Behavioural insights tell us about the biases that often keep us from making the right investment decisions and cost us a lot of money. We identify some of the most common biases and tell you what to do about it.

Intelligent Investors

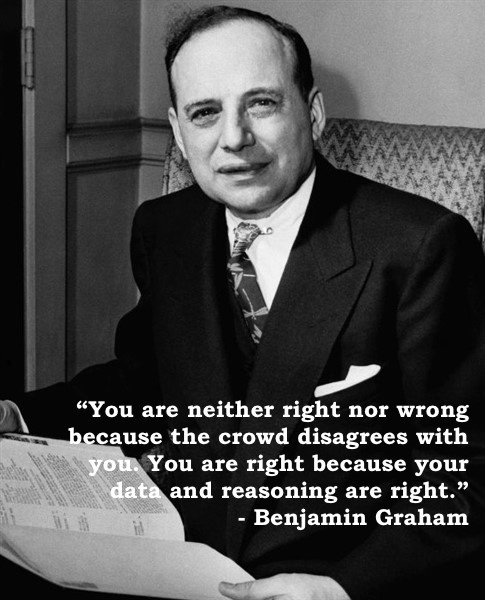

Benjamin Graham is widely known as the ‘father of value investing and probably one of the most brilliant minds in the history of financial investors. His acclaimed book, “The Intelligent Investor”, is lauded by Warren Buffet,no less, as by far the best book on investing ever written. It’s genuinely well written for a book on investments and full of good investment advice. For example, in the revised edition commentator Jason Zweig summarises Graham with “investing isn’t about beating others at their game. It’s about controlling yourself at your own game.”

That exactly is the crux though. Despite the growing amount of financial information available and extensive literature at our disposal, many of us fall into the same traps generations of investors have done before, too.

Behavioral Insights

The International Organization of Securities Commissions (IOSCO) and the Organisation for Economic Co-operation and Development’s International Network on Financial Education (OECD/INFE) recently published a report that looked into ways to use behavioral insights could help educate investors. The organizations pointed out that retail investors find it increasingly more difficult to navigate today’s complex financial markets. The report names the accelerated growth of new and innovative technologies, an excessive amount of available financial information, i.e. big data not smart data, and increasingly sophisticated financial products as key problems, but also points to the ways our brains tend to sabotage our investing and why it’s important to control yourself at your own game to prevent our brains from doing so. A number of cognitive, social and psychological factors or barriers prevent people from using their newly acquired knowledge to make satisfactory or rational financial choices. Behavioral economics has identified these barriers, known as biases in the scientific literature and which often arise from the use of heuristics (i.e. mental shortcuts) to simplify the decision-making process.

Below is a list of seven popular biases that often affect the performance of investing, but the list is far from conclusive:

The problem: Herd mentality

Yes, people are social animals and tend to follow the herd. It’s a phenomenon that can be witnessed in many circumstances and it frequently can be found in the financial world as well. When a large amount of people buys or sells a stock, we tend to perceive this as a proof of value in the underlying company and follow the herd even though the core financials of the company might not warrant that behaviour. Alternatively, it’s not in line with our own investment objectives. Graham advised that an intelligent investor should never buy a stock because it has gone up or sell one because it has gone down. Still, we regularly do so and potentially even move against better knowledge. A classic example of herd mentality is the behaviour in the markets during the global financial crisis of 2008. There are a number of reasons that triggered the crisis, but one aspect was that when the housing bubble burst and share prices dropped, investors got nervous and fell prey to mentality behavior called “panic selling. This resulted in further drops of share prices and you might remember what the outcome of that was for Lehman Brothers and others.

What to do about it:

While it is sometimes difficult to spot being caught up in a herd movement, always question your investment decisions and make sure the only reason is “because everyone else is buying/selling”. Instead, be mindful of the risks and the benefits of herd mentality. Just think about what Warren Buffet said: “Be fearful when others are greedy and greedy when others are fearful”.

The problem: Loss aversion

Who hasn’t heard of the Latin Proverb “Audentes Fortuna Iuvat”, i.e. Fortune Favors the Bold? Still, the investment reality seems to be different as our brains are apparently wired differently. When it comes to investing, humans generally feel the pain of loss more than the joy of gains. In investment terms that means that losses are remembered more vividly than gains even if the gains are bigger in absolute terms than the losses. Strange but true, but you can test it for yourself if you don’t believe us.

What to do about it:

Make sure you manage your expectations appropriately. A good financial advisor is able to highlight the influence of emotions of its clients and how they impact their behaviour. This is something that needs to be addressed before any investment decision as well as an ongoing exercise to reflect changes in an investor’s approach and mentality.

The problem: Confirmation bias

When people make investment decisions they have a tendency to seek confirmation of their beliefs and preferences. For example, investors value the opinion provided by analysts that share the assumptions of the investor while giving less weight to negative information. The same is true for stocks of companies we relate to, e.g. a company whose products we like or the firm we work for.

What to do about it:

Make sure you consider various sources of information and make sure you give them the appropriate weigh before making a decision. Also, factor in general aspects of sensible investing, like the importance of diversification of a portfolio.

