Payroll processing can be cumbersome if you have employees worldwide or even across different states within the same country. At the same time, not complying with these payroll regulations can lead to heavy fines and penalties. According to multiple research, it is estimated that 23% of small businesses spend more than 120 hours every year on payroll processing and 35% of businesses use three or more systems to manage their payrolls.

Here’s a look at the best payroll compliance software available today:

- Workday An enterprise payroll management system that supports a global workforce. It enables maximum productivity and higher worker engagement.

- PaidRight PayPrecision An automated payroll compliance system that identifies errors in pay calculations to ensure compliance with the prevailing laws.

- ADP An integrated payroll processing and compliance platform that supports other HR activities and processes.

- Zimyo An efficient payroll management system for small and medium businesses.

- Paychex An all-in-one HR solution that handles payroll, time, attendance, benefits, tax payments, and more.

- Paylocity An established HR suite with extensive payroll features for global employee management.

To avoid these hassles, many organizations are turning to payroll software – an automated software platform to manage employee salaries, deductions, and taxes according to local laws. Many platforms also offer advanced features like tax calculation, self-service portals, leave management systems, and more. In this guide, we will discuss the types of payroll systems and how they can benefit your organization. We will end with a detailed review of the best payroll compliance software.

Types of Payroll Software

Payroll software can be divided into many types based on implementation and scope. Below are the prominent payroll software categories.

In-House or On-Premises Payroll

As the name suggests, this software is installed on your servers and computers, and your employees handle the payroll processing. They handle tax filing according to the latest laws, credit to the respective bank accounts, and generate reports. This software eases your employees’ workload and makes them more efficient and productive. It is also highly secure and avoids major delays.

Cloud-based Payroll

This is an Internet-based payroll system hosted on the service provider’s servers. You can access this tool through a web-based browser and automate tax calculation and payroll processing workflows. The advantage of this tool is its easy accessibility from anywhere and no requirement for expensive hardware. Moreover, these solutions are also flexible to meet your organization’s specific requirements and scale well with your growth.

Professionally Managed Payroll

In this model, you outsource payroll processing to experts like bookkeepers and CPAs who can handle your organization’s payroll with little intervention. You save time and effort by outsourcing your payroll, however, there are security and privacy challenges involved. This option is well-suited for large enterprises.

In this guide, we will focus on the on-premise and cloud-based payroll systems.

Benefits of Payroll Systems

Before we go further, you may wonder if you even need a payroll system for your organization. Here are the benefits that these systems offer.

Meets Tax Compliance

Tax computation is one of the biggest hassles of payroll processing, as it can vary across jurisdictions. Moreover, companies must file taxes before specified deadlines to avoid penalties. Payroll software can automate all these tasks to ensure you promptly comply with local taxation laws.

Improves Accuracy

Manual computations can be error-prone, as it involves multiple computations. Payroll software can eliminate these errors and the associated legal risks of miscalculated payrolls.

Offers Customization

Payroll processing platforms offer the flexibility to accommodate varying pay frequencies and deductions. Moreover, these processes can happen automatically without frequent intervention.

Ensures Data Security

Many payroll software have cybersecurity features and processes to safeguard your sensitive data. You can maintain data security and privacy along with your organization’s security policies.

Empowers Employees

Self-service portals are an essential aspect of payroll processing software, and they empower employees to stay on top of their salaries, deductions, payment cycles, and other preferences.

Integrates Time Tracking

The best payroll processing software integrates time tracking and leave management systems to streamline pay calculation. It also helps employees to log their time, apply for leave, and more. Additionally, it provides comprehensive visibility for managers to monitor their team members’ timesheets.

Generates Reports

The software must generate extensive reports for management and other stakeholders. It also has options to customize fields for different purposes, including auditing and compliance. You can even access tailored datasets for critical metrics.

Due to such wide-ranging benefits, payroll processing software is used by most organizations today.

That said, not all software is created alike, and you must select the one that best meets your needs. Given the many choices available today, narrowing down based on your specific requirements can be overwhelming. This is why we have listed down the best payroll compliance that can suit most organizations today.

Our Methodology

We looked into the following aspects while selecting the best payroll compliance tools:

- Extensive and compatible with all global and local laws.

- Advanced features like employee segmentation, customization for different pay frequencies and employment types, and data security.

- Customer support.

- Integration with your existing tech stack.

- Ability to generate reports for different stakeholders.

