It’s hard to stay compliant when the rules and regulations change every year. The financial services industry is no exception. The Financial Conduct Authority (FCA) has recently announced a stricter strategy for the Client Assets Sourcebook (CASS) 2022-2023. CASS is vital in safeguarding clients’ assets in the event of insolvency.

The Importance of CASS

The FCA introduced CASS after the collapse of Lehman Brothers in 2008. It was a cold, hard shock to the system. It was clear that clients’ assets had to have better protection. The FCA tries its hardest to keep up the financial services industry’s reputation. As a result, the results and regulations will be stricter every year.

Regulatory Compliance And Safeguarding Reconciliations

The regulator is already demanding that companies work closer to the CASS rules. Risk management should be at the forefront of business strategies. Additionally, companies should make it a priority to safeguard clients’ funds. This stipulation is even more critical in such a difficult time economically.

Why RegTech Solutions Are The Answer for CASS

CASS is hard to manage, especially if your data is everywhere. If your company relies on manual spreadsheets, it’s time to think again. There is only so much you can do manually. A regtech solution can speed up your business processes. It can also give you proper control over your compliance requirements.

A Revolutionary Platform – Built for Safeguarding Reconciliations

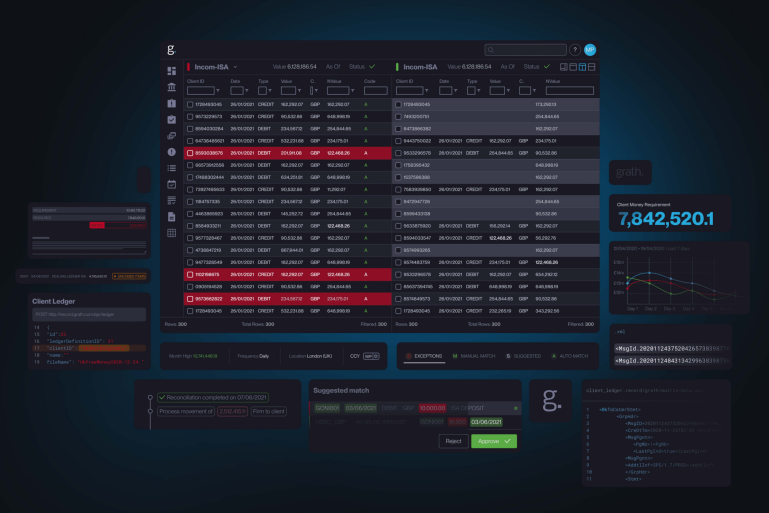

You might have looked at different platforms to help you handle CASS. However, your “standard” reconciliation platform will not suffice. Safeguarding reconciliations are a completely different kettle of fish. Grath’s innovative safeguarding reconciliation product comes at the right time.

You can use this system to:

- Automate more of your processes

- Use flexible multi-format data intake or REST API integration

- Have real-time visibility for your client’s money

- Perform client asset and safeguarding reconciliations

- Minimize manual exception management for your business

- Link reconciliation output to your CASS pack and populate your CMAR

Manage CASS Before It Manages You

When you update your regulatory compliance strategy, think about how you will manage it in practice. Using your old manual methods will not cut it. It’s time to move into the future and use a digital solution. Consider using a specialist platform like Grath’s explicitly for your safeguarding reconciliations.