You may be excused to have missed the news that at the end of March the European Parliament and Member States reached a political agreement on a stronger and more integrated European supervisory architecture. With so much going on in financial services regulation, it is simply difficult to keep track of everything that happens. This agreement is more than another political statement though as it has far reaching consequences on the framework of supervision of financial firms in the EU as well as AML, Market Abuse and the future of European FinTech. And a bunch of other things. Here is why you need to read it.

Let’s face it: do you really read all the press communications issued by the institutions of the European Union? For the month of April alone (and with one more day to go before we turn the page on the month), the EU newsroom holds 405 press releases and statements alone. And that is a month that has been dominated by a breather from Brexit negotiations and Easter holidays. At the end of March though the European Commission published a statement, in which it congratulates the European Parliament and Member States for agreeing on the core elements of the reform of the European supervision in the areas of EU financial markets including when it comes to anti-money laundering. Something it has for some time promoted and pushed for.

“The political agreement reached by the European Parliament and Member States on the core elements of the reform of the European supervision in the areas of EU financial markets is an important step to achieve the Capital Markets Union’s objective to ensure stronger, safer and more integrated financial markets to the benefit of European consumers, investors and businesses.”

– European Commission

The press release reads that this agreement “is an important step to achieve the Capital Markets Union’s objective to ensure stronger, safer and more integrated financial markets to the benefit of European consumers, investors and businesses.” Why it is such an important step though and why should you have read it? Because it changes the setup of the European supervisory architecture and it sets out the direction for a number of fields of regulation in financial services, which are surely to concern you if you are working in a financial institution. But one thing at a time.

EU Supervisory Framework

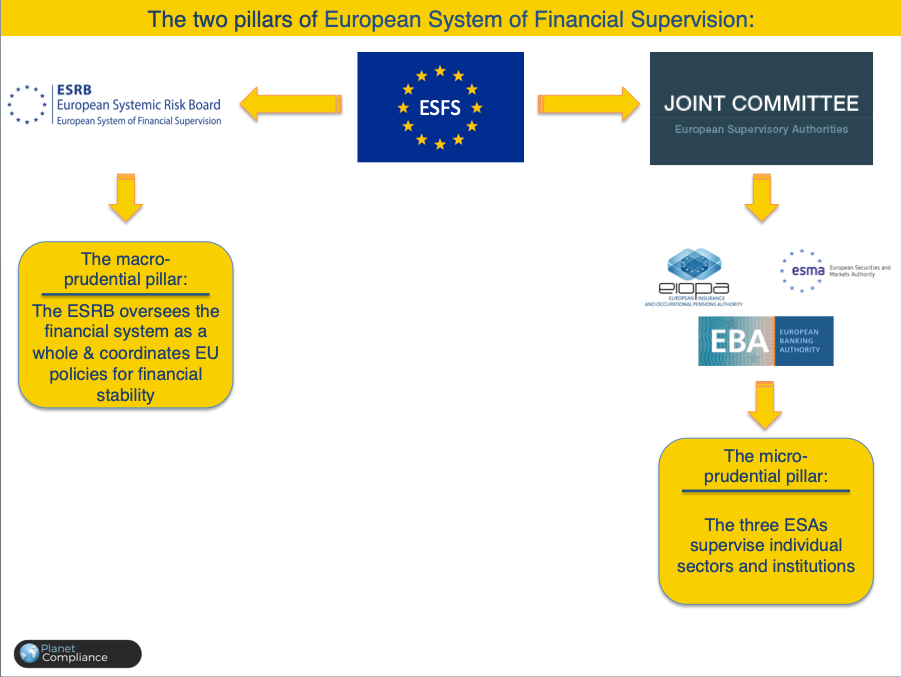

Following the Global Financial Crisis, the EU found that it had to change the way financial institutions were supervised. As a result a new system was introduced in 2010: The European System of Financial Supervision (ESFS). It consists of the European Systemic Risk Board (ESRB) on one hand and the three European Supervisory Agencies (ESAs): the European Banking Authority (“EBA”), the European Securities and Markets Authority (“ESMA”) and the European Insurance and Occupational Pensions Authority (“EIOPA”).

While the creation of the ESAs on the whole was a success in terms of regulatory supervision, it has become apparent that it needed some tweaking. As a result, the Commission proposed to further integrate and strengthen EU financial market supervision by reinforcing the coordination role of the ESAs and attribute new direct supervisory powers to ESMA. The Commission also proposed to strengthen the EBA’s role in the area of anti-money laundering. In order to fit their new tasks, the Commission also made changes to the ESAs’ governance and funding. The overhauled supervisory framework is a result of these proposals and will hopefully prepare these organisations to tackle the new challenges in supervision and make them future ready in particular with a view to the rise of FinTech.

FinTech

Talking of which: FinTech has transformed entirely financial services as we know it and the process is far from over. The Commission praises it as means to facilitate access to financial services and make them more convenient, to increase operational efficiency and lower costs for consumers, to lower barriers for new market players and increase competition. However, for this to happen, the Commission knows that “it is important to ensure the integrity and resilience of IT systems, data protection, and fair and transparent markets. As financial services become more technology and data dependent, regulators and supervisors must be familiar with these technologies and be able to accommodate them. As part of the Capital Markets Union, the Commission has set out a comprehensive strategy setting detailing actions that must be taken to address these challenges and allow for an integrated market for digital financial services without constraints to economies of scale and scope.”