Best Payroll Compliance Software

Now that you know how we identified the above tools, let’s do a detailed review of each to help you identify the best fit for your organization.

1.Workday

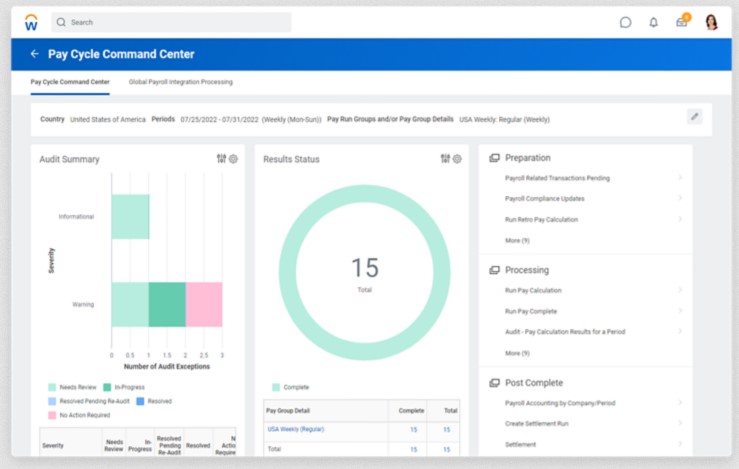

Workday is an enterprise payroll management system that provides complete control over your data and processes. It is intuitive to set up, use, and manage. It also complies well with local laws and works well for employees worldwide.

Source: Workday

Here’s a look at Workday’s payroll compliance features.

Global Payroll Processing

Workday supports payroll processing for countries like the U.S., Canada, the UK, and France. Also, its integrations and APIs make it a good choice for computing payroll salaries, deductions, and taxes across other countries. Workday offers certified and secure connectors to payroll systems across 100 countries to help you see all the information in one place. Furthermore, you can support multiple pay frequencies.

Unified Platform

Workday eases work for your employees, so they can focus on more strategic areas. Its smart reconciliation support helps employees save many hours. Moreover, they can find all the required information like third-party payslips, tax details, payroll documents, and all other information in a centralized place.

Compliance

Managing the ever-changing laws is tough, and Workday ensures compliance with all local laws. Its dedicated team of experts continuously monitors the regulatory changes and provides inputs to help you comply with these provisions. You can even monitor tax payments and computations through the compliance view on the dashboard.

Overall, Workday I found is the right choice if you have a global workforce, want to automate many payroll processes and get unified views.

Pros:

- Secures employee data.

- Offers benefits management.

- Complies with local laws and regulatory standards like COBRA, OSHA, etc.

- Automates pay calculations.

Cons:

- Limited timekeeping and leave management functionalities.

- Steep learning curve.

Reach out to the sales team for more information.

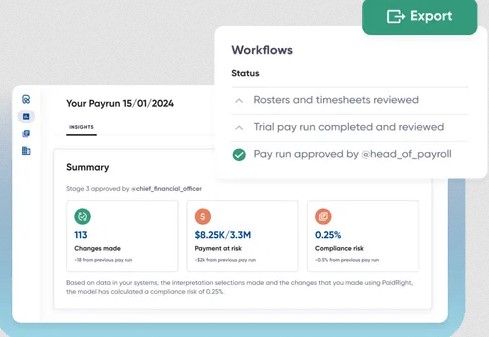

2. PaidRight PayPrecision

PaidRight’s PayPrecision is a payroll compliance system that enhances employee productivity by automatically identifying and rectifying errors. It overcomes the problems associated with manual processing, like misaligned dates, outdated business logic, and retrospective reviews. As a result, your payroll processes are accurate without overburdening your employees.

Source: PaidRight

Let’s look at PayPrecision’s key features.

Integration with Time and Attendance Systems

I observed that PayPrecision integrates well with any time and attendance systems to automatically gather data and check the calculations before the payments are sent out. This identifies errors in timesheets and catches them. Moreover, it comes with rate and overtime triggers to catch errors and omissions. Its audit trail also simplifies the checking process.

Support for Wage Remediation

PayPrecision supports wage remediation for organizations with more than 100 employees. Its pre-built pay models provide the initial result of the remediation within a week, and based on it, you can take further action. Its compliance experts and tech features prioritize issues and ensure a speedy recovery.

API Integrations

The many API integrations ensure that PayPrecision can seamlessly connect with any tech stack. You can also create custom reports and dashboards to suit your organization’s needs and to make data-driven decisions.

