Cryptocurrencies have made people rich and considering the volatility in value there is still a fortune to be made for the lucky investor. That is also the argument of financial advisors that promise way above average returns on investment and we recently such an offer. Time for a case study and the question: Is Lucent Financial Service (LFS) a scam?

As you can imagine, we get a lot of mail. Unfortunately, a not insignificant quantity of these emails comes from people we never asked to contact us and we actually tell to leave us alone. Still, among those unsolicited offers for app development, top notch SEO services from Hotmail accounts, there are also emails that we find even more concerning than the regular spam we get.

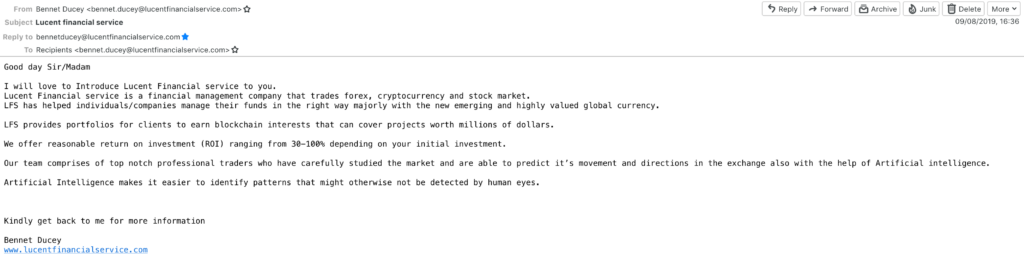

One such email found its way into our mailbox a few weeks ago, introducing us to the services of Lucent Financial Services:

30-100% return on investment in times of negative interest rates?!? Sounds almost too good to be true. And if it too good to be true… it is probably a fraud, Ron Weber is quoted to have said.

Well, we don’t want to get ahead of ourselves and we want to give Bennet Ducey, the author of the e-mail the benefit of the doubt for now.

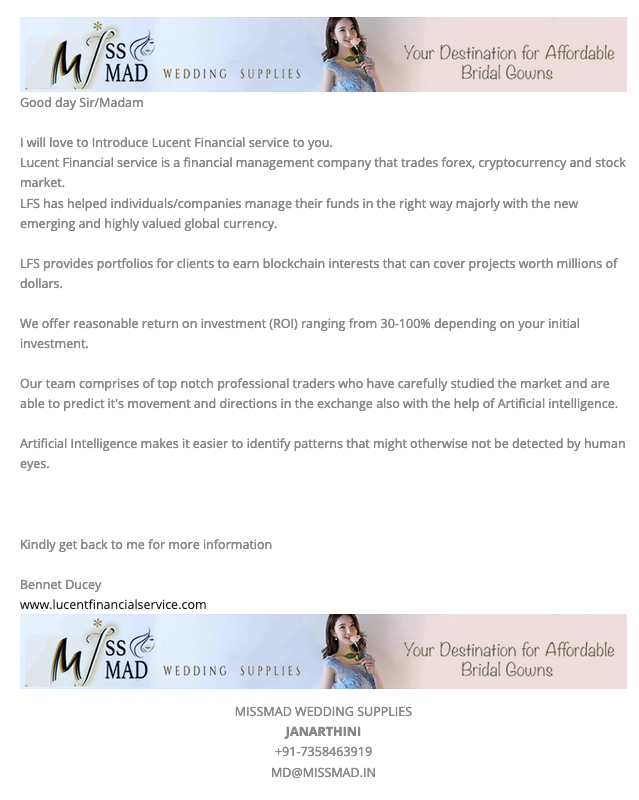

But who is Bennet Ducey? A LinkedIn search did not produce any results and looking him up on Google we could only find a reprint of the e-mail on wedding blog. Weird, isn’t it?

Still intrigued by the fabulous returns, we nonetheless tried to get in touch with him, asking kindly for more information. Unfortunately, our message got returned to sender: Mail to Bennet got suspended without further reason.

Well, no luck there but we still got the website as a source of more information on the people that are able to predict the market’s movements:

Sadly, our attempt to get in touch with them through their website didn’t produce any results either: following our delight to see that the online chat appeared to be ready to answer my questions came nothing but disappointment. Despite the green online signal, our question was not answered, as the service is actually offline and we were instead invited to complete a contact form.

What does the website tell us about the company though?

