One of the things that got me thinking early in my career in financial services was the realisation that many financial instruments are not registered. Or, as I should better say, their beneficial owner is not registered or at least not updated in a way that any given time the actual beneficial owner could be known.

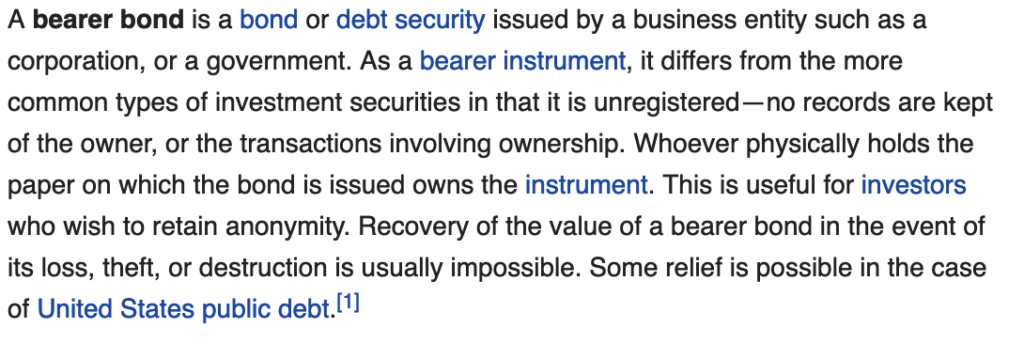

A good example are bearer bonds as explained on Wikipedia:

There is probably a good reason for this anonymity, but it also exposes the instrument to some issues, namely the use for criminal activities, money laundering, terrorism financing and so on.

But there was also the question of stock lending that got me thinking. Was it really in the interest of investors and the integrity of markets that the identity of the person or entity controlling a financial instrument (and not necessarily owning it) should not be publicly available? This is of course a question that is worthy of some contemplation and I appreciate that there are a number of aspects that we have not touched upon in my short description like disclosure rules (which make it necessary to lift the veil of anonymity in some circumstances). Leaving these small and unimportant details aside though for the sake of the argument: Wouldn’t it be great to have a universal register of ownership of financial ownership or at least some form of ledger that could be accessed at any time if not by everyone at least by people who should know about it like regulators to avoid mischief happening in the markets? Little did I know back then and those small and unimportant details are obviously not as small and unimportant. But the financial scandals of the last decades show that I was up to something.

Fast forward many years and rewind a few I came across Blockchain technology. Blockchain offered quite a few advantages and some of them promised to be the solution to the problem, which I just outlined.

Three years ago we then wrote about the basics of blockchain technology and its advantages using the most prominent example of its application, Bitcoin: “The Bitcoin protocol uses a distributed database, which is operated by a peer-to-peer network of unaffiliated contributors and maintains a continuously growing list of data records that is hardened against tampering and revision in the so-called blockchain. Simply put, the database or distributed ledger records all transactions between users in the form of blocks. The technology of blockchain is therefore revolutionary and has the potential to be disruptive since control of the transaction process is spread out and provides for crystal clear transparency of its elements; intermediaries or authorities that usually execute and verify a transaction are consequently not necessary.” The crystal clear transparency was the key to issue but I was also fully aware of the downsides. But it was apparent that the implementation would be difficult and take time. Blockchain technology instead rose to prominence thanks to the easy money that was to be made through initial coin offerings and the creation of new cryptocurrencies.