In practical terms this means that the ESAs are meant to take technological innovation into account while carrying out their tasks. What sounds to be a given, it appears that in the past it was not – or at least not to the extent the Commission would have liked it to be. The ESAs will therefore have to to enhance a common EU supervisory culture as regards technological innovation among competent authorities and in particular with the coordination of innovation hubs or regulatory sandboxes. Something that has for too long been left to national supervisory authorities alone considering the importance of international collaboration in this space.

Anti-Money Laundering

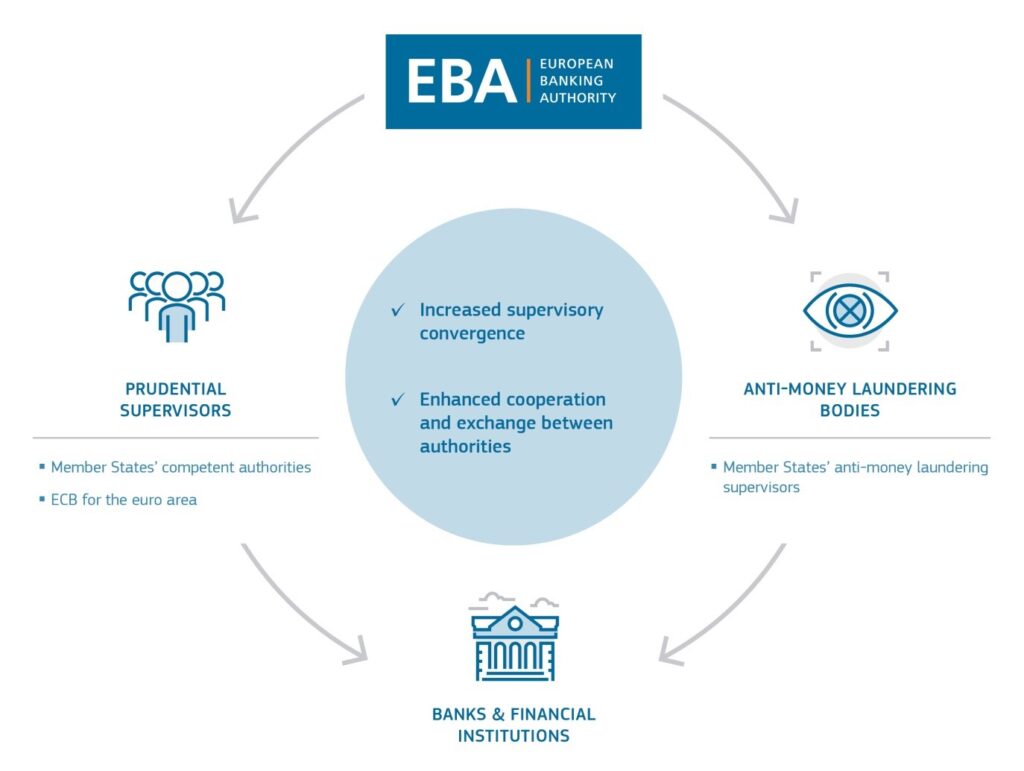

Taking one step back now, the changes to the supervisory framework also speaks of an enhanced role for the EBA in the fight against money laundering.

“We have strong rules against money laundering in the EU, but recent scandals in European banks showed gaps in supervision. Today’s agreement will equip the supervisors with efficient tools to better prevent any money laundering risks and act swiftly when there is a weakness in one country. The new rules will ensure that there is no weak link in the EU, when it comes to money laundering and terrorist financing.”

Vĕra Jourová, EU Commissioner for Justice, Gender Equality and Consumers

The EU likes to speak of a set of strong anti-money laundering rules it has in place, but the reality is a different one: as recent examples involving banks in almost all member states have shown, the existing rules are not always supervised and enforced effectively across the EU. When we spoke of the importance of international collaboration in the field of financial technology, it is all the more true with regard to fighting money laundering and terrorism financing. The amendments to the supervisory structure mean that the EBA will be empowered to

- ensure that breaches of anti-money laundering rules are consistently investigated: the EBA will be able to request national anti-money laundering supervisors to investigate potential material breaches and to request them to consider targeted actions – such as sanctions;

- provide that the national anti-money laundering supervisors comply with EU rules and cooperate properly with prudential supervisors. The EBA’s existing powers will be reinforced so that, as a last resort if national authorities do not act, the EBA will be able to address decisions directly to individual financial sector operators;

- enhance the quality of supervision through common standards, periodic reviews of national supervisory authorities and risk-assessments;

- enable the collection of information on anti-money laundering risks and trends and fosterng exchange of such information between national supervisory authorities (so-called data hubs);

- facilitate cooperation with non-EU countries on cross-border cases;

- establish a new permanent committee that brings together national anti-money laundering supervisory authorities;

- ensure that the EBA will have enough resources to carry out these new tasks.

It also means that we should see closer ties between the three ESAs and cooperation in the fight against anti-money laundering and terrorist financing. For this reason, a dedicated committee will be established within the EBA to prepare decisions relating to money laundering and terrorist financing measures consisting of high-level representatives of national supervisory authorities responsible for ensuring compliance with laws against money laundering and terrorist financing as well as high-level representatives of the three ESAs.

And there is more…

But that is the end of news to come. The new rules will have an impact on a wide range of areas from Market Abuse (i.e. ESMA will have a greater coordinating role in market abuse cases and where certain orders, transactions or behaviours give rise to suspicions of market abuses and have cross-border implications for the integrity of financial markets or financial stability in the EU, ESMA will be able to issue an opinion on the appropriate follow-up), Critical benchmarks, Payment Services in particular with regard to PSD2 (i.e. Data reporting service providers enable the reporting of transactions in financial instruments to regulators and to the public) and consumer protection in general.

Clearly, one EU press release you shouldn’t have missed.