Just when you thought STOs were the answer to the ICO impasse, the financial watchdog of HK issues a warning against investing in Security Tokens. Does this spell the beginning of the end for STOs in similar way the Chinese crack down on cryptocurrencies and ICOs did in September 2017 or what should we make of this statement?

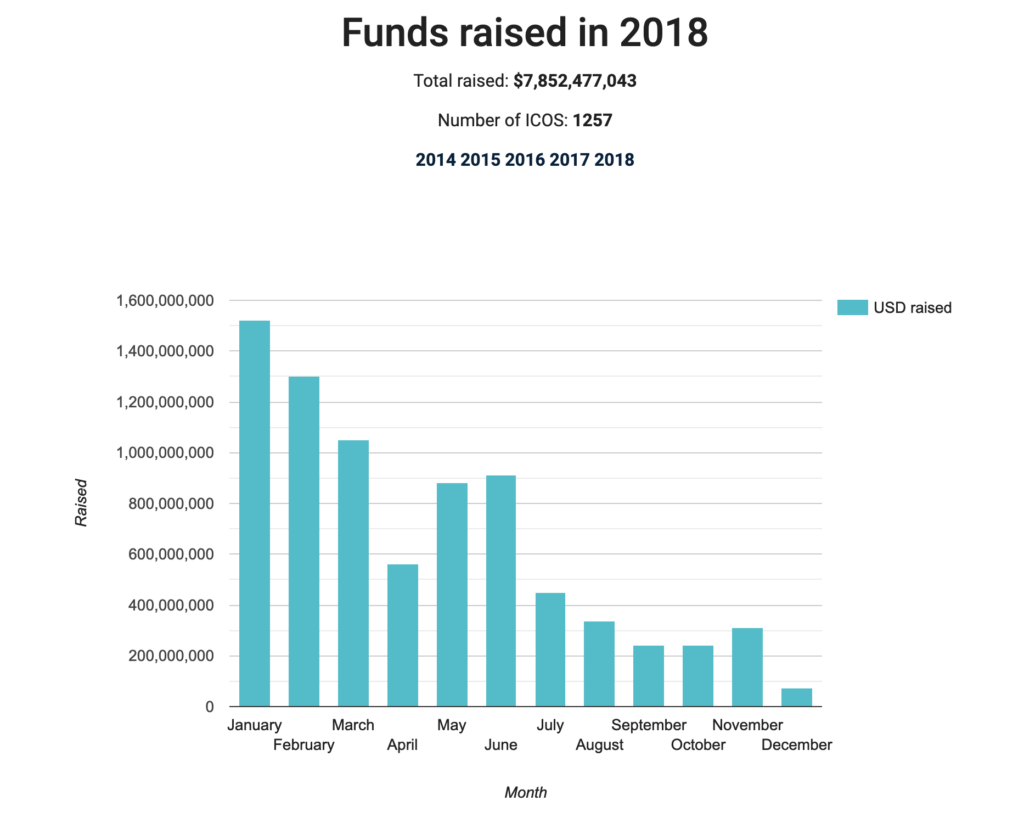

ICOs are dead, long live STOs! Sure, that’s a bit of an exaggeration but it represents a common sentiment in the crypto industry. The trend in Initial Coin Offerings funding knows only one direction as the following graph shows:

This is in large parts due to the attention ICOs have received from regulators over the last years, which has turned a big free for all into the current reality for ICOs. And the regulatory tide shows no signs of ebbing down – regulators like the German BaFin are not getting tired to warn against ICOs as seen earlier this month.

At the same time Security Token Offerings in line with existing security regulation have slowly made their way into headlines. If you think that the only way for STOs is up, you might be mistaken. It is still early days and in a similar fashion many in the token industry proclaimed a couple of years ago that most ICOs would not fall under the restriction of securities laws thanks to the utility model. Something that surprisingly turned out not to be exactly true… For this reason, STOs are a mere plantlet and whether they will live up to the hopes of saving the token fundraising model is far from certain. Instead, caution is key and in this sense one should analyse the statement on Security Token Offerings the Hong Kong Securities and Futures Commission (SFC) issued yesterday.

It came with a clear message: Be wary of STOs. While the SFC chose to extend the warning to the potential risks involved in forms of virtual assets. It has on several occasions reminded investors that virtual assets are exposed to heightened risks of insufficient liquidity or volatility, opaque pricing, hacking and fraud, and now it seems to be the time for a warning that these risks are also applicable to Security Tokens, according to the regulator. “As STOs are a nascent form of fundraising and the market is still evolving, investors should be cautious when deciding whether to invest. Investors may be exposed to significant financial losses in trading Security Tokens. If investors cannot fully understand the risks and bear the potential losses, they should not make an investment”, the statement reads.

The SFC also recalls the key elements of security tokens and their regulatory handling. The bottom line is that security tokens are securities according to existing laws and as such come with a long list of regulatory obligations, but for sake of completeness, here is what the SFC said on the regulation of STOs:

“STOs typically refer to specific offerings which are structured to have features of traditional securities offerings, and involve Security Tokens which are digital representations of ownership of assets (eg, gold or real estate) or economic rights (eg, a share of profits or revenue) utilising blockchain technology. Security Tokens are normally offered to professional investors only.

In Hong Kong, Security Tokens are likely to be “securities”1 under the Securities and Futures Ordinance (SFO) and so subject to the securities laws of Hong Kong.

Where Security Tokens are “securities”, unless an applicable exemption applies, any person who markets and distributes Security Tokens (whether in Hong Kong or targeting Hong Kong investors) is required to be licensed or registered for Type 1 regulated activity (dealing in securities) under the SFO. It is a criminal offence for any person to engage in regulated activities without a licence unless an exemption applies.

Intermediaries which market and distribute Security Tokens are required to ensure compliance with all existing legal and regulatory requirements. In particular, they should comply with paragraph 5.2 of the Code of Conduct2 as supplemented by the Suitability FAQs. Under the Guidelines on Online Distribution and Advisory Platforms and paragraph 5.5 of the Code of Conduct4, Security Tokens would be regarded as “complex products” and therefore additional investor protection measures also apply.

Further, intermediaries are expected to observe requirements which are similar to those set out in the Circular to intermediaries on the distribution of virtual asset funds dated 1 November 2018. The requirements are highlighted as follows:

(A) Selling restrictions

Where an intermediary markets or distributes Security Tokens, it must be licensed or registered for Type 1 regulated activity (dealing in securities) and the Security Tokens should only be offered to professional investors.

(B) Due diligence

Intermediaries distributing Security Tokens should conduct proper due diligence in order to develop an in-depth understanding of the STOs. This should include, but is not limited to, the background and financial soundness of the management, development team and issuer as well as the existence of and rights attached to the assets which back the Security Tokens. Intermediaries should also scrutinise all materials relevant to the STOs including published information such as the whitepaper and any relevant marketing materials. Intermediaries should also ensure that all information given to their clients is accurate and not misleading.

(C) Information for clients

To help clients make informed investment decisions, intermediaries should provide the information in relation to STOs in a clear and easily comprehensible manner. Intermediaries should also provide prominent warning statements covering risks associated with virtual assets.

Intermediaries are reminded to implement adequate systems and controls to ensure compliance with the requirements before they engage in the distribution of STOs. Failure to do so may affect their fitness and properness to remain licensed or registered and may result in disciplinary action by the SFC.

Intermediaries are reminded to discuss with the SFC before engaging in any activities relating to STOs.”

If you have read it carefully though, it doesn’t mean anything else that an STO needs to comply with all the regular obligations that anyone serious about raising funds lawfully shouldn’t have already considered. Yes, it is also a stern warning against abusing a different name (=STO) for something that in the experience of the Hong Kong regulator has often been unlawful (=ICOs) and the SFC must have reason to issue such a statement, namely in the form of a number of examples that are exactly trying to that. On the other hand, it doesn’t contain any indication that if done correctly STOs don’t have a future in Hong Kong. Whether the authorities in mainland China take a similar line, remains to be seen however.