In all, PayPrecision is a powerful tool for automating and ensuring the accuracy of your pay calculations.

Pros:

- Calculates complex rewards, overtime, and bonuses

- Helps with remediation.

- Works well for all companies.

- Reduces errors and risks in payroll processing.

Cons:

- Largely limited to Australia.

- Limited reporting templates.

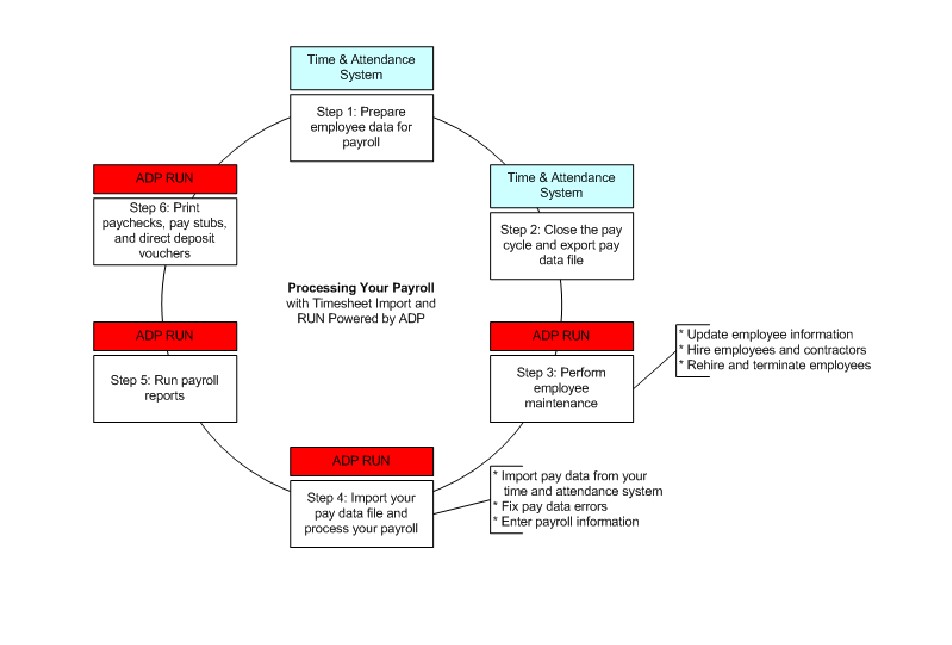

3. ADP Payroll

ADP Payroll uses cutting-edge technology to simplify financial management and payroll processing. Known for its high accuracy and reliability, this automated tool reduces errors and optimizes end-to-end financial processing. It also meets compliance laws and improves the accuracy of tax deductions.

Source: ADP

Below are ADP Payroll’s important features.

Payroll Calculation and Approval

ASP automatically calculates employees’ gross pay based on time worked, overtime, bonuses, and deductions. It also calculates federal, state, and local taxes, along with health insurance, retirement funds, and other entitlements. It also sends the computed value to business administrators for approval and transfers it to appropriate employees’ bank accounts.

Self-service Portal

As I discovered, a highlight of ADP is its self-service portal where employees can see their tax documents, pay stubs, tax compliance, and other payroll components. They can also update their details like bank accounts, addresses, etc. Such a well-designed portal reduces admin work for your HR and finance teams.

Reporting and Analytics

ADP analyzes payroll data and creates insightful reports for informed decision-making. You can use this tool for audit tracking and financial planning. It can also help with internal compliance.

Overall, ADP Payroll saves time and cost while ensuring accuracy and compliance with all laws and regulations.

Pros:

- User-friendly interface.

- 24/7 customer service.

- Works well for businesses of all sizes.

- Extensive built-in integrations.

Cons:

- Steep learning curve.

- Reports can be confusing.

Contact the sales team for next steps.

