, supply chain companies, auditing firms, etc., look for articles of incorporation, statutory filing reports, and anything else that provides insights into their operations.

In the case of high-risk profiles, have a secondary and a more in-depth screening process.

Continuous Monitoring

Along with identity verification at the time of onboarding, you must have a system in place for continuous monitoring. In particular, your processes must look for behavioral changes, variations in traffic patterns, large volume transactions, multiple new account creation, and any other information that can point to suspicious behavior.

Accurate Record Keeping

As a part of AML compliance, you must maintain accurate record keeping. Back up all suspicious transactions with appropriate evidence. More importantly, have a process in place to report suspicious activities to the relevant authorities.

Regular Training

Make training an essential part of your compliance. Educate your employees and help them understand their roles and responsibilities towards AML compliance. Also, train them to identify and report suspicious transactions.

Integrate Technology

Given the detailed onboarding and continuous monitoring requirements, it’s hard for organizations to manually handle everything. Moreover, such elaborate checking can take up too much time and effort. A better option is to leverage technological tools to gain greater efficiency and compliance.

However, choosing the right tool is key. To save you hours of time and effort, we have shortlisted the best AML software that can benefit your organization.

Our Methodology

We shortlisted the above tools based on a set of stringent criteria essential to maintain AML compliance:

- Data quality and source.

- Use of AI, ML, and other advanced technologies.

- Real-time updates.

- Reports and recommended actions, insights, and contextual information about compliance gaps.

We believe the above criteria will make AML screening extensive and relevant for any business, while providing actionable information to help you take the necessary actions.

Best AML Screening and Compliance Software

Next, let’s review each tool in detail to help you make an informed decision about the right fit.

1. AMLCheck

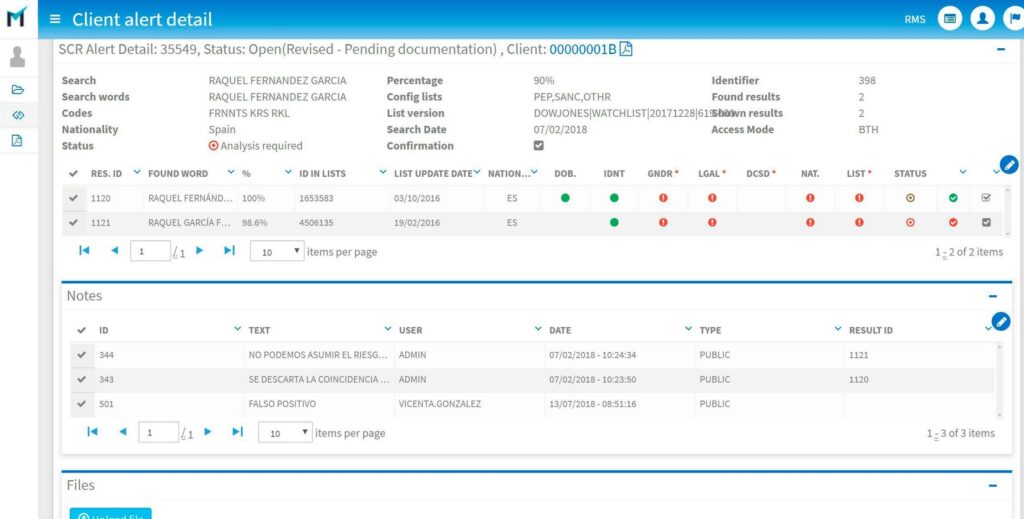

AMLCheck is a comprehensive tool that continuously checks for money laundering activities and transactions on your platform. It can automatically prevent, detect, and investigate any suspicious activity on your platform to ensure compliance with AML regulations. Also, it sources credible data from the Dow Jones Risk & Compliance platform, which means the screening criteria will be up-to-date.

Source: AMLCheck

Here’s a look at AMLCheck’s important features.

Comprehensive Screening Process

With AMLCheck, you can manually and automatically check the names and identities of entities against sanction, watch, and Politically Exposed Persons (PEPs) lists. Its AI-based algorithms also check against typographical and phonetic errors to ensure that risky profiles are immediately identified and removed from your device.

Risk Score

AMLCheck performs a detailed analysis of every customer on your platform based on the existing information sources from Dow Jones. This platform uses extensive processes to establish a risk score for each entity. Based on the risk score, you can do further investigation called Enhanced Due Diligence (EDD) for risky profiles and Simplified Due Diligence (SDD) for low-risk profiles. Note that you have the flexibility to set the parameters for calculating this risk score.

