Blockchain has caused a funding frenzy that is often compared with the Wild West. In 2016 alone funding in the industry has increased to over $850 million according to Funderbeam. Its Blockchain Industry Report outlines that though the total number of rounds has been decreasing since 2014, the total funding has increased, making the funding per investment round bigger and pointing to a form of consolidation of the sector. Or in other words, while in previous years more investments in a greater number of Blockchain startups was made, the investments now get bigger. This in turn could be seen as a sign that the companies that receive financing are more mature in terms of products and solutions.

Within this sector of Blockchain firms sit those that apply the technology for the purpose of addressing regulatory challenges. These RegTechs use Blockchain technology for different aspects of the compliance lifecycle such as customer identification, monitoring, reporting and, record keeping, though this list is not conclusive.

According to data from CBInsights, Regtech startups have raised roughly $2.99B across 405 deals since 2012, though that included Regtech firms from other sectors than financial services, too. In contrast, when we reviewed investments in the industry for the PlanetCompliance RegTech Directory, we found that the 167 RegTechs listed in this directory had until the end of 2016 raised $1.2 billion. The actual number though is likely to be significantly higher since many firms do not disclose the amount they have raised or the funding rounds at all as they are predominantly privately held companies.

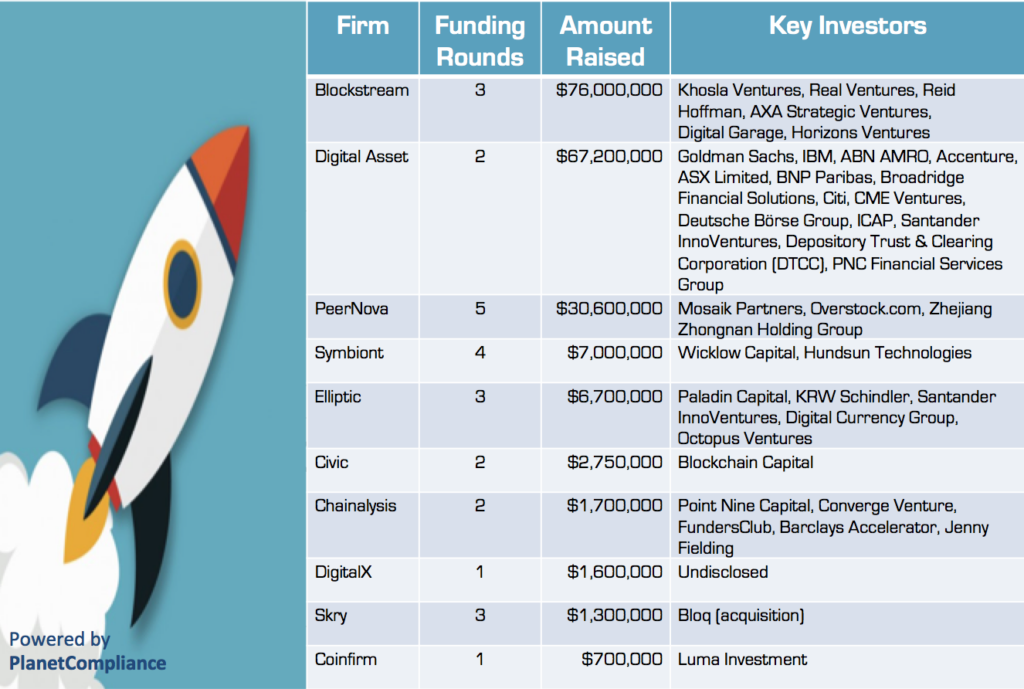

So, within the RegTech sector, who are the ones that employ Blockchain technology, how much have they raised as far as we know and who are their backers? Let’s have a look at the 10 best funded RegTechs based on Blockchain:

No. 10: Coinfirm

Coinfirm provides an easy to use Compliance as a Service platform to solve the AML/CTF/Sanctions and counterparty risk management problem for entities operating around blockchain and digital currencies. Blockchain agnostic, the platform applies its algorithms and complex queries that structure data into clear actionable insights for clients and users, eliminating the need to dedicate major resources to compliance. Based in London, UK and founded last year, it has so far receved $700k funding from Luma Investment.