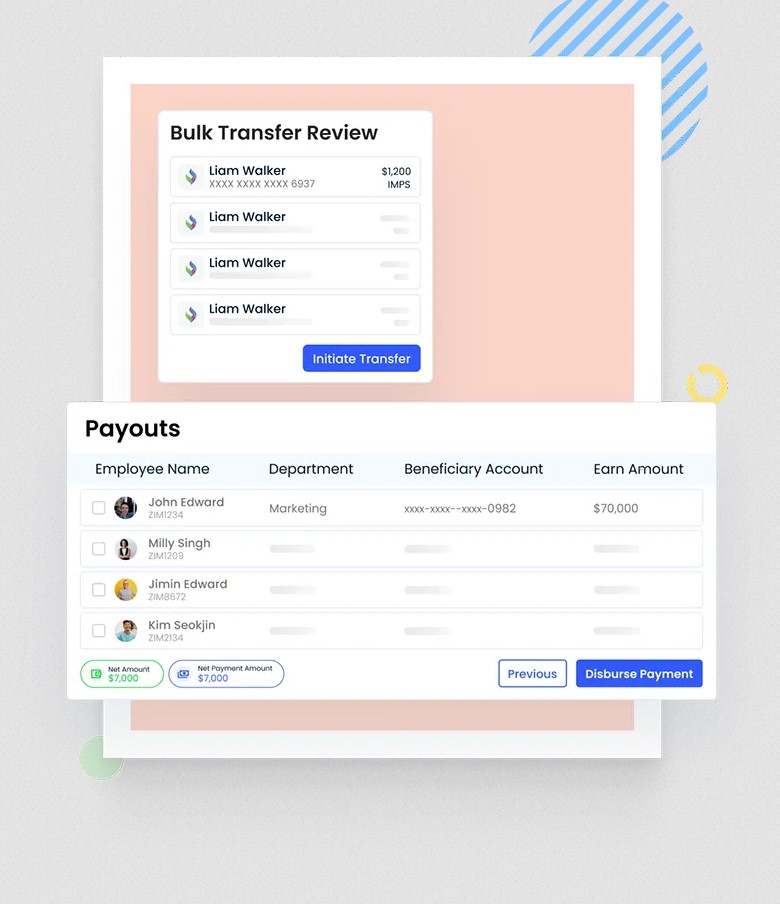

4. Zimyo

Zimyo is an efficient payroll management system that automates payroll processing for small and medium businesses. Also, it handles other HR components like performance, recruitment, onboarding, training, and engagement. Such an integrated approach is highly cost-effective for SMBs and eases the burden of finance and HR teams.

Source: Zimyo

Here’s a look at Zimyo’s payroll compliance features.

Statutory Compliance

Compliance is one of the biggest hassles in payroll, but Zimyo handles this for you. It handles mandatory requirements like PF, ESIC, TDS, and more. It automatically computes the equivalent values and deducts them from employees’ payrolls. Moreover, it offers secure and centralized data storage and management to meet other data security regulations.

Employee Expense Management

Zimyo simplifies your employees’ expense management. With this tool, you can create reimbursement approval workflows and automate the entire process to make it faster. Also, you can go paperless and even manage expenses across multiple categories.

Payroll Processing

Zimyo processes payroll in five simple steps. In the process, it calculates payrolls, manages deductions, handles taxes, and administers benefits. I noticed that you can even pay your employees through digital channels for faster processing.

Overall, Zimyo is a convenient tool for managing all payroll activities and processes.

Pros:

- Manages attendances.

- Easy to use.

- Statutory compliance.

- Engages employees.

Cons:

- Limited integrations.

- Training can be better.

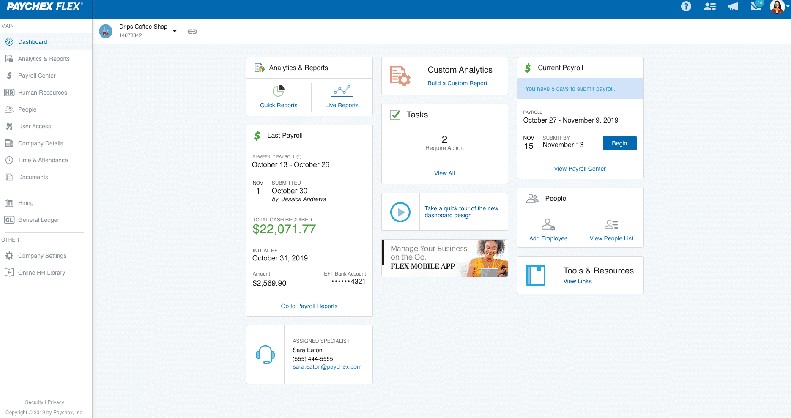

5. Paychex

Paychex is an all-in-one payroll and HR software that works well for all businesses, regardless of size or industry. It also blends service and technology to manage all HR processes and comply with local laws. It also comes with an intuitive user interface.