Streamlined Alerts

With AMLCheck, you can proactively identify potential fraud and money laundering activities, even before they occur. You can even set up different control scenarios and analyze each activity to prevent getting exposed to risks. Its alert system also helps you stay updated.

Overall, AMLCheck can increase compliance with AML regulations while reducing the operating costs and risks associated with non-compliance.

Pros:

- Well-defined alerts and notifications.

- Extensive reporting and analytics.

- Compliant with AML, KYC, HIPAA, FDA, ISO, and more.

- Uses extensive automation and AI algorithms.

Cons:

- It can be expensive.

- More suited for small businesses.

Contact the sales team to know more.

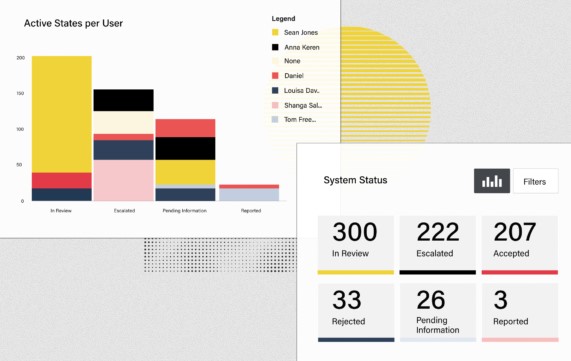

2. ComplyAdvantage

ComplyAdvantage is an AI-based platform for detecting risks and ensuring compliance with AML and other regulations. According to the company, this tool can reduce false positives by 70% and the onboarding cycle time by 50%. It is also ideal for companies with a global presence, as there may be variations in the AML implementation for each country.

Source: ComplyAdvantage

Read on to understand more about what ComplyAdvantage can do for your organization.

Reduced Fraud

With ComplyAdvantage, you can identify fraud and prevent it in real time. Its automated processes and workflows detect transactions that come from suspicious locations, devices, or currencies, and flag them for further review. It can also identify deviations in behavior and report the same to reduce compliance gaps.

Control your Risk-based Approach

You can use a combination of risk data, case management, advanced filters, and matching capabilities to create a tailored risk-based approach to protect your organization from potential fraud and non-compliance. Its no-code rules builder makes it easy to create custom workflows that meet your specific needs. More importantly, it scales well to perform billions of transactions.

AI-driven Screening

ComplyAdvantage uses AI to screen for potential fraud in onboarding and transactions. It leverages the latest data from sanction, PEP, FATF, and watch lists to use as a benchmark for your screening. Its easy-to-use interface coupled with RESTful APIs makes it ideal for all tech stacks.

Due to such features, ComplyAdvantage can enable you to stay safe from fraudulent users and transactions and in the process meet AML compliance regulations.

Pros:

- It includes adverse media screening.

- Detects and investigates suspicious transactions in real time.

- Supports customizable rules and a centralized dashboard.

- Screens both incoming and outgoing payments.

Cons:

- The email updates and digests can be more relevant.

- Flexible in report generation.