No. 9: Skry

Skry, formerly known as Coinalytics, is a leading Blockchain analytics and intelligence firm based in Silicon Valley. The company provides an end-to-end platform that enables enterprises to derive real-time business intelligence and risk assessment from Blockchains and decentralized applications. Since its foundation in 2014 it has raised a total of $1.3m in 3 rounds and was acquired by Bloq in February this year.

No. 8: DigitalX

DigitalX is an innovative Blockchain enhanced payment solutions company focused on the global digital payments industry developing fintech products and services in the mobile bill payments and remittance space. DigitalX was listed on the Australian Securities Exchange (ASX) in June 2014 and recently raised $1.6 million post-IPOfrom new and existing institutional and sophisticated investors.

No. 7: Chainalysis

Chainalysis is a New York based startup and a leading provider of AML solutions for blockchain businesses, financial institutions that provide banking services to the blockchain industry as well as blockchain search tools for government agencies. Its compliance service focuses on monitoring as well as client and counterparty identification. Since its foundation in 2014, it has raised a total of $1.7m in 2 rounds. Investors include Point Nine Capital, Converge Venture, FundersClub, Barclays Accelerator, and Jenny Fielding .

No. 6: Civic

Civic is a free identity management service and an identity theft protection service that allows banks, financial institutions and other merchants to confirm the usage of social security numbers with the true owner of that number before creating new accounts. Based in Palo Alto and founded only in 2015 it has raised so far $2.75m plus undisclosed amount for convertible note with lead investor Blockchain Capital, the company that with its recent ICO raised $10 million for a digital liquid venture fund in only 6 hours.

No. 5: Elliptic

Elliptic describes itself as the global standard for blockchain intelligence. Elliptic identifies illicit activity on the Bitcoin blockchain, and provides its services to financial institutions and law enforcement agencies. Founded in 2013 it has raised so far a total of $6.7m in 3 rounds from investors such as Paladin Capital, KRW Schindler, Santander InnoVentures, Digital Currency Group, and Octopus Ventures.

No. 4: Symbiont

Symbiont is a market-leading smart contracts platform for institutional applications of distributed ledger technology. Among its services, it offers fully electronic administration of corporate and compliance actions, to minimize costs for both the client and the servicer. Symbiont has raised $7m in 4 funding rounds from 7 Investors led by Wicklow Capital plus a round for an undisclosed amount, which was led by Hundsun Technologies.

No. 3: PeerNova

PeerNova is a Silicon Valley-based technology company founded by veteran entrepreneurs with deep expertise in distributed systems, networking solutions, compiler technology and financial services. It focuses on digital recordkeeping and has developed a new approach to tackling the challenge of staying on tip of ever increasing data by building the first immutable ledger with built-in audit, scale, and other capabilities. PeerNova has raised funding of $30.6 in 5 rounds. Among its 9 investors are Mosaik Partners, Overstock.com, and Zhejiang Zhongnan Holding Group

No. 2: Digital Asset

Digital Asset is a software company that builds distributed, encrypted straight through processing tools. Its technology improves efficiency, security, compliance and settlement speed. In particular with regard to post-trade processing and record keeping it promises better result with respect to cost and capital requirements management as well as added counterparty, operational, and cyber-security risks. The company has raised $67.2m in two funding rounds with the second consisting of Goldman Sachs, IBM, ABN AMRO, Accenture, ASX Limited, BNP Paribas, Broadridge Financial Solutions, Citi, CME Ventures, Deutsche Börse Group, ICAP, Santander InnoVentures, The Depository Trust & Clearing Corporation (DTCC), and The PNC Financial Services Group, Inc.

No. 1: Blockstream

Blockstream provides a range of software and hardware solutions and expert professional services to companies deploying new blockchain-based networks. Its core software platform Elements was released as part of the open source Elements Project and is one of the most mature protocols for blockchain developers. Its solutions are used for fraud and counterfeiting prevention. Blockstream has raised $76m in 3 rounds from 20 Investors with lead investors Khosla Ventures, Real Ventures, Reid Hoffman, AXA Strategic Ventures, Digital Garage, and Horizons Ventures

No one at Planet Compliance is an investor (unfortunately) in the companies mentioned above and the numbers presented here are based on our own research. We are fully aware that many firms do not disclose the amount they have raised or the funding rounds at all as they are predominantly privately held companies, so there is a likelihood that this list may not be the whole truth. Just so you know.