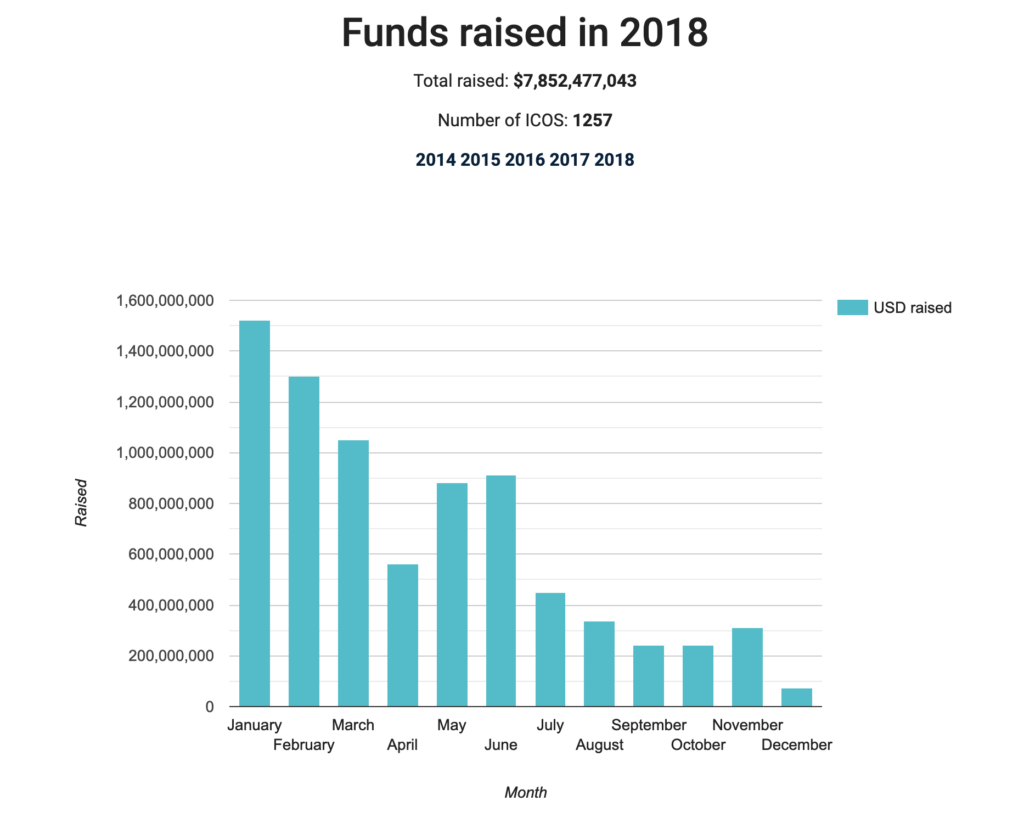

Keeping a close eye on the developments in the crypto world, it wasn’t entirely surprising when regulators turned against initial coin offerings and laid down the law. Nonetheless the total of funds raised through ICOs in 2018 at $7.8 billion exceeded the $5.6 billion raised in 2017, a trend became apparent in terms of volume and numbers of ICOs:

Even though blockchain technology promotes trustless business transactions since you don’t need to know your counterpart or trust an intermediary, it appeared that trust in the system of ICOs was still required and that to many of them had been selling nothing but hot air. While a lot of people had been relying on the perception that they were operating in a lawless space or tried to veil their ICOs as not selling securities in their whitepapers, they obviously weren’t right in the regulatory analysis. The SEC in particular has been pursuing a large number of ICOs and the people behind them.

We had long been proposing using models like private placements as a way to operate on the right side of the law and while all ICOs are different and each token needs to be evaluated separately, it appeared to us that the solution would be the alignment with existing securities regulations and models.

Some people in the crypto world try to align innovation with regulatory obligations through the use of tokens that are based on actual assets replicating the functioning of traditional securities under the name of Security Token Offerings (STO). Unlike most ICOs, the tokens of an STO need to be supported by something tangible like equities, bonds, profit sharing or promissory notes – basically any kind of financial instrument or product the financial industry offers. These tokens are therefore more like traditional securities and could hence be applied in a similar way and in accordance with securities regulations.

I couldn’t find any decent stats for STOs but would be more than happy to include any solid numbers. However, one source speaks of $380 million that had been raised through STOs last year. Not great compared with ICOs, but not bad either and the whole thing seems to gain some momentum.

More to follow…