Source: Paychex

Below are Paychex’s salient features.

Easy to Use

A highlight of Paychex is its intuitive user interface where you can easily find the required information. With this tool, you can view the current and future pay periods for comprehensive planning and visibility. Also, you can find information per employee to analyze patterns and trends. Furthermore, adding or removing employees is easy.

Generates Reports

Paychex offers customizable reports that can help with compliance and informed decision-making. You can create a payroll journal, understand your financial position, plan for future months, and do much more.

Automatic Tax Administration and Compliance

Paychex comes with a tool called Taxpay, a tax administration service, that calculates, pays, and files your taxes automatically. It handles taxes across federal, state, and city administration to ease the burden for your employees. More importantly, it meets the changing requirements and files taxes before deadlines to avoid penalties.

Due to these features, I determined that Paychex is a handy platform for businesses that want to automate their payroll while meeting compliance with different laws.

Pros:

- Centrally stores and organizes data.

- Intuitive user interface

- Tracks employee hours.

- Good customer support.

Cons:

- The self-service portal can be better.

- Limited reporting templates.

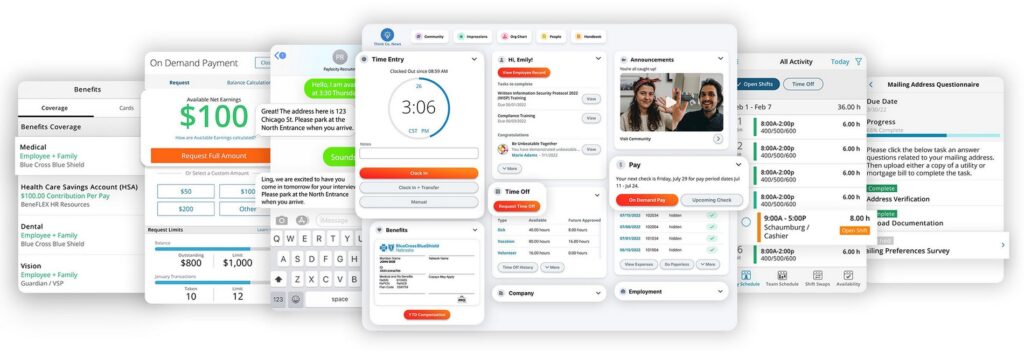

6. Paylocity

Paylocity is a comprehensive HR suite with advanced payroll processing and tax computation features to meet statutory compliance requirements. With this tool, you can confidently build a global workforce without increasing pressure on your HR and finance teams.

Source: Paylocity

Here are Paylocity’s payroll compliance features.

Seamless Global Payroll

Paylocity offers integrated global payroll systems that work well across 100+ countries. It displays global payroll data through a unified plane in real time for insights and patterns. At the same time, you can use Paylocity to ensure compliance with the laws of these countries to avoid fines and penalties.

Time and Labor Management

With time and labor management integrated with payroll processing, Paylocity automatically extracts employee working hours to calculate their payroll, deductions, entitlements, and taxes. With this automated process, Paylocity improves efficiency and reduces time and effort.

Benefits Administration

Organizations are looking for innovative benefits administration programs to retain their workforce while ensuring compliance with local laws, and Paylocity offers both. With this tool, you can easily manage specific employees’ benefits and even provide them with multiple options when applicable.

I noted that features like mobile access, event notifications, and reminders make Paylocity a good choice for organizations with a global workforce.

Pros:

- User friendly

- Integrates tax documentation and calculation.

- Single Sign On (SSO) capability.

- Mobile access and reminders.

Cons:

- It can be expensive.

- Customer support can be better.

Thus, these are the best payroll compliance software. While selecting the right fit, start with a list of your requirements and look for the tool that best matches them.

Final Thoughts

Payroll compliance is a critical task for all organizations, but also a complicated one, given the many calculations and deductions involved. More importantly, every calculation must meet the local laws and other statutory regulations applicable to your industry. If you have a global workforce, this requirement can add pressure on your employees, leading to the possibility of errors. Moreover, non-compliance with the statutory laws can lead to heavy fines, penalties, and reputational loss.

One way to avoid these problems is to use payroll compliance software that can automate this computation and even tax filing for you. Many of these tools are part of a wider HR suite that can provide comprehensive support for your employees. In this article, we looked at the top six tools, and we hope they help you to automate your payroll.