We published the first edition of the PlanetCompliance RegTech Directory in December 2016. In spring we started to build on the initial work and published the Directory in a different format in July. Now, just a few weeks after the launch and continuously updating it with new information, we thought we take a quick break and share some of the insights we gained from this exercise.

When we underwent a massive review of the RegTech sector during the second half of last year and published the results in the form of the PlanetCompliance RegTech Directory, we didn’t think we would go through the same exercise only 6 months later. While we continuously update our records on the firms active in the RegTech space, the feedback we got and the development this area has made, caused us to reconsider the format (it’s an online database that gets regularly updated as opposed to a periodic publication) and almost double the number of firms included. The result is the most comprehensive collection of RegTech firms out there, but we though it might also be interesting to share some insights from our research.

Location, location

For instance, when we last went through this exercise we found that a lot of the RegTechs we came across, were based in London, UK. Since then we came to learn that the country where the most RegTechs are based are the United States as you would expect. The last time we counted 115 firms were based there. However, we still believe that – at least to an extent – London is the centre of the RegTech world since most of the 72 firms in the UK that we included in the Directory are based there with only a few exceptions. At the same time, New York as the area with the most RegTechs only has little more than 30 firms located there despite the importance of its financial centre. Other locations like the wider San Francisco area including Silicon Valley or Chicago almost seem to be equally attractive. London’s success as a RegTech hub is based on the combination of the leading financial centres of the world with the support of innovation firms receive there. It will be interesting to see if and how this changes in the wake of Brexit, but for now it doesn’t seem to have much of an impact yet.

With regard to the rest of Europe, Switzerland is the new number 2 with Ireland hot on its heals, but neither of them come close to London, which doesn’t mean that you won’t find exciting firms and solutions there. Germany and France have been very active in trying to pry away financial institutions from the UK following the Brexit decision, but in respect of there representation of RegTech firms the results are rather disappointing, and there are both battling with Luxembourg, thanks to its thriving funds sector and respective support sector, and countries like Sweden or The Netherland, which are very supportive in terms of innovation and startups. Most of these offerings focus are rather local or regional though as they seem to focus on their home countries, while many have additional offices elsewhere.

Outside of Europe, Australia outshines Hong Kong and Singapore and many of the RegTechs from Oz have a strong presence in the Asian markets. There is very little in Africa with the exception of a few firms in South Africa and we are not aware of any RegTechs in South America, but we would love to hear about it, so please get in touch if you know of someone. In any case, it highlights the importance of a well-established financial centre as a foundation of a successful RegTech solution despite the fact that the Digital Age has apparently made location less relevant.

Interestingly, when looking at the distribution of firms focusing on Data Protection (i.e. solutions that focus on protecting the privacy of individuals in data use especially in light of new regulations like the GDPR, which require financial institutions to adapt to a different framework.) as the primary activity, all but one category is equally allocated: Data Protection, however, appears to be to a great degree the dominion of US firms with only 4 Swiss firms and the odd firm in other locations. In light of GDPR and other regulations that have a very strong impact on privacy, this comes a bit of a surprise; though several firms in Europe also offer Data Protection services in addition to other activities.

What do you do for a living?

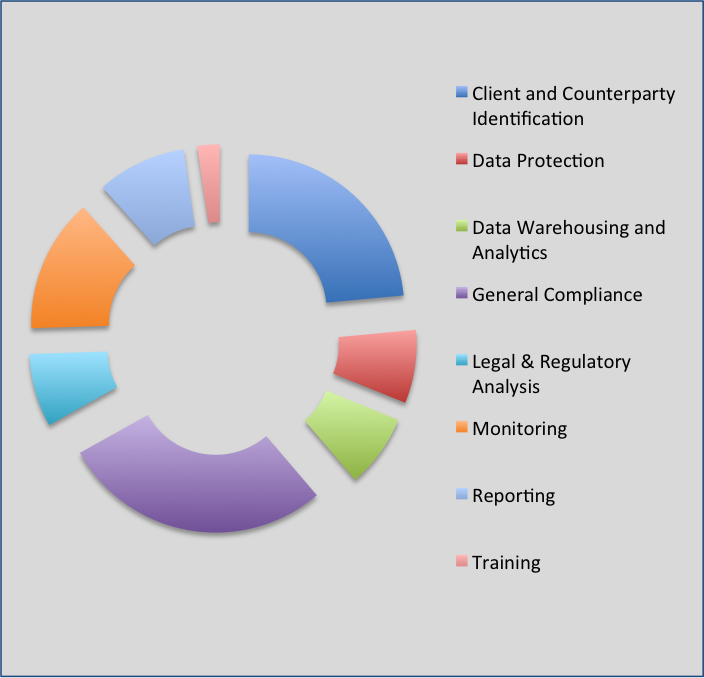

Talking about activities, what is the most prominent of the eight categories we classified RegTechs in? If you have said Client and Counterparty Identification, you are right with almost a fourth of all RegTechs naming it their primary activity. Helping financial institutions with the gathering and processing of the necessary information for KYC and AML purpose or other forms of Due Diligence seems to be the area RegTechs have identified to apply innovative technologies. Considering the time and costs these checks consume in traditional processes, this is not surprising though.

General Compliance, accounts for 28% and thus more than CCI, but this is due to the fact that General Compliance refers to all solutions that don’t fit in one of the other, more traditional RegTech categories or deal with new trends and aspects that don’t fit into those. As such, some firms may be focus, for example, on regulatory risk modelling, scenario analysis and forecasting could be such activities or all actions to evaluate and oversee a firm’s internal culture and behaviour, while others relate to workflow management. Therefore, it isn’t really one category and can’t be considered the top one. Monitoring with almost 14% follows with Reporting accounting for 9.3% and Data Protection, Data Warehousing & Analytics, and Legal & Regulatory Analysis each come up with 7.6%. Especially, the latter though seems to be an area that is the most intriguing as Artificial Intelligence as well as machine readable regulation might have the biggest impact on the Compliance profession and we’re very curious to see how it all pans out. Training as it was in our first RegTech Directory still only accounts for a handful of RegTech solutions, 2.3% to be precise, though we would hope to see more of them since Compliance training, for instance, is an area that notoriously could do with some help. Obviously, you have to bear in mind that many firms are active in more than one category (one claims to over all aspects, for instance), but if you had to stick them into a category of their primary activity (which we did) these are the numbers.

Investments and Financing

A recent report by CBInsights stated that RegTech start-ups had raised approximately $3billion since 2012 though that included Regtech firms from other sectors than financial services as well. Our research finds that the over 300 RegTech firms we have listed in our Directory have raised close to $1.9billion with the actual number though likely to be significantly higher since many firms do not disclose the amount they have raised or the funding rounds at all as they are predominantly privately held companies.

Outlook

These are exciting times for RegTech and with a myriad of new regulations like MiFID II or GDPR around the corner, the demand for clever RegTech solutions that drive down costs and help to ease the pain is not going to go away any time soon. We will continue to monitor the sector and have already started updating the database that we launched in mid July several times, but if you have any questions or input or simply would like to discuss RegTech, just drop us a line at info@planetcompliance.com