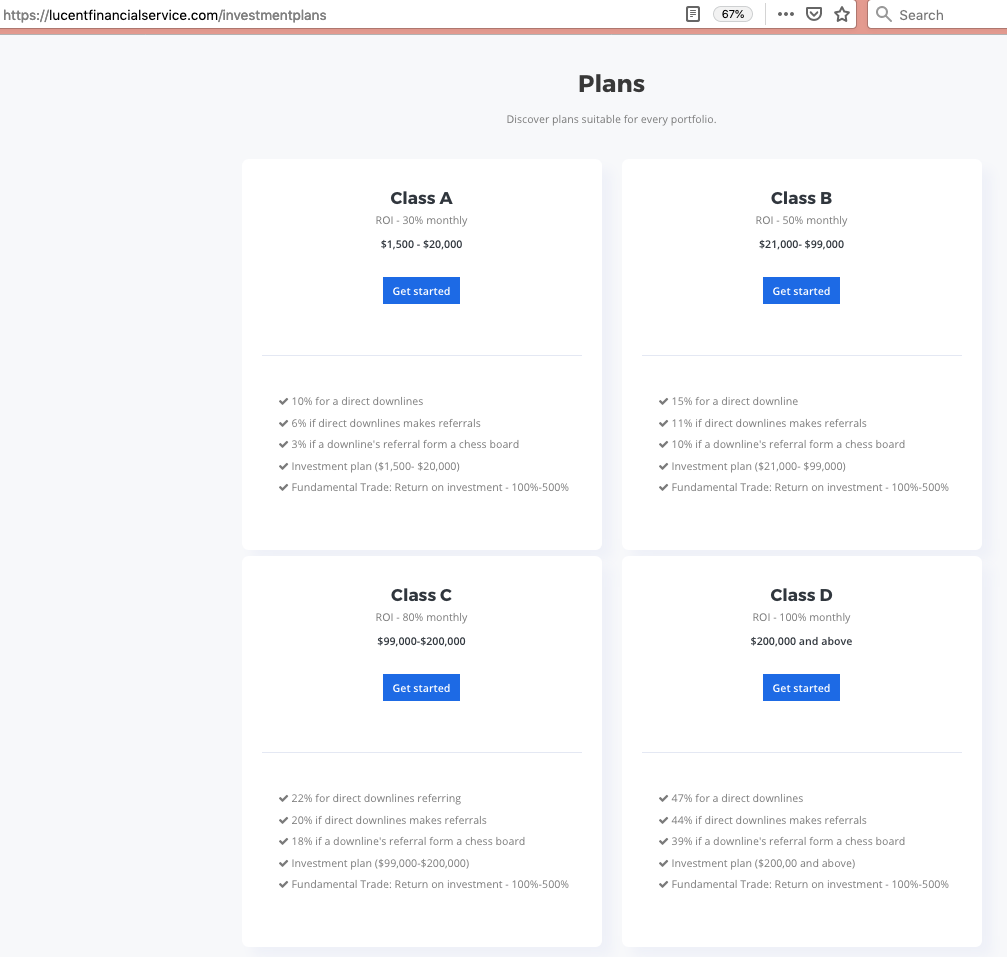

Most importantly are certainly the different investment plans the company offers. And indeed, a 100% monthly ROI on investments of $200,000 and above.

Can a promise of 100% returns be backed up by information from the website or do we have to take their word for it? Well, looking around we find that the company apparently is based in Curacao, a jurisdiction named as a major money-laundering country and “country of primary concern” in the International Narcotics Control Strategy Report by the US State Department. In its latest edition it reads:

“Curacao’s prominent position as a regional financial center is declining, but it is still considered a transshipment point for drugs and gold from South America. Money laundering occurs through the sale of illegal narcotics, unlicensed money lenders, online gaming, and the transfer of gold from South America.”

Not exactly the kind of info that inspires you with trust in a company, does it?

What else? The About Us section doesn’t provide any personal information that could be followed up upon either but rather a vague statement about a vision and values. Instead, we are invited to register, drop an email to an admin e-mail address or call a Mr Marco. The blog page appears to be a selection of links to Coindesk and the FAQ equally add to the impression that we don’t want to trust LCF with $200,000 or more. The LinkedIn profile is not available and the first thing you see on the company’s Facebook page are messages that warn about it being a scam.

Well, maybe it isn’t but there are clearly a number of red flags that makes it obvious for us that we are not risking even a single dollar with LCF. Of course, we might be wrong here and the people form LCF can tell us so. After all, they have our email address…

We regularly look into potential scams and publish our findings, hoping to help people staying clear of cons. For example, check out our posts on the latest Sextortion Scam or the Fake Domain Name Protection con.