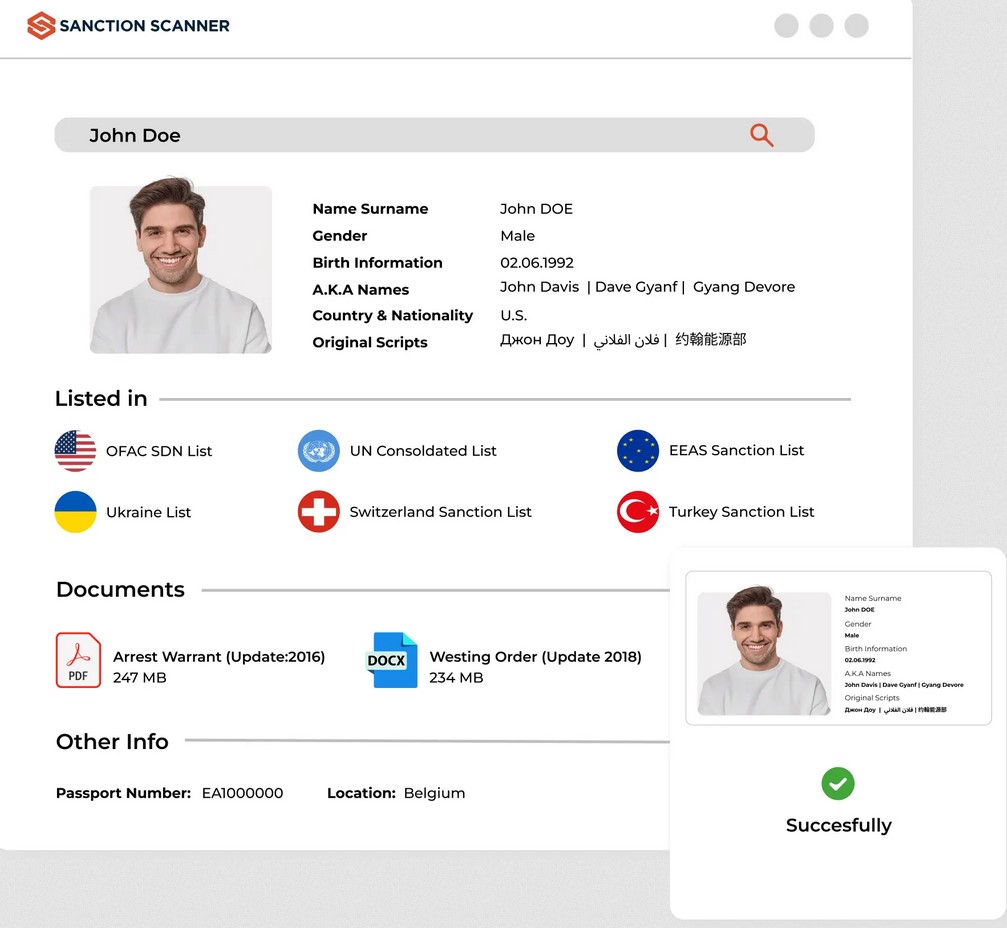

3. Sanction Scanner

Sanction Scanner simplifies AML operations to make them quick, safe, and effective for your business. It can scan your customers across 3,000+ global lists across 220 countries to assess their risk levels for your organization, and accordingly, helps you make data-driven decisions.

Source: Sanction Scanner

Below are the notable features of the Sanction Scanner related to AML.

Name Screening

When a user enters details on your platform, Sanction Scanner automatically checks the name across 3,000+ lists to determine their risk profile. The advantage is that these lists are updated every fifteen minutes to identify risks in near real-time. Also, you can screen remittances, sanctions, arrest warrants, and more, using just the name and its typographical variations.

Transaction Monitoring

The software monitors transactions and if they match any of the suspicious criteria, the Sanction Scanner automatically stops the transaction and sends an alert. The advantage of this tool is that you can set the rules for specific scenarios in your organization.

User-friendly Dashboard

Sanction Scanner offers a user-friendly dashboard to easily find the required information. Also, it is well-designed, and the relevant information is prominently displayed. Its powerful APIs integrate with different tech stacks as well.

In all, Sanction Scanner is an easy-to-use AML compliance tool that’s also highly effective in identifying fraudulent user-profiles and suspicious transactions.

Pros:

- Highly user-friendly.

- Ensures AML compliance, with minimal effort from your employees.

- Accurate results.

- Good customer support.

Cons:

- Reporting can be better.

- Limited documentation.

