The biggest futures trading market globally is the Chicago Mercantile Exchange (CME) and it is often cited that the futures market is how institutions and family offices can most easily gain exposure to digital assets. This is partially due to the fact that, for an institution, trading Bitcoin futures is as easy as trading any other commodity or equity future in terms of settlement and custody. This makes handling compliance and back office administration much easier than holding a digital asset directly, where the added challenges of crypto wallets, private keys etc, are required.

It would appear that institutional interest in Digital Assets has increased as the volume of ‘open interest’ for Bitcoin futures on CME rose by over 50% in March this year. Fidelity Digital Assets (a subsidiary of Fidelity asset management) with over $6.85 trillion of clients assets, claims; “From a trading perspective, we continue to onboard new clients every month and are seeing significant pipeline growth. […] And in recent weeks, we’ve seen more momentum across our business.”

CME Bitcoin futures , according to regulatory filings, is now being invested in by the highly successful hedge fund manager Renaissance Technologies, whose fund some commentators claim have has grown in excess of 66% p.a. since 1998. This more evidence of highly sophisticated institutional investors embracing Digital Assets, which ought to lead to not only other institutions investing but greater liquidity in these assets.

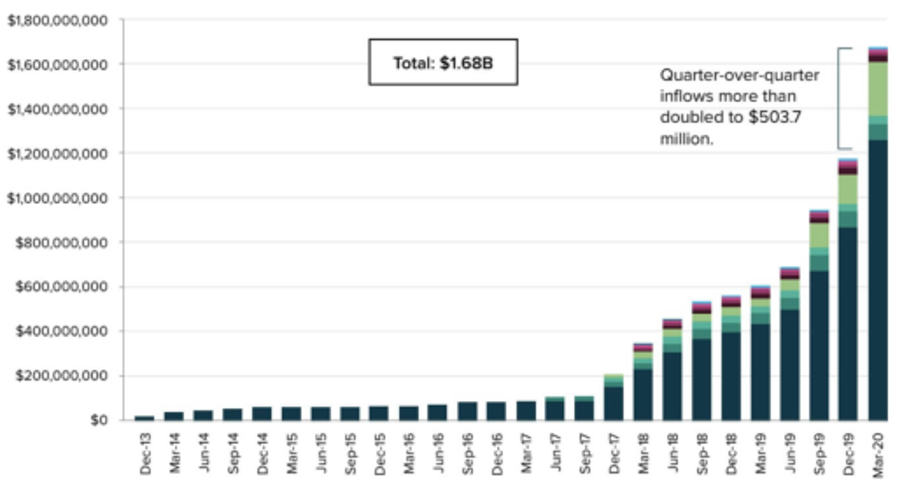

Meanwhile a firm called Greyscale in just Q1 saw assets under management increased by almost 50% as their new Digital Assets fund attracted $500 million mainly from institutional investors.

Greyscale’s quarterly inflows and total assets under management

Source: Greyscale

We have also seen property backed Digital Assets continuing to be launched, with Black Mantra Capital offering investors a yield of 8% based on €12 million property in a prime location of Berlin. In March, the World Federation of Exchanges reported that of the 83 stock exchanges it monitors, there had been a fall of 7%.in the last year. However, MERJ (the digital exchange based out of the Seychelles), had seen assets on its exchange increase by over 325% to $1.2 billion – making it the exchange with the biggest growth globally. Meanwhile, in the USA, we have seen another ‘first’ for Digital Assets as a company called Wave is to issue a token backed by 10,000 to 20,00 barrels of bourbon. Now the price of this Digital Asset really ought to be uncorrelated to equity markets. What’s more, investors can also take the opportunity to sample their investment when mature enough to drink!

However, given the turbulence in equity markets and the uncertainty caused by covid-19 (for how long the work and travel restrictions will last), it is likely that we will see asset managers looking for ways to reduce costs yet still maintain their high compliance standards. It is therefore highly likely we will see an increasing demand for digital systems to be introduced (as opposed to manual), which ought to be highly beneficial for Digital Assets. This interest in digitalisation may well help to explain the $69 billion that was invested in the FinTech sector in 2019!

Written by Jonny Fry CEO of Teamblockchain Ltd and editor of Digital Bytes which is a weekly analysis of some of the developments in the Blockchain and Digital Asset sectors. To receive your weekly copy register here: http://eepurl.com/gTDiwP