The problem: Mental accounting.

Introduced by behavioural economist Richard Thaler in a paper published in 1999, mental accounting is defined as an economic concept, which contends that individuals classify personal funds differently and therefore are prone to irrational decision-making in their spending and investment behaviour. Thaler gives a number of examples in his paper to explain the different forms of mental accounting and here are two to give you a better picture:

In his first example, Thaler recalls how a few years ago he gave a talk to a group of executives in Switzerland. After the conference he and his wife spent a week visiting the area. At that time the Swiss franc was at an all-time high relative to the US dollar, so the usual high prices in Switzerland were astronomical. The couple comforted itselves that Thaler had received a fee for the talk that would easily cover the outrageous prices for hotels and meals. Had he received the same fee a week earlier for a talk in New York though, he explains, the vacation would have been much less enjoyable.In the second example, Thaler describes how a friend of his was once shopping for a quilted bedspread. She went to a department store and was please

d to find a model she liked on sale. The spreads came in three sizes: double, queen and king. The usual prices for these quilts were $200, $250 and $300 respectively, but during the sale they were all priced at only $150. My friend bought the king-size quilt and was quite pleased with her purchase, though the quilt did hang a bit over the sides of her double bed.

What to do about it:

While Thaler touches on ways to avoid the pitfalls of mental accounting, he also stresses it importance: mental accounting matters. However, as in general certain aspects should be addressed, for instance, the importance of different origins of the funds used for an investment, i.e. work income versus an inheritance or lottery win, as well as the investment itself, for instance, where the investment was made originally by a family member or in a company the investor is emotionally invested in.

The Problem: Recency bias

The recency bias is sometimes also called the party effect in investment circles. It basically means that we overvalue or emphasise recent events in contrast to those lying further in the past. If there is a bull run on markets, investors want to join the party even though prices may have been going up for a while and the peak has already been reached. As a result, these investors buy high and when the market turns… The same is true for bear markets when it can be observed that investors remain on the side-lines for too long instead of being active as they believe against all rationality that markets will never go up again.

What to do about it:

Professional investors recommend a cyclical approach to investing, i.e. when a sector has been performing well for a continued period it is bound to drop and vice versa. Therefore, a sector, an asset class or a region that has underperformed for some time could be due to bounce back and might be a good pick. However, eventually it is impossible to predict which asset classes or sectors are going to perform well and picking the right moment in time when the tide is about to turn is obviously extremely difficult. Also, past performance can only be an indication, so it is important to take this advise with a bit of caution and not make it the sole basis of our investment decisions.

The Problem: Illusion of Control

The illusion of control refers to people’s tendency to overestimate their ability to control events. Named by psychologist Ellen Langerfor, it means that we overestimate our personal influence, sometimes to the extent that we feel a sense of control over outcomes that we clearly do not influence. Here is a prominent research example: When people are giving the choice to buy a lottery ticket where they get to choose the numbers as opposed to a ticket where the numbers with randomly generated numbers, they would be willing to pay more for the first even though both kinds of tickets have the same probability to win. In investing a result of this bias means that people regularly underdiversify their portfolios or trade too often ramping up costs.

What to do about it:

First, remember that there are many things outside of our control. And if you really think you are an investment genius that can influence the outcome of things through sheer will power, why not keep detailed records of your predictions and refer back to these in order to get an honest assessment of your predictive powers?

The Problem: Hindsight bias

“I knew it all along!” Whenever surprising events happen, you’ll find someone to tell you that they knew this would happen. The only problem is that too often they actually didn’t know it all along. They only believe as though they did and now feel the urge to tell anyone who would listen that they are the next Nostradamus.

We fall into the same trap when we come across investment decisions that have turned sour. Hindsight bias might make it look like there were reasons why we shouldn’t bought/sold when we did. However, in most cases it is information that at the time of a trade was not available to us has surfaced and changed our view on a specific decision. We confuse the information foundation we actually had with the one we have now. As a result, we either get confused or insecure about our ability to make good investment decisions and thus overly risk adverse or we get too confident as we believe that future events are more predictable than they actually are.

What to do about it:

Keep in mind that the information you have now might now be the one you had back in the day when you bought or sold a financial instrument. If you want to honestly evaluate the quality of your investment decisions, take notes about the reasons you had at said moment and analyse the decision based on this information at a later point in time.

Better investor education

However, despite good advice there are a number of reasons why it’s still difficult to overcome these and other biases. Our brains are wired as they are and in order to rewire them in often needs something more than just good advise.

IOSCO and the OECD have come to a similar conclusion and therefore propose that findings from behavioural sciences should be used to develop investor education as well as financial literacy initiatives that may be more effective than traditional programs, largely by mitigating the effects of behavioural biases, for example, through the use of online comparison and simulation tools.

It is similar to the approach industry expert Paolo Sironi promoted in his book “FinTech Innovation”, which we discussed previously, through the use of gamification, which refers to the use of engaging gaming mechanisms to modify the behaviour of individuals. Sironi stresses that Gamification can actually help investors rewire their brains and mitigate some well-known biases identified by behavioural finance and prospect theory to avoid making inconsistent decisions.