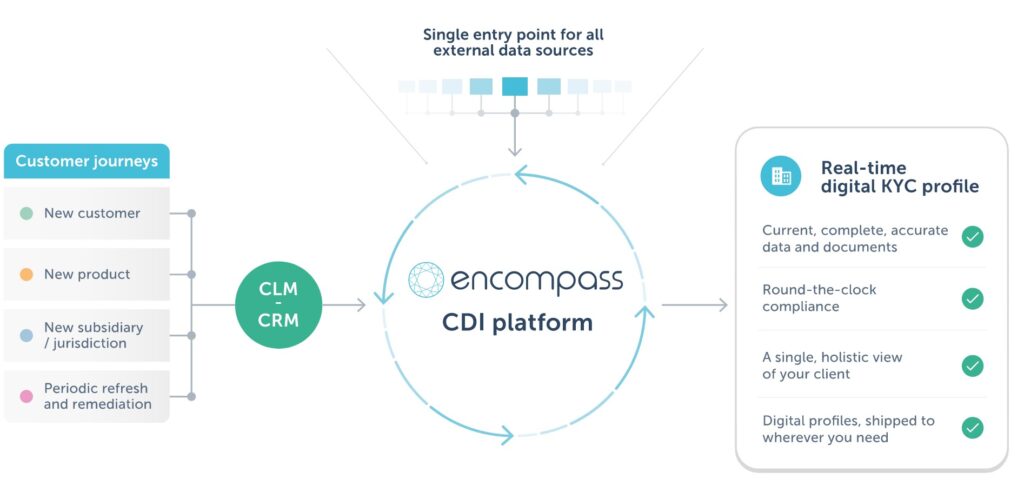

4. Encompass

Encompass is a digital identity verification platform that uses real-time data and documents from renowned global sources to identify fraudulent user profiles. With its consistent compliance and risk mitigation capabilities, Encompass can enhance your user experience and increase business opportunities.

Source: Encompass

Let’s now delve into the AML compliance features of Encompass.

Holistic View

Encompass offers a holistic view of every user profile that can be easily shared and used across the organization. It offers a complete and consistent view of multiple use cases. Moreover, its full audit trail and data attribute lineage can come in handy for making streamlined decisions.

Advanced Integrations

The Encompass platform offers 175+ data product integrations, and you can select the ones you need. All these integrations are offered through a single API, streamlining the entire verification process. Moreover, with so many options, Encompass can fit well into any tech stack. It saves time and resources as well because only one API has to be integrated.

Continuous Compliance

With access to world-class data sources, Encompass ensures that all the user profiles are up-to-date and always compliant with AML guidelines. It also automates KYC searches for improved safety. Furthermore, it also safeguards your organization from fraud and risk exposure.

Due to the above features, Encompass brings together all the risk data and analyzes them through a holistic platform to ensure AML compliance.

Pros:

- Intuitive and user-friendly interface.

- Highly customizable.

- Easy to set up and use.

- Optimized workflows.

Cons:

- Uploading and sending documents can be slow.

- Outages and glitches seem to be common.

Contact the sales team for more details.

5. ComplyCube

ComplyCube is a powerful identity verification platform that also supports AML and KYC compliance. It gathers ID documents, selfies, and other trusted information through an intuitive interface and verifies IDs within seconds. As a result, the user onboarding is smooth and hassle-free for your customers. At the same time, it also protects your organization from fraudulent information.

Source: ComplyCube

Below are the ComplyCube’s AML compliance features.

Global KYC Checks

With ComplyCube, you can scan user profiles against data lists spread across 220+ countries. It also offers trusted biometric verification that detects spoofing and fraud while minimizing false positives. Its document checks are advanced too, as it can analyze up to 25 points on every document to ensure its accuracy. All these aspects make it ideal for global checks, where the national IDs can vary greatly among nations.

Automated Checks

ComplyCube offers automated checks and prebuilt workflows that can monitor your user profiles and transactions in real-time. In case of deviations, you get instant alerts and contextual information, using which you can fix the issues. Undoubtedly, these checks save time and effort without compromising on business outcomes.

Scalable and Flexible

ComplyCube’s AML compliance platform is highly scalable and flexible. It processes an average of 10 million+ transactions every week across 220+ countries. Moreover, it can collect 3,000+ data points from trusted sources and partners to ensure comprehensive checking. Despite these numbers, it offers a client onboarding rate of 98% to help you grow and scale.

Overall, ComplyCube is an advanced AML compliance platform that focuses on comprehensive checking of user profiles for high rates of compliance.

Pros:

- Intuitive and user-friendly.

- Simple to integrate.

- Affordable.

- Good customer support.

Cons:

- Limited charts and KPIs on the dashboard.

- No on-premise deployment.

Thus, these are the best AML screening and compliance software that offer global coverage, an intuitive user interface, actionable alerts, and excellent customer support.

Bottom Line

Anti-money Laundering (AML) is a set of regulations imposed by most governments around the world, and are aimed to prevent illegal activities like funding for terrorism, converting dirty money into legitimate money, and more. These regulations can vary from country to country but largely include a thorough verification of new user profiles, continuous assessment of existing profiles, and scrutinizing financial transactions. In the case of risky profiles, an organization must conduct further scrutiny.

However, there are no specific processes, and organizations have the flexibility to create custom processes as long as they meet the required compliance pillars. In this guide, we looked at some best practices that can help with compliance. Also, we reviewed the best tools that can automate these verification processes, saving you time and money. We hope this information helps you to easily become AML-compliant and leverage the benefits that